TGOD saw a significant loss in the market on Wednesday after reporting down numbers for Q4 and the full 2019 year.

Shares of a Canadian cannabis producer dropped mightily on Wednesday (March 11) following the release of its latest quarterly and annual results.

The Green Organic Dutchman Holdings (TGOD) (TSX:TGOD,OTCQX:TGODF) posted heavy losses for both Q4 and the full 2019 year, leading to a drop off in the market for the producer.

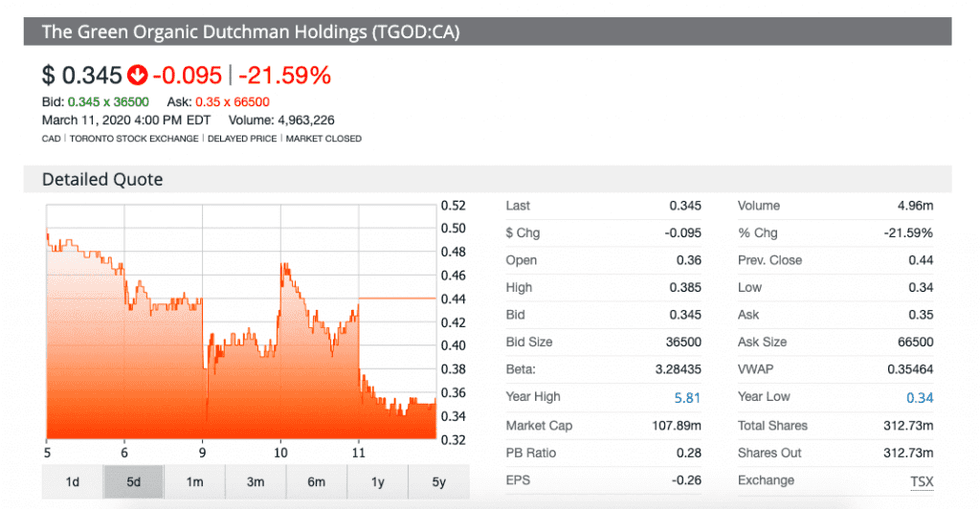

Near the end of the trading session on Wednesday, the company was trading at C$0.34, representing a decline in value of 21.59 percent.

In a release, Brian Athaide, CEO of TGOD, recognized the challenges for the Canadian marijuana investment market, but indicated to shareholders that he anticipates to see “continued sales momentum” in 2020 thanks to the eventual launch of TGOD’s first cannabis 2.0 products.

Cannabis 2.0 refers to Canada’s second phase of legalization, which covers ingestible items.

Despite that future optimism, the company reported a net loss of C$144.75 million in the most recent quarter, a new low, and a net loss of C$195.75 million for the whole year.

When it comes to its revenue, TGOD reported C$3.25 million for Q4 and C$11.16 million for the year.

Athaide told investors and analysts during a conference call that last year the company was “largely a construction company,” but it is now on the path to see substantial revenues.

Discussing recent cuts, the company told shareholders it now counts about 200 employees in total, with 120 of those working in its facilities.

Due to current market conditions, TGOD is revising both its near- and long-term forecasts. Alongside this revision the company is letting go of its ambitious plans for expansion in Jamaica.

TGOD attempted to reassure investors regarding some of its non-cash impairment charges:

As market conditions improve, and should the Company decide to bring additional cultivation zones online which would increase the expected recoverable amount of future cashflows, the non-cash impairment charges may be reconsidered and be reversed as permitted by its accounting framework.

The company said it expects to become cash flow positive before the end of 2020.

Like many others in the cannabis stock universe, TGOD shares have faced a sharp decline recently. Over a one year period, the company has dropped in value by over 90 percent.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.