Tetra Plans 2020 Product Launch, Confirms C$10 Million Offering

Tetra told investors it is moving ahead with a plan to launch its TERPACAN products in Canadian pharmacy retail locations by mid-2020.

After receiving two drug identification numbers from Health Canada last week, Tetra Bio-Pharma (TSXV:TBP,OTCQB:TBPMF) is now looking to get its products to market within this calendar year.

On Monday (January 20), the Canadian maker of cannabinoid-based drugs told investors that, with the two over-the-counter identification numbers for its TERPACAN brand of hemorrhoid and back and muscle pain treatments, it is moving ahead with its plan to launch the products in Canadian pharmacy retail locations by mid-2020.

Following the receipt of the identifications, Tetra is in the final steps of closing a supply agreement to secure private reimbursement for the TERPACAN offerings and has secured an unnamed manufacturer to create the products.

Tetra said that, in preparation for commercializing its products, it identified an undisclosed contract sales organization to assist in product marketing, and also that it has been in discussions to expand the distribution of the two products into the US once it receives a national drug code from the US Food and Drug Administration (FDA).

Guy Chamberland, CEO of Tetra, said in a press release that the firm has goals to push its products into the wider international marketplace.

“We intend to sell these products globally and to continue to expand these product lines and maintain our lead as an innovator in the world of botanical medicines,” Chamberland said.

Chamberland also noted the firm is working off of the momentum created from the upcoming launch of AWAYE, an osteoarthritis pain relief treatment developed by its subsidiary Panag Pharma. In October, Tetra signed a binding term sheet with Portuguese pharmaceutical brand Azevedos Indústria Farmacêutica to distribute AWAYE across Portugal, Tunisia and Mozambique in Q1 2020.

The AWAYE line is also up for distribution in the Middle East. Tetra said it is in discussions with two undisclosed Middle Eastern pharmaceutical companies for the regional manufacturing and distribution of the AWAYE and TERPACAN product lines.

The company has been on an upswing as of late following a nod of approval from the FDA in December. Tetra’s delta-9-tetrahydrocannabinol (THC) treatment of hepatocellular carcinoma, a type of liver cancer, received orphan drug designation from the federal regulator, resulting in a 10 percent jump in share price.

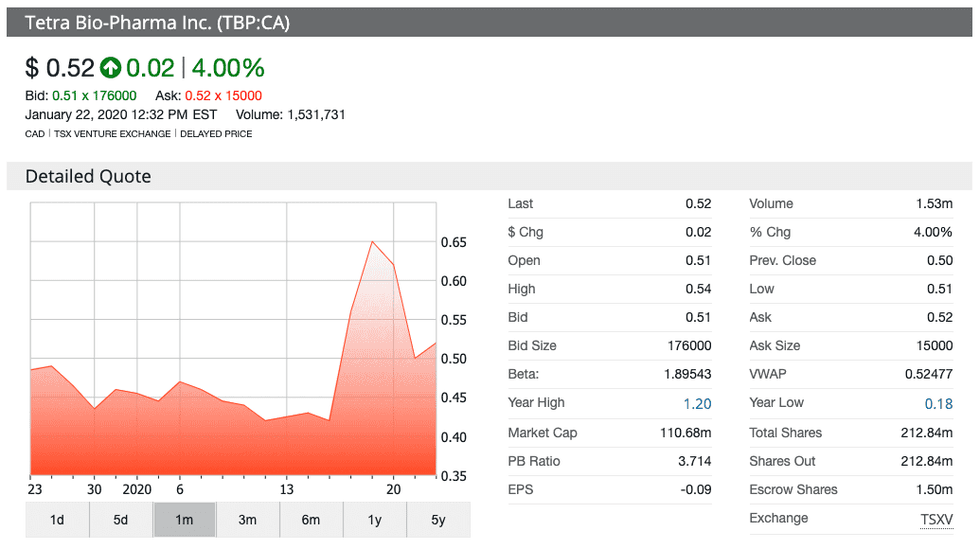

In the past month, share prices have been up 6.1 percent in Toronto, and over the last six months, Tetra has doubled its value, rising 100 percent. The company opened at C$0.51 on Wednesday (January 22) and sits at C$0.52 as of 2:13 p.m. EST.

Tetra and Echelon Wealth enter C$10 million bought deal offering

The week has proven to be a busy one for the drug developer. On Tuesday (January 21), Tetra revealed that investment firm Echelon Wealth Partners has agreed to purchase almost 19 million units of the company on a bought deal basis for a value of about C$10 million.

Echelon will work as the sole underwriter and bookrunner of the deal and has been granted the option to purchase up to 15 percent more units.

Tetra said it plans to use the funding as working capital for general corporate purposes.

The offering is expected to close sometime around February 13, 2020, and is subject to customary closing conditions, including approval from the TSX Venture Exchange and other regulatory authorities.

Don’t forget to follow @INN_LifeScience for real-time updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.