Ontario Returns “Non-conforming” CannTrust Items Worth C$2.9 Million

CannTrust confirmed to INN that the returned product came from its unlicensed rooms. The firm does not yet know when it will receive the product or what it will do with it.

The reputation of a Canadian cannabis company has fallen even further with the news of a million dollar product return in the midst of a growing scandal.

CannTrust Holdings (NYSE:CTST,TSX:TRST) announced Monday (August 19) that the Ontario Cannabis Store (OCS) has returned all of the company’s products, worth C$2.9 million.

The crown corporation tasked with the distribution of cannabis products in the province has deemed that certain CannTrust goods are “non-conforming products” that do not comply with its master cannabis supply agreement with CannTrust.

CannTrust told shareholders it will adhere to the terms of the master agreement, through which the OCS holds the right to return any products deemed non-conforming at the company’s expense.

In an email to the Investing News Network (INN), an OCS spokesperson said that the decision to return the product is “consistent with the OCS’ obligation to operate its business in a responsible manner.”

In its statement, CannTrust notes that the OCS operates independently of Health Canada, the country’s federal cannabis regulator, which has not ordered a recall of the company’s cannabis products.

As the cannabis industry continues to search for valid metrics to compare companies, provincial deals for the distribution of recreational product have gained prominence as a way to examine market presence.

The OCS has now pulled all options for CannTrust products from its website.

In an email response to INN, a CannTrust spokesperson said the company does not know when exactly the OCS will be returning the physical cannabis product.

The Canadian producer confirmed that the product being returned was grown in its unlicensed rooms. According to the spokesperson, all the product sent to the OCS had “met Health Canada standards.”

When asked where the returned product will be allocated, the CannTrust spokesperson told INN the firm is currently reviewing the purpose of the items, but is already considering a clearance by performing bulk sales and holding it under licensed storage.

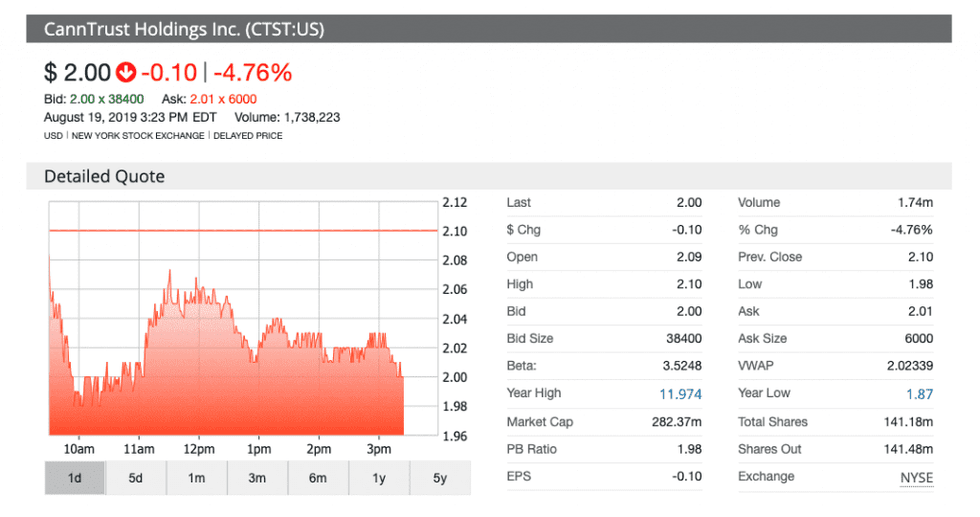

The company’s share price has dropped drastically since news of its non-compliance broke last month. In Toronto, the company opened at C$2.72 on Monday, a decrease of almost 58 percent since it closed at C$6.46 on July 5, before the company disclosed Health Canada’s findings.

New York is a similar tale. On Monday, shares of the company opened at a price of US$2.09 on the NYSE, a drop of almost 58 percent since July 5, when it closed at US$4.94. Near the end of the trading session, shares of the company were down 4.29 percent at a price of US$2.01.

This follows a management cease trade order (MCTO) issued by the Ontario Securities Commission that the company announced on Thursday (August 15). The order prevents CannTrust executives from trading in securities of the company until two days after the company files all the necessary documents, including CannTrust’s Q2 financial report.

The Canadian company elected to file the MCTO because it would be unable to meet the August 14 deadline to file its interim financial reports for the three and six month periods that ended on June 30.

The beleaguered Ontario-based cannabis company has been in the middle of a developing scandal since the unlicensed growing of cannabis in five unlicensed rooms at its facility in Pelham, Ontario, was exposed, resulting in a non-compliant rating from Health Canada.

Following the initial reveal from the cannabis producer, Health Canada placed a hold on 5,200 kilograms worth of dried cannabis product, with CannTrust itself also holding back 7,500 kilograms of marijuana product. The held cannabis is worth over C$69 million based on the average sale price of C$5.47 per gram that was reported in the company’s Q1 results.

In the fallout, an internal investigation was launched as it was found that false walls were hung to hide the unlicensed rooms during routine Health Canada inspections.

The scandal grew when BNN Bloomberg reported that CannTrust executives, including former CEO Peter Aceto and Chairman Eric Paul, were aware of the unlicensed rooms and told employees to “continue as planned” with regards to the illegal growing.

The news resulted in Aceto’s firing and the requested resignation of Paul. Robert Marcovitch, chair of the special committee charged with investigating the matter, was appointed to the role of interim CEO.

Analysts on TipRanks have the company listed as a “hold” with a price target of C$7, a 251 percent upside over the current share price.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.