Next Green Wave Expands Distribution of Its Cannabis Products Via Direct Delivery Service

Next Green Wave is pleased to announce that a selected line of its products will now be available by means of direct delivery service in San Diego.

Next Green Wave Holdings Inc. (CSE:NGW, OTCQX:NXGWF) (“Next Green Wave”, “NGW” or the “Company”) is pleased to announce that a selected line of its products will now be available by means of direct delivery service in San Diego through its distribution partners; Mankind, Columbia Care and March and Ash. The company is also further enhancing its distribution network in Los Angeles by launching its products at premier dispensary Genius. This brings NGW’s distribution network to over 35 access points across 13 states. *

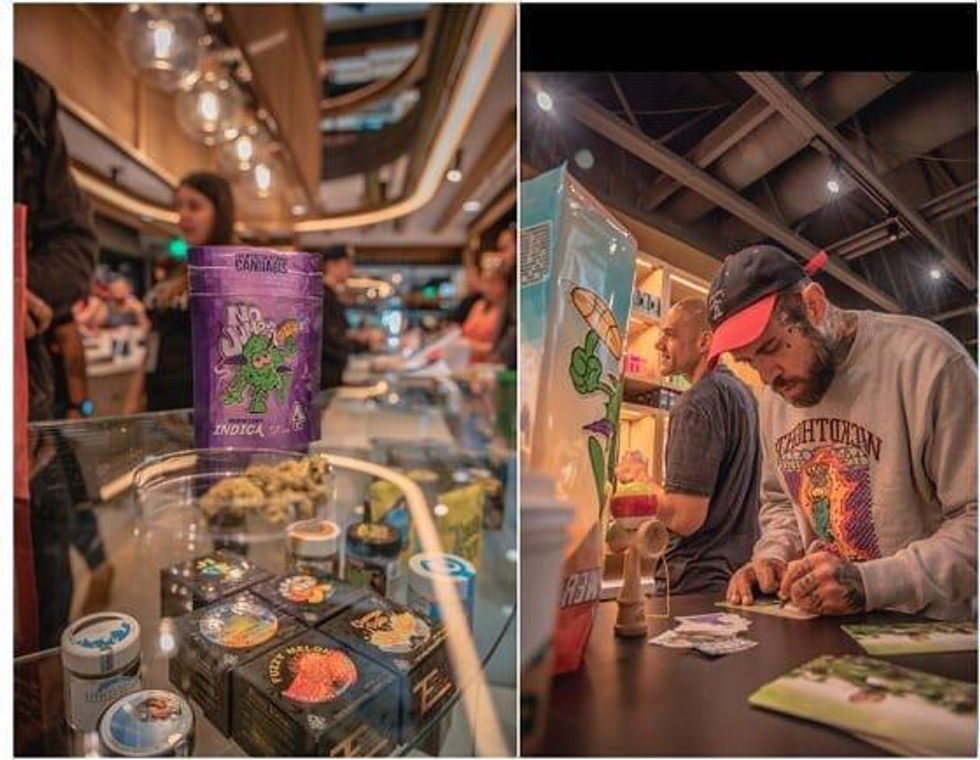

Next Green Wave would also like to thank everyone who attended our successful ‘meet and greet’ with No Jumper at the Mission Valley March and Ash dispensary this past weekend. The pop-up event was the first of many to launch new products and merchandise at exclusive partner dispensaries. Adam22 was met by over 500 fans who took pictures and autographs with the podcast host, resulting in the sell-out of select coveted strains sold during the event.

No Jumper Appearance at March and Ash

To view an enhanced version of this image, please visit:

https://orders.newsfilecorp.com/files/6127/49290_nojumper.jpg

“Selecting premier dispensary locations allows us to have greater control down our brand value chain, from packaging to budtender training events, we are building our story with our community and partners. We are leading the market by meeting the expectations of our new customers with superior product and giving them the opportunity to engage with our brands and partners, like we did this past weekend. We are working on elevating the customer experience at every touch point, with the expectation that when we host these product drops, we can sell out of stock in hours,” commented Chief Marketing Officer Ryan Lange.

Cannot view this video? Visit:

https://www.youtube.com/watch?v=bAjHEHB2O0I

Additionally, the company would like to note that it is on schedule with its next harvest and weekly distribution to replenish product to its partner distributors.

*In accordance to regulations, only CBD line of products will be made available to consumers outside the California state through partner dispensary locations and online orders permitted within those states.

NGW is a fully integrated premium cannabis producer with 8 legacy brands and over 45 products marketed through its WEARESDC brand house. Based in Coalinga, California the company owns and operates a 35,000 sq ft state-of-the-art cultivation facility and is currently expanding extraction and other operations on its cannabis zoned campus. NGW has a seed library of over 120 cannabis strains which include multiple award-winning genetics and cultivars and is developing its nursery cloning operations with bio-tech leader Intrexon. To find out more visit us at www.nextgreenwave.com or follow us on Twitter, Instagram, or LinkedIn.

On behalf of the board,

Michael Jennings, CEO

Next Green Wave Holdings Inc.

For more information regarding Next Green Wave, contact:

Caroline Klukowski

VP Corp. Development

Tel: +1 (604) 609.6167

IR@nextgreenwave.com

Next Green Wave Forward Looking Statements

This press release contains forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be materially different from any future results, events or developments expressed or implied by such forward looking statements. Such risks and uncertainties include, among others, the risk factors included in the preliminary prospectus, including without limitation dependence on obtaining and maintaining regulatory approvals, including acquiring and renewing state, local or other licenses and any inability to obtain all necessary governmental approvals licenses and permits to complete construction of its proposed facilities in a timely manner; engaging in activities which currently are illegal under US federal law and the uncertainty of existing protection from U.S. federal or other prosecution; regulatory or political change such as changes in applicable laws and regulations, including U.S. state-law legalization, particularly in California, due to inconsistent public opinion, perception of the medical-use and adult-use marijuana industry, bureaucratic delays or inefficiencies or any other reasons; any other factors or developments which may hinder market growth; NGW’s limited operating history and lack of historical profits; reliance on management; NGW’s requirements for additional financing, and the effect of capital market conditions and other factors on capital availability, including closing of Tranche 1 and Tranche 2 of the Notes; competition, including from more established or better financed competitors; and the need to secure and maintain corporate alliances and partnerships, including with customers and suppliers. Readers are encouraged to the review the section titled “Risk Factors” in NGW’s prospectus. These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward-looking statements. Although NGW has attempted to identify important risk factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other risk factors that cause actions, events or results to differ from those anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in forward-looking statements. NGW no obligation to update any forward-looking statement, even if new information becomes available as a result of future events, new information or for any other reason except as required by law.

Click here to connect with Next Green Wave (CSE:NGW) for an Investor Presentation.