Neptune Reveals Acasti Share Sale After Failed Drug Study

Neptune said the months-long sale generated US$4 million in net proceeds, a move geared at monetizing the firm’s non-core investments.

After a failed drug study and massive drop in value for Acasti Pharma (NASDAQ:ACST,TSXV:ACST), Neptune Wellness Solutions (NASDAQ:NEPT,TSX:NEPT) has revealed it recently sold over 1.9 million shares of the company.

On Monday (January 13), Neptune informed investors of the months-long sale, which generated US$4 million in net proceeds. It said the selloff of its subsidiary’s shares was part of a monetizing process for Neptune’s non-core investments.

Since the market closed on Monday, Neptune’s value has risen 3.2 percent, and its share price sat at US$2.57 as of 3:16 p.m. EST on Tuesday (January 14).

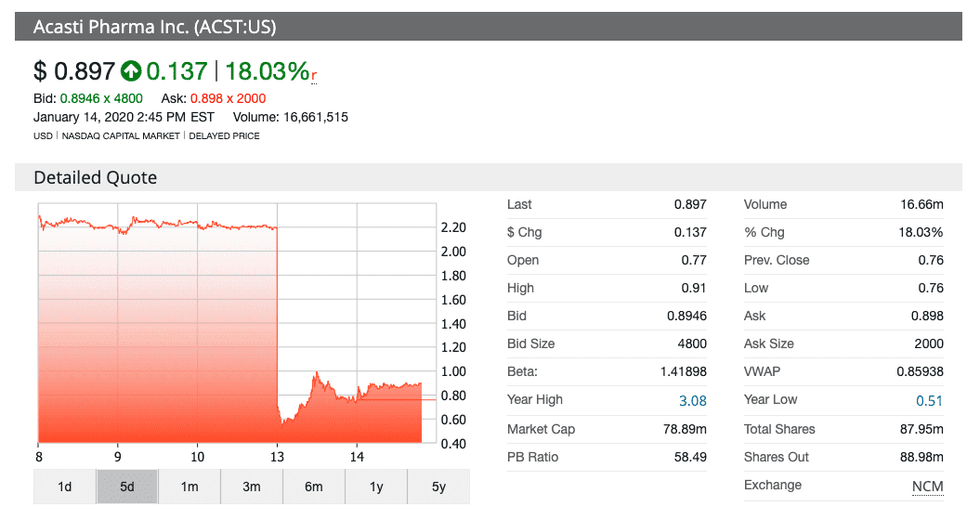

Acasti has not fared as well. Shares dropped a stunning 68.3 percent from last Friday (January 9) to market open on Monday, the day it announced the failed trial.

CaPre, Acasti’s krill-oil-based medicine, is being developed to treat severely elevated levels of triglycerides, a type of fat found in the blood. High triglyceride levels are linked to an increased risk of cardiovascular disease and pancreatitis, according to Acasti.

Though CaPre proved to be slightly more effective in lowering triglyceride levels, patients in both the placebo groups and the groups given the active drug had experienced significant triglyceride reductions by the end of the Phase 3 study period.

Dariush Mozaffarian, principal investigator for the study, said the results for the placebo groups were “unexplained and highly unusual,” adding that the initial review of the study didn’t reveal any issues in quality control or capsule content.

The company is now in the process of investigating the data to uncover the cause of the unprecedented placebo effect, and it expects to report the results of the audit by the end of February.

In the meantime, there are still plans to move forward with another CaPre study; however, with the audit of the failed trail, Acasti said there could be a delay in the new results.

Key secondary data from both studies is expected to be released during the first quarter of calendar 2020 year, the firm said.

Neptune still holds 1 million shares of the Quebec-based biopharmaceutical company and plans to use the new funds to distribute its Cannabis 2.0 products into the market.

Recently, Neptune disclosed some of its plans for ingestible cannabis products.

In a corporate update released this past Friday, the company noted that it’s targeting a February launch window in the US for its Forest Remedies brands of hemp-derived products, including soft gels, oils and topicals.

Another part of Neptune’s plan to focus on production involves the expansion of its packaging and warehousing capability at its facility in Sherbrooke, Quebec, which will give it more space for product formulation.

Neptune is also looking to get permission from Health Canada to sell its products directly to licensed cannabis retailers for the initial launch of its portfolio of branded products.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.