Harborside Inc. Announces Second Quarter and First Half 2019 Results

Harborside Inc. (“Harborside” or the “Company”) (CSE:HBOR), today reported financial results for the three and six months ending June 30, 2019.

Harborside Inc. (“Harborside” or the “Company”) (CSE:HBOR), today reported financial results for the three and six months ending June 30, 2019. All figures are reported in U.S. dollars unless otherwise stated.

Financial Highlights

- Second quarter revenue increased 19.8% year-over-year to $12.7 million, driven by 6.5% growth in retail revenue and 208% growth in wholesale revenue

- Adjusted gross margin for the second quarter improved to 56% from 14% in the prior year due to an increase in wholesale sales and a favorable fair value adjustment to inventory(1)

- Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) of $2.5 million for the second quarter of 2019 compared to ($3.3) million for the prior year(1)

- Net loss for the second quarter was $15.6 million, as compared to net loss of $4.8 million in the prior year, primarily due to a $15.4 million provision for potential tax penalties under 280E and $3.6 million of non-recurring expenses relating to the Company’s reverse takeover transaction (“RTO”) and other one-time items, offset by a non-cash gain on derivative liabilities of $7.2 million due to translation on exercise prices of options and warrants, and conversion prices of debentures, denominated in other foreign currencies

- Total assets totaled $60.1 million and included $19.3 million cash on hand

- On June 10, 2019, commenced trading on the Canadian Securities Exchange (“CSE”) following the completion of the RTO and concurrent private placement financing of approximately $15.0 million worth of subscription receipts

Management Commentary

“The second quarter was a milestone for Harborside. On June 10, we listed on the CSE after completing the RTO and raising capital. I am pleased that in our first quarter as a public company, we reported solid revenue growth and were profitable on an Adjusted EBITDA basis(1), and that we now rank among the top 20 US listed cannabis companies by revenue,” said Harborside CEO Andrew Berman.

“That said, the Board and our executive team are not at all satisfied with the significant loss of market capitalization in our first months as a public company. While the overall market is down, what upsets us is that Harborside is down even more despite our installed base of revenue and solid growth prospects. We think we are significantly undervalued, and to demonstrate that firm belief, today we also announced that we are implementing a normal course issuer bid under which we expect to buy up to 5% of our subordinate shares.”

“In addition to this program, we have engaged secondary liquidity providers, are seeking research coverage of our company, are executing our California-centric growth plan, and are working towards rightsizing our operating expenses with a goal of achieving no more than 35% of revenue.”(2)

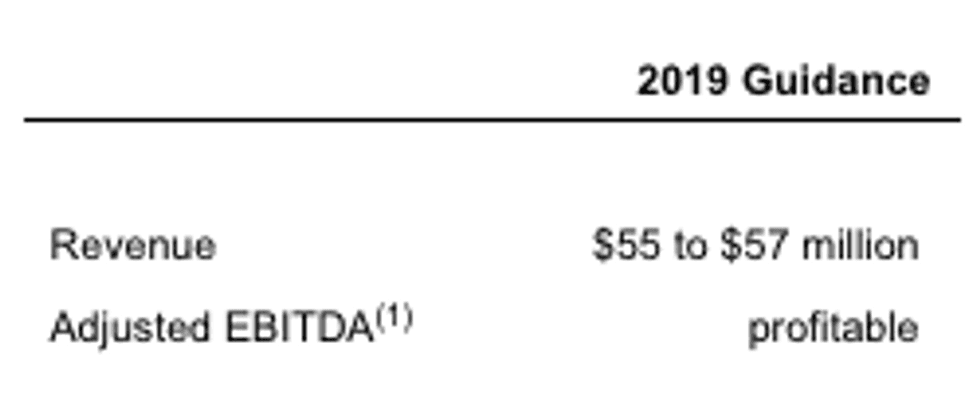

“I also want to provide you with our goals for 2019. We are targeting $55 to $57 million of revenue and to achieve positive Adjusted EBITDA.(1) We believe that the combination of solid topline growth and margin expansion for a cannabis asset trading at 1.5x revenue makes for a highly attractive investment opportunity.” (2)

These targets, and the related assumptions, involve known and unknown risks and uncertainties that may cause actual results to differ materially. While Harborside believes there is a reasonable basis for these targets, such targets may not be met. These targets represent forward-looking information. Actual results may vary and differ materially from the targets. See “Cautionary Note Regarding Forward-Looking Information” and “Assumptions” below.

Retail Business Development

- Second quarter retail revenue increased 6.5% year-over-year to $10.5 million, driven by higher sales activity at the two flagship Harborside stores in Oakland and San Jose

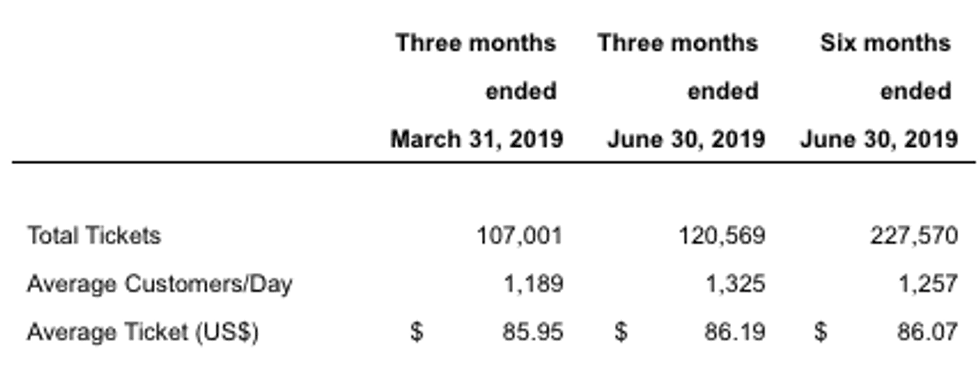

- Harborside’s dispensaries in Oakland and San Jose serviced an average of 1,325 customers per day during the second quarter, with an average basket size of $86

- Our continued innovation in the retail experience at the Oakland flagship store, including a positively received, redesigned open retail floor plan, drove improved basket size and traffic in the second quarter

- Harborside dispensaries won awards in three cannabis-related categories in the 2019 East Bay Express “Best of the East Bay” competition including Best Cannabis Dispensary, Best Cannabis Deals and Most Deluxe Cannabis Accessories

- On August 29th, Desert Hot Springs received its certificate of occupancy after passing building, fire and public works inspections, clearing the way for an opening in October. The store is one of only two in the State of Californiawith a licensed drive-thru window.

Wholesale Business Development

- Second quarter wholesale revenue increased 208% year-over-year to $2.2 million, driven by increased scale of cultivation, improved product quality, and expanded distribution throughout the state of our cannabis products

- New state-of-the art 44,000 square foot Dutch Venlo greenhouse, which we are planting in mid-September and harvesting by end of November 2019, which is expected to contribute nearly 10,000 lbs of annual production

- Continued traction for our proprietary Key brand, sold into nearly 20% of licensed stores in California. Key won 3rd Place title in the Best Edibles category for Key’s Red Berry Fruit Jellies at the High Times Bay Area Cannabis Cup held in June

- Additional proprietary brands under development targeting underserved demographic segments with significant growth potential

Discussion of Second Quarter 2019 and First Half 2019 Results

Revenue for the second quarter of 2019 totaled $12.7 million, compared to $10.6 million for the second quarter of 2018, representing an increase of 19.8%. Revenue for the first half of 2019 was $24.7 million, an increase of 21.4%, compared to $20.4 million in the prior year period.

Gross profit before biological asset adjustment for the second quarter of 2019 was $7.1 million or 56%, as compared to $1.5 million or 14% for the same period last year. For the first half of 2019, gross profit, excluding the impact of fair value adjustments for biological assets was $8.9 million or 36%, as compared to $1.8 million or 9% in the prior year period. The improvement in adjusted gross margin was due to increased quality wholesale sales and a favorable fair value adjustment to inventory.

Total operating expenses for the second quarter of 2019 were $13.0 million, compared to $7.9 million for the prior year period. Total operating expenses in the second quarter of 2019 included $1.5 million in expenses related to share-based incentive compensation, $2.3 million of share-based payments, $3.3 million in non-recurring RTO-related expenses, $0.3 million in founders’ separation costs included in General & Administrative, and $0.3 million of depreciation and amortization.

Adjusted EBITDA for the second quarter of 2019 was $2.5 million, compared to ($3.3) million for the second quarter of 2018. Adjusted EBITDA for the first half of 2019 was ($0.1) million, compared to ($6.0) million in the prior year period. See “Non-IFRS Financial Measures, Reconciliation and Discussion.”

Net loss for the second quarter of 2019 was $15.6 million, compared to a net loss of $4.9 million for the second quarter of 2018, and for the first half of 2019 was ($21.7) million, compared to ($8.9) million in the prior year period. The primary reason for the 2019 net loss increase over the prior year is the inclusion in the second quarter of a one-time provision of $15.4 million relating to potential tax liabilities under Section 280E of the Internal Revenue Code. The Company contests in all aspects any and all such liabilities, and the recording of this one-time provision is not an indication of the Company’s position on this matter or an admission of any liability. This was partially offset by a non-cash gain of $7.2 million due to foreign currency translation on options and warrants.

Balance Sheet and Liquidity

As of June 30, 2019, total assets were $60.1 million, including $19.4 million of cash. Outstanding debt includes notes payable and accrued interest of $1.2 million and leases payable of $0.4 million. Total shareholders’ equity was $19.3 million.

Capital Markets and Financing Activities

Harborside commenced trading of its subordinate voting common shares on the CSE on June 10, 2019 under the symbol “HBOR” following the successful completion of a reverse takeover (“RTO”) transaction with Lineage Grow Company Ltd. and a concurrent private placement financing which raised approximately $15.0 million.

Subsequent to quarter end, Harborside exercised its merger option to acquire 100% ownership of Patients Mutual Collective Corporation (“PMACC”), which operates the retail Harborside dispensaries in Oakland and San Jose. As part of the transaction, the Company also acquired indirectly a 50% ownership interest in San Leandro Wellness Solutions, Inc., which owns the entitlement on a retail dispensary located in San Leandro, California, which is currently under construction and is anticipated to commence cannabis related activities during the second half of 2019.

Update on Pipeline Acquisitions

On August 29, 2019, management determined that the Company does not expect to proceed with the transactions contemplated by the stock purchase agreement among FLRish Retail Management & Security Services LLC and Airfield Supply Co., Inc. and its owner, in light of the Company’s current share price and the substantial cash component of the purchase price which management has determined is not in the best interests of shareholders.

On August 29, 2019, management determined that the Company does not expect to proceed with the Agris Acquisition as contemplated by the Agris Agreement, in light of the principal owner’s demand for an increase in the purchase price and other terms which in management’s judgment make the transaction not in furtherance of the Company’s goals or strategy or otherwise in the interests of the Company’s shareholders, and given the Company’s already substantial capacity to produce high-quality cannabis at its Salinas facility at significant scale. The Company expressly reserves in all respects all rights it has or may have under the Agris Agreement. In addition, Menna Tesfatsion, the founder and principal owner of Agris Farms, will not be joining Harborside as Chief Operating Officer.

Conference Call and Webcast Details

The Company will host a conference call and webcast to review its results at 11:00 a.m. Eastern Time (8:00 a.m. Pacific Time) tomorrow, Friday, August 30, 2019. The conference call will be accessible on our corporate website at www.investharborside.com and by dialing 888-390-0605 (416-764-8609 for international callers) and providing conference ID 94887237. To ensure proper connection, it is advised to log on or dial in ten minutes prior to start time.

A recording of the call will be available one hour after the end of the conference call until 11:59 p.m. Eastern Time (8:59 p.m. Pacific Time), September 13, 2019, by dialing 888-390-0541 (416-764-8677 for international callers) and providing playback passcode 887237, or by visiting www.investharborside.com.

About Harborside:

Harborside Inc. is one of the oldest and most respected cannabis retailers in California, operating two major dispensaries in the San Francisco Bay Area, two dispensaries in Oregon and a cultivation facility in Salinas, California. Harborside has played an instrumental role in making cannabis safe and accessible to a broad and diverse community of Californiaconsumers. Co-founded by Steve DeAngelo and dress wedding in 2006, Harborside was awarded one of the first six medical cannabis licenses granted in the United States. Harborside is currently a publicly listed company on the CSE trading under the ticker symbol “HBOR”. Additional information regarding Harborside is available under Harborside’s SEDAR profile at www.sedar.com including in Harborside’s Listing Statement dated May 30, 2019, the unaudited condensed interim consolidated financial statements for the three and six months ended June 30, 2019 and 2018, and the management’s discussion and analysis of financial condition and operating performance for the three and six months ended June 30, 2019.

For the latest news, activities, and media coverage, please visit the Harborside corporate website at www.investharborside.com or connect with us on LinkedIn, Facebook, and Twitter.

Non-IFRS Measures, Reconciliation and Discussion

This press release contains references to “Adjusted EBITDA”, “Adjusted Gross Profit” and “Adjusted Gross Margin”, which are non-IFRS financial measures.

Adjusted EBITDA is a measure of the Company’s overall financial performance and is used as an alternative to earnings or net income in some circumstances. Adjusted EBITDA is essentially net income (loss) with interest, taxes, depreciation and amortization, non-cash adjustments and other unusual items added back. This measure can be used to analyze and compare profitability among companies and industries, as it eliminates the effects of financing and capital expenditures. It is often used in valuation ratios and can be compared to enterprise value and revenue. This measure does not have any standardized meaning according to IFRS and therefore may not be comparable to similar measures presented by other companies.

Adjusted Gross Profit and Adjusted Gross Margin exclude the fair value adjustments for the Company’s biological assets. Management believes these measures provide useful information as they represent the gross profit based on the Company’s cost to produce inventories sold and removes fair value metrics tied to changing inventory levels, as required by IFRS.

There are no comparable IFRS financial measures presented in Harborside’s unaudited condensed interim consolidated financial statements. Reconciliations of the supplemental non-IFRS measures are presented in the Company’s management’s discussion and analysis of financial condition and financial performance for the three and six months ended June 30, 2019 (the “Interim MD&A”). The Company believes that the measures provide information useful to shareholders and investors in understanding our performance and may assist in the evaluation of the Company’s business relative to that of its peers. For more information, please see “Non-IFRS Measures” in the Company’s Interim MD&A available on www.sedar.com.

Notes:

- This is a non-International Financial Reporting Standard (“IFRS”) reporting measure. For a reconciliation of this to the nearest IFRS measure, see “Non-IFRS Measures, Reconciliation and Discussion” in the Company’s Interim MD&A.

- This is forward-looking information and based on a number of assumptions. See “Cautionary Note Regarding Forward-Looking Information.”

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward looking-statements relate to, among other things, future expansion plans.

These forward-looking statements are based on reasonable assumptions and estimates of management of the Company at the time such statements were made. Actual future results may differ materially as forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors, among other things, include: fluctuations in general macroeconomic conditions; fluctuations in securities markets; expectations regarding the size of the Californiacannabis market and changing consumer habits; the ability of the Company to successfully achieve its business objectives; plans for expansion; political and social uncertainties; inability to obtain adequate insurance to cover risks and hazards; and the presence of laws and regulations that may impose restrictions on cultivation, production, distribution and sale of cannabis and cannabis related products in the State of California; and employee relations. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Readers should not place undue reliance on the forward-looking statements and information contained in this news release. The Company assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

The Company is indirectly involved in the manufacture, possession, use, sale and distribution of cannabis in the recreational and medicinal cannabis marketplace in the United States. Local state laws where the Company operates permit such activities however, these activities are currently illegal under United States federal law. Additional information regarding this and other risks and uncertainties relating to the Company’s business are contained under the heading “Risk Factors” in the Listing Statement dated May 30, 2019, filed under the Company’s profile on SEDAR at www.sedar.com.

Assumptions

In developing the financial guidance set forth above, Harborside made the following assumptions and relied on the following factors and considerations:

- The targets are based on Harborside’s historical results including its year to date consolidated results of operations.

- The targets are subject to the completion of Harborside’s 44,000 square foot Dutch Venlo greenhouse cultivation facility in Salinas expansion and other cultivation improvement plans anticipated to come online in the last quarter of 2019 and during 2020.

- The targets are subject to the successful closing of the previously announced acquisition of Lucrum Enterprises, Inc. (“LUX”), which operates a 3,700 square foot dispensary in San Jose, California, and the relocation of that dispensary to a new location. There is no assurance that such acquisition will be completed as contemplated or at all.

- Revenue at our retail dispensaries through the end of the year are based on our YTD results.

- Wholesale revenue in the second half of 2019 is expected to grow by approximately 180% compared to the first half of the year, which growth is based upon more favorable weather conditions in Salinas, our Dutch Venlo greenhouse coming on-line in September 2019, and implementation of additional environmental and other quality controls aimed at ensuring product quality.

- Both retail and wholesale revenue sustainability and growth depend on a variety of factors, including among other things, location, competition, legal and regulatory requirements. Prices are projected forward at recently realized wholesale and retail prices.

- Cost of goods sold, before taking into account the impact of value changes in biological assets (which are non-cash in nature, and, accordingly, are excluded from calculations of Adjusted EBITDA), have been projected based on estimated costs of production and capacity available from a vertically-integrated supply chain. Cost of goods sold relating to retail inventory purchased from third parties have been projected in line with historical levels, which is approximately 50%. Across our retail and wholesale businesses, we assume blended adjusted gross margin to be approximately 35%. Our gross margin can be influenced by a number of factors given, among other things, the cost of cannabis cultivation and production, wholesale cannabis prices, and other relevant factors.

- Selling, general and administrative expenses through the end of 2019 are assumed to remain consistent through the end of 2019, but to decrease as a percentage of revenues due to inherent scalability of selling, general and administrative expenses, and to be in the range of 35% or below as a percentage of revenue. Additionally, total selling, general and administrative expenses include an allocation for corporate overhead and public company costs.

- Our 2019 guidance does not include the results of any pipeline acquisitions other than LUX.

The CSE has neither approved nor disapproved the contents of this news release. Neither the CSE nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Click here to connect with Harborside Inc. (CSE:HBOR) for an Investor Presentation.

Source: www.prnewswire.com