Grown Rogue Second Quarter Revenue Increases Sixfold Year-over-Year and 125 percent Quarter-over-Quarter to $1.9M

Grown Rogue International Inc. (CSE:GRIN, OTC:GRUSF) (“Grown Rogue” or the “Company”), a vertically-integrated, multi-state cannabis company, with licenses and operations in Oregon, California, and now entering Michigan, has released its financial and operating results for its fiscal second quarter ended April 30, 2019.

Grown Rogue International Inc. (CSE:GRIN, OTC:GRUSF) (“Grown Rogue” or the “Company”), a vertically-integrated, multi-state cannabis company, with licenses and operations in Oregon, California, and now entering Michigan, has released its financial and operating results for its fiscal second quarter ended April 30, 2019. The Company’s financial statements and management’s discussion and analysis for the period are available on the Company’s SEDAR profile at www.sedar.com or through the Company’s website at www.grownrogue.com. All amounts are expressed in United States Dollars unless otherwise indicated. Certain metrics, including those expressed on an adjusted basis, are non-IFRS measures.

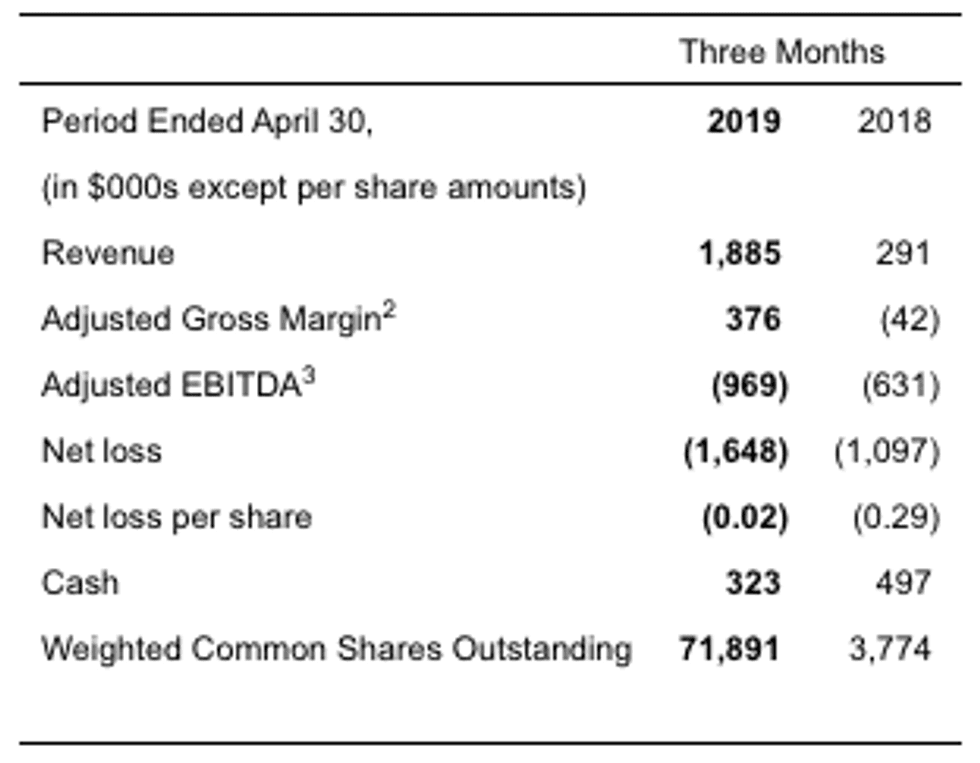

Financial Highlights

- Second quarter 2019 revenues increased more than six-fold year-over-year, from $0.3 million to $1.9 million. Quarter-over-quarter revenues increased 125%, from $0.8 million in Q1.

- Adjusted Gross Margin2 was ($0.02) million for the quarter and $0.2 million for the year-to-date. Adjusted Gross Margin was $0.4 million for the second quarter (20%) and $0.8 million for the year-to-date (28%)

- Adjusted EBITDA3 was ($1.0) million for the second quarter.

Management Commentary

“Our second quarter revenue results are indicative of the brand strength and distribution reach we have achieved in Oregon and we are taking the same platform to California and Michigan,” said Obie Strickler, CEO of Grown Rogue. “The proposed acquisition of Decibel Farms announced in April is expected to increase our manufacturing capacity in Oregon where we continue to enjoy record demand for our products. Our California distribution license went into effect during the second quarter with revenues expected to commence this month.”

Grown Rogue expects to increase its combined annual flower production capacity in Oregon and Michigan from approximately 5,000 lbs (2,300 kgs) currently, to approximately 12,000 lbs (5,400 kgs) by the end of fiscal year 2019 following the anticipated incorporation of Decibel Farms and scaling of its cultivation operations in Michigan. The increased capacity is inclusive of the 40,000 square feet of greenhouse production capacity in Oregon in the proposed Decibel Farm transaction announced in April 2019. Grown Rogue’s anticipated acquisition of the Decibel brand includes Decibel’s “Loud” branded pre-roll which features a unique “painted on” rosin. Grown Rogue plans to introduce this innovative product in the California market in the third calendar quarter of 2019.

Qualitative Performance Factors

“We believe that licenses, assets, and operations are of little value without an experienced team that knows how to cultivate quality cannabis products at scale and build meaningful brands. Our team has been building these core competencies for the past 3 years,” added Jacques Habra, Chief Strategy Officer.

Grown Rogue has received recognition at regional cannabis competitions for “Highest Percentage THC”, “Highest Percentage Terpenes”, as previously announced in a press release on January 8, 2019. This recognition for cultivation excellence are the foundation of the Grown Rogue products that the company intends to bring to California and Michigan.

Grown Rogue current multi-state presence

Well-established in Oregon, Grown Rogue has expanded into California and its third state, the highly populated, limited-license state of Michigan through a partnership agreement

Oregon Operations

- Cultivating 130,000 sq. ft. of canopy in Oregon (including Decibel Farms) including three outdoor and greenhouse farms and a state-of-the-art indoor facility

- Increased outdoor yield from 2018 to 2019 by over 50%

- Increasing market penetration and sales revenue

California Operations

- Expanded into California with a 16,000-square-foot microbusiness facility in Eureka with retail, processing and distribution licensing partnership spanning San Francisco to Los Angeles.

- Secured state and local approval for distribution license and type 6 manufacturing (non-volatile), and local approval for type 7 manufacturing (volatile).

Michigan Operations

- Subsequent to the close of the second quarter a binding LOI was signed to acquire Michigan operator “Inferno Gardens Inc.” which includes one retail dispensary (referred to as provisional centers in Michigan), a 24,000 sq ft indoor cultivation facility, and a processing/manufacturing center. First sales are anticipated to begin in early 2020.

- As a result of this new agreement with Inferno Gardens originally disclosed in a press release on July 2, 2019, Grown Rogue has elected not to move forward with a previously announced option to acquire alternative Michiganoperations as previously announced in a press release on February 25, 2019.

Selected Financial Information (Complete financial tables have been filed on www.sedar.com)

Second Quarter 2019 Financial Overview

Grown Rogue revenue grew to $1.9 million, a 548% increase from revenue of $0.3 million in its second fiscal quarter ended April 30, 2018, and a 125% increase on a consecutive quarterly basis from $0.8 million in Grown Rogue’s first quarter of fiscal 2019. Organic sales growth are driven through the internal sales force, third party distribution, and strengthening of the Grown Rogue brand.

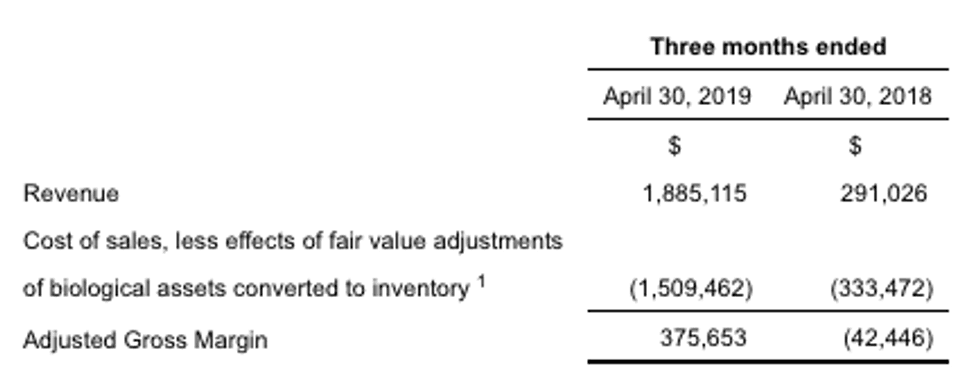

F2019 Q2 Adjusted Gross Margin2 was $0.4 million, or 20% of revenues, a substantial improvement from Adjusted Gross Margin of ($0.04) million for the same period last year. Adjusted Gross Margin improved as a result of the efforts of the Company over the past year to refine its cultivation processes to be more efficient, resulting in lower cost of sales, while also increasing revenue.

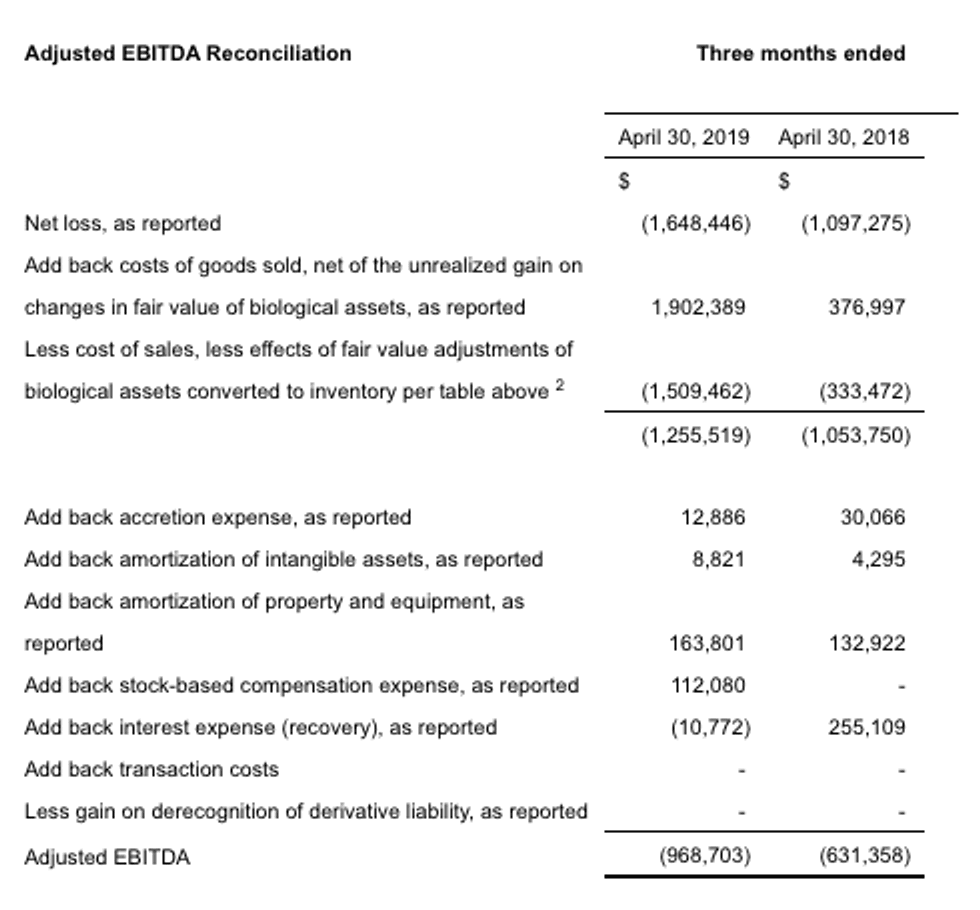

General and administrative expenses were $1.3 million for the second quarter of fiscal 2019, compared to similar expenses of $0.6 million for the second quarter of fiscal 2018. The increase in expenses was primarily related to the expanded scope of operations and associated sales, general and administrative support. Grown Rogue’s Adjusted EBITDA3 amounted to ($1.0) million for the three months ended April 30 2019, compared to ($0.6) million for the three months ended April 30, 2018. The increased loss was primarily attributable to infrastructure investments required to support the company’s growth plans.

The Company’s cash and cash equivalents position was $0.3 million as at April 30, 2019. Subsequent the second quarter the Company completed a CAD $1.5 million debenture financing.

Subscribe to Grown Rogue investor news alerts.

About Grown Rogue

Grown Rogue International (CSE: GRIN | OTC: GRUSF) is a vertically-integrated, multi-state Cannabis family of brands on a mission to inspire consumers to “enhance experiences” through cannabis. We have combined an expert management team, award winning grow team, state of the art indoor and outdoor manufacturing facilities, and consumer insight based product categorization, to create innovative products thoughtfully curated from “seed to experience.” The Grown Rogue family of products include sungrown, light dep and indoor premium flower, live rosin jars and terp diamonds, infused, indoor and sungrown pre-rolls, live resin and rosin carts, along with chocolate edibles created in partnership with a world-renowned Chocolatier.

NOTES:

| 1. | |

| The Company’s “Cost of sales, less effects of fair value adjustment of biological assets converted to inventory” is a non-IFRS measure that does not have any prescribed meaning by IFRS and that may not be comparable to similar measures presented by other companies. As the Company’s biological assets are developed towards a state where they can be harvested and processed into saleable inventory, the carrying value of these biological assets are adjusted to fair value as at each financial reporting date. Once the biological assets are transferred to inventory based on this value, these fair value adjustments form a component of the value of the inventory, which is subsequently recorded as cost of sales upon final sale. The Company’s cost of sales, less effects of fair value adjustment of biological assets converted to inventory measure attempts to remove these fair value adjustments from cost of sales. The Company believes that this is a useful metric to evaluate its operating performance. | |

| 2. | |

| “Adjusted Gross Margin” is the result of deducting “Cost of sales, less effects of fair value adjustments of biological assets converted to inventory” from revenue for the period. | |

| 3. | |

| Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) is not a recognized performance measure under IFRS. The Company defines Adjusted EBITDA as the Company’s net income (loss) for a period, as reported, before interest, taxes, depreciation and amortization, and is further adjusted to remove transaction costs, stock-based compensation expense, accretion expense, gain (loss) on derecognition of derivative liabilities and the effects of fair-value accounting for biological assets and inventory. The Company believes that this is a useful metric to evaluate its operating performance. The following is a reconciliation of the Company’s net income (loss) to Adjusted EBITDA. | |

FORWARD LOOKING STATEMENTS

This press release contains statements which constitute “forward‐looking information” within the meaning of applicable securities laws, including statements regarding the plans, intentions, beliefs and current expectations of the Company with respect to future business activities. Forward‐ looking information is often identified by the words “may,” “would,” “could,” “should,” “will,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “expect” or similar expressions and include information regarding: (i) statements regarding the future direction of the Company (ii) the ability of the Company to successfully achieve its business and financial objectives, (iii) plans for expansion of the Company intoMichigan and securing applicable regulatory approvals, and (iv) expectations for other economic, business, and/or competitive factors. Investors are cautioned that forward‐looking information is not based on historical facts but instead reflect the Company’s management’s expectations, estimates or projections concerning the business of the Company’s future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Although the Company believes that the expectations reflected in such forward‐looking information are reasonable, such information involves risks and uncertainties, and undue reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements of the combined company. Among the key factors that could cause actual results to differ materially from those projected in the forward‐looking information are the following: changes in general economic, business and political conditions, including changes in the financial markets; and in particular in the ability of the Company to raise debt and equity capital in the amounts and at the costs that it expects; adverse changes in the public perception of cannabis; decreases in the prevailing prices for cannabis and cannabis products in the markets that the Company operates in; adverse changes in applicable laws; or adverse changes in the application or enforcement of current laws; compliance with extensive government regulation and related costs, and other risks described in the Company’s public disclosure documents filed on www.sedar.com.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward‐looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update this forward‐looking information except as otherwise required by applicable law.

Safe Harbor Statement:

This press release may contain forward-looking information within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including all statements that are not statements of historical fact regarding the intent, belief or current expectations of the Company, its directors or its officers with respect to, among other things: (i) the Company’s financing plans; (ii) trends affecting the Company’s financial condition or results of operations; (iii) the Company’s growth strategy and operating strategy; and (iv) the declaration and payment of dividends. The words “may,” “would,” “will,” “expect,” “estimate,” “anticipate,” “believe,” “intend” and similar expressions and variations thereof are intended to identify forward-looking statements. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date hereof. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, many of which are beyond the Company’s ability to control, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors including the risk disclosed in the Company’s Form 20-F and 6-K filings with the Securities and Exchange Commission.

The Company is indirectly involved in the manufacture, possession, use, sale and distribution of cannabis in the recreational cannabis marketplace in the United States through its indirect operating subsidiaries. Local state laws where its subsidiaries operate permit such activities however, these activities are currently illegal under United Statesfederal law. Additional information regarding this and other risks and uncertainties relating to the Company’s business are disclosed in the Company’s Listing Statement filed on its issuer profile on SEDAR at www.sedar.com. Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

Click here to connect with Grown Rogue (CSE:GRIN) for an Investor Presentation.

Source: www.prnewswire.com