Green Growth Brands Fourth Quarter Revenue Increases 29 Percent Quarter-Over-Quarter to $7.2 Million

Green Growth Brands Inc. reported its results for the fourth quarter and full year ended June 30, 2019.

Green Growth Brands Inc. (GGB or the Company) (CSE:GGB, OTCQB:GGBXF) today reported its results for the fourth quarter and full year ended June 30, 2019. The Company reported total revenue for fiscal 2019 of $15.7 million. For the three month period ended June 30, 2019, the Company reported a 29% quarter-over-quarter increase in revenue to $7.2 million.

“In a short-time we have built a pathway to open up to 47 dispensaries in three key states and established the first, best and only vertical CBD distribution network in the country,” said Peter Horvath, CEO of Green Growth Brands. “This foundation leverages our strengths of creating brands consumers love, building innovative product assortments and operating and growing retail at scale, quarter after quarter.

“As we look ahead to fiscal 2020, our focus will shift from foundation building to operating and executing, which we expect to result in a steep sequential growth in both our CBD and MSO businesses.”

To read more of Horvath’s thoughts on the growth and trajectory of the business, please read the Letter to Shareholders.

GGB will host a conference call and audio webcast with Chief Executive Officer, Peter Horvath, and Chief Financial Officer, Brian Logan, at 8:30 AM EDT on Thursday, October 24, 2019.

Fourth Quarter & Full Year Fiscal 2019 Highlights

- Total revenue for fiscal 2019 was $15.7 million, which reflects seven and a half months of MSO revenue since the reverse takeover in November 2018 and the launch of the CBD business in February 2019.

- Total revenue for the quarter, including both MSO and CBD operations, was $7.2 million, a sequential increase of 29% over the prior quarter.

- MSO revenue for the quarter, which primarily consists of one dispensary in Las Vegas, The+Source, was $5.5 million, a sequential increase of 7% over the prior quarter.

- The+Source continues to generate annualized revenue of nearly $15,000 per selling square foot, one of the highest reported figures in the industry and in retail overall.1

- CBD revenue for the quarter was $1.7 million, a sequential increase of 271% over the prior quarter. Q1 fiscal 2020 CBD revenue is expected to grow by approximately 200%.

- As of the June 30, 2019, the Company operated 58 CBD shops, including 52 that opened during the quarter.

- The Executive team was expanded during the quarter with the addition of Jann Parish as Chief Marketing Officer. Parish brings significant branding, marketing and consumer expertise to the Company.

- During the full year, the Company entered into CBD wholesale partnerships with Abercrombie & Fitch for 161 stores, DSW for a total of 155 stores and white labeling American Eagle’s MOOD for 500 of their stores.

______________

1 eMarketer Retail, “Ecommerce trends and store sales for top retailers”

Subsequent Events

- In August, the Company completed a C$50 million bought deal and the founders posted a backstop commitment of up to C$102 million.

- In August, the Company announced the completion of the acquisition of Florida-based Spring Oaks, granting The Company the ability to open and operate up to 35 licenses in Florida.

- In August, the Company completed the acquisition of Henderson Organic Remedies, LLC (The+Source Henderson), the sister location of The+Source Las Vegas.

- The Company is currently operating over 160 CBD shops and expects to reach over 200 by the holiday shopping season this year.

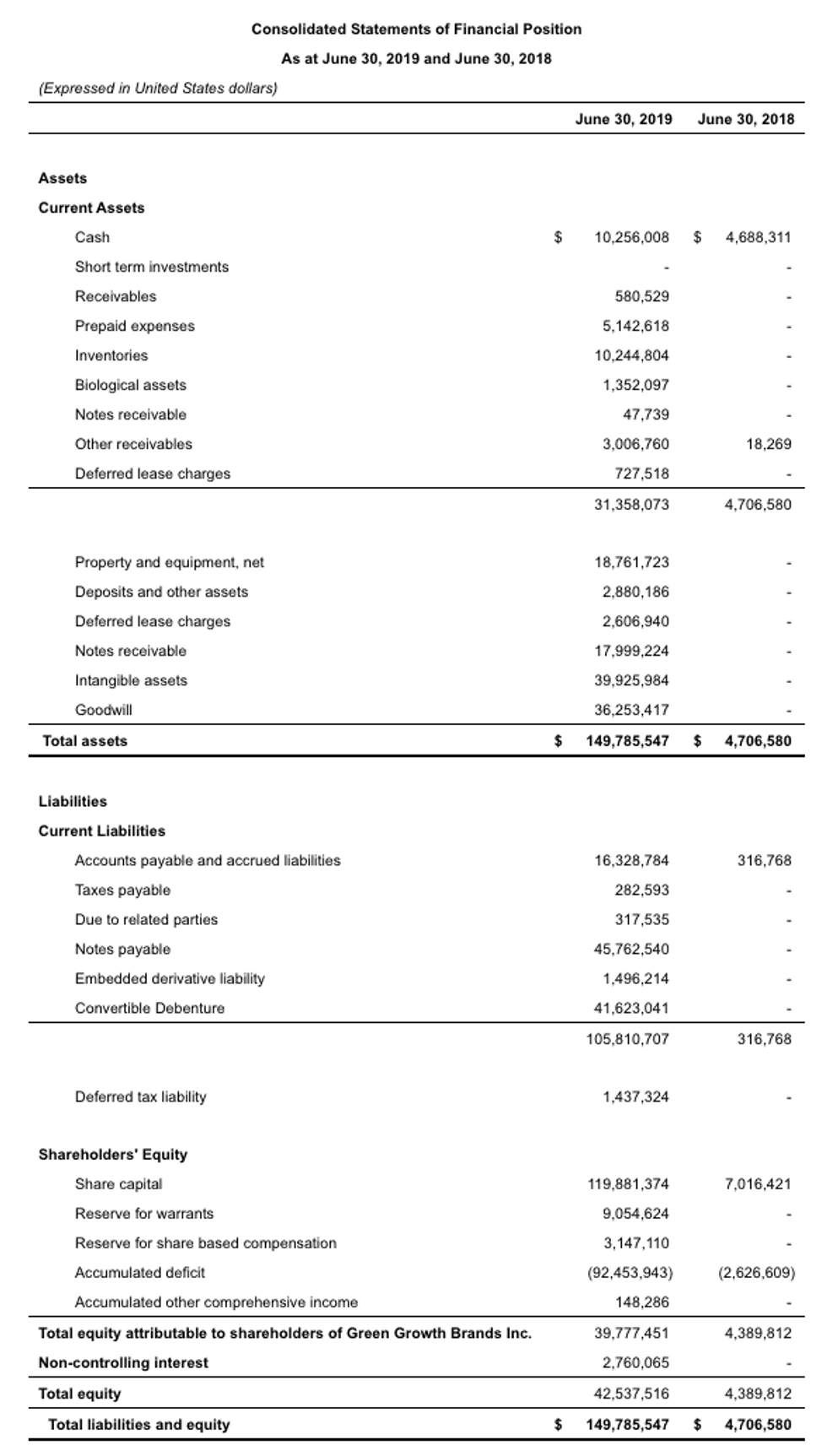

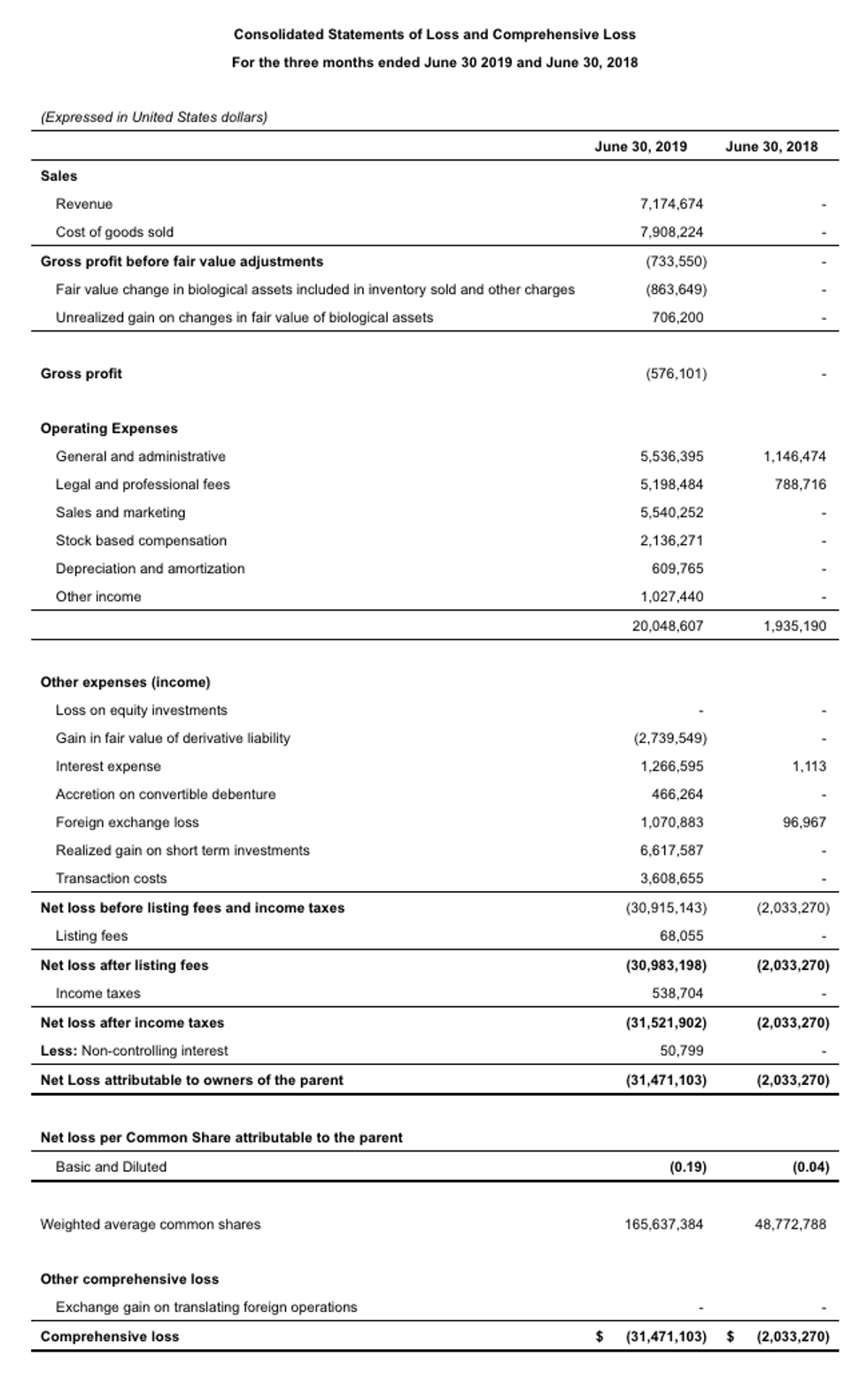

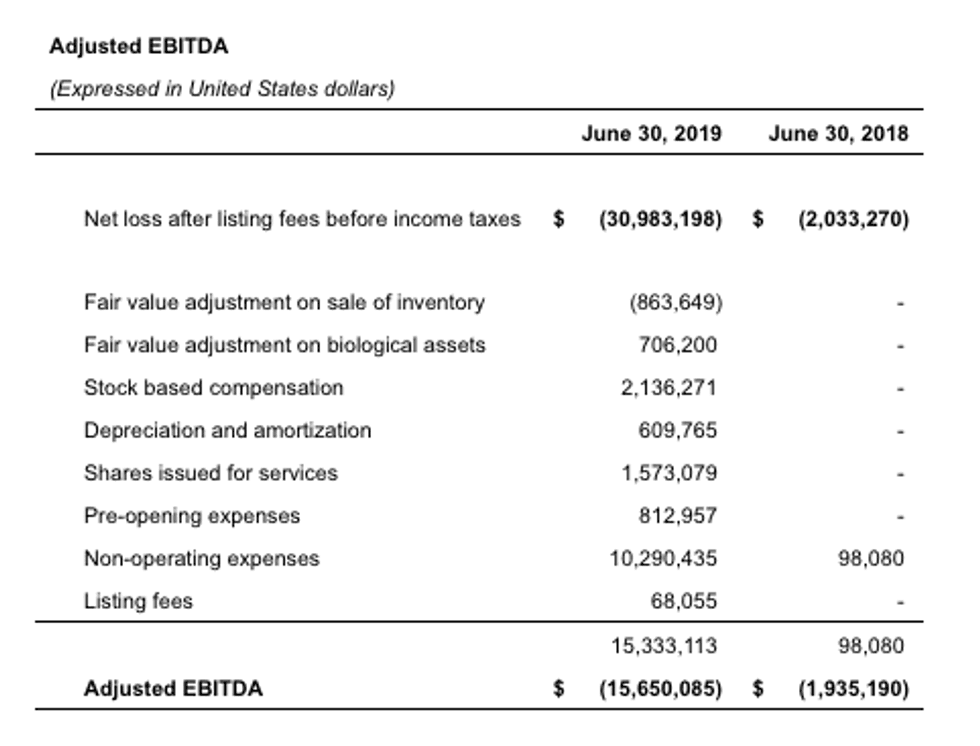

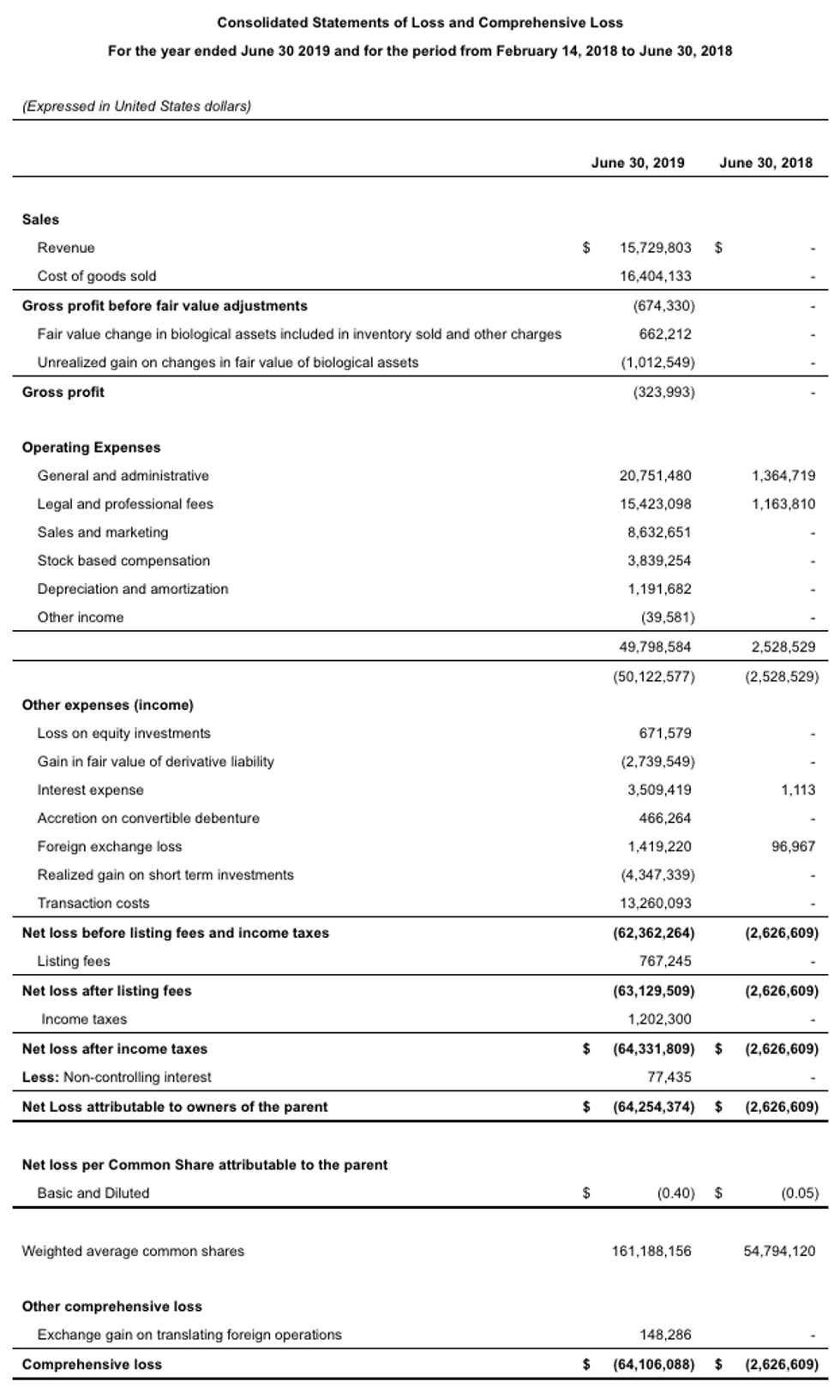

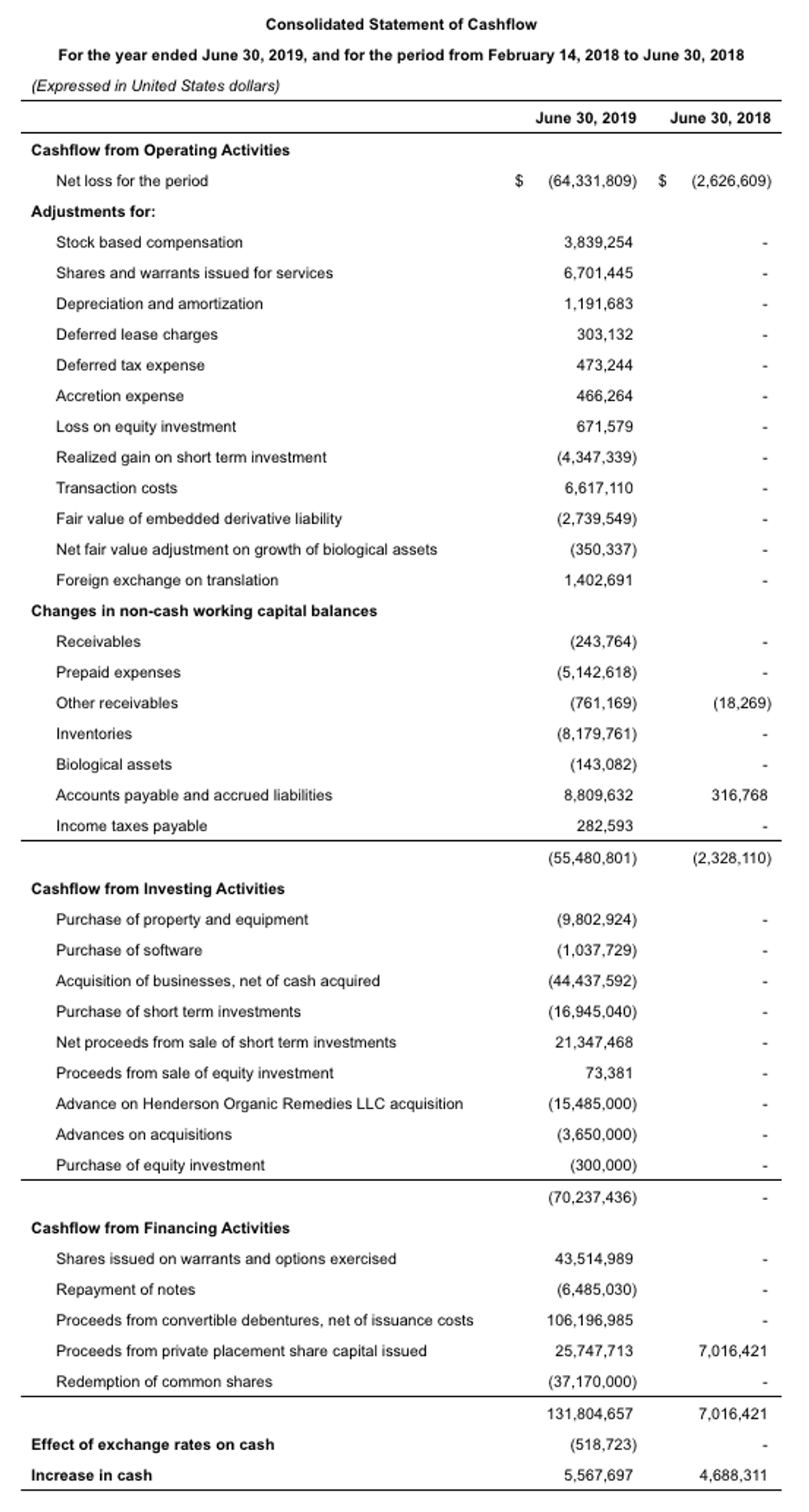

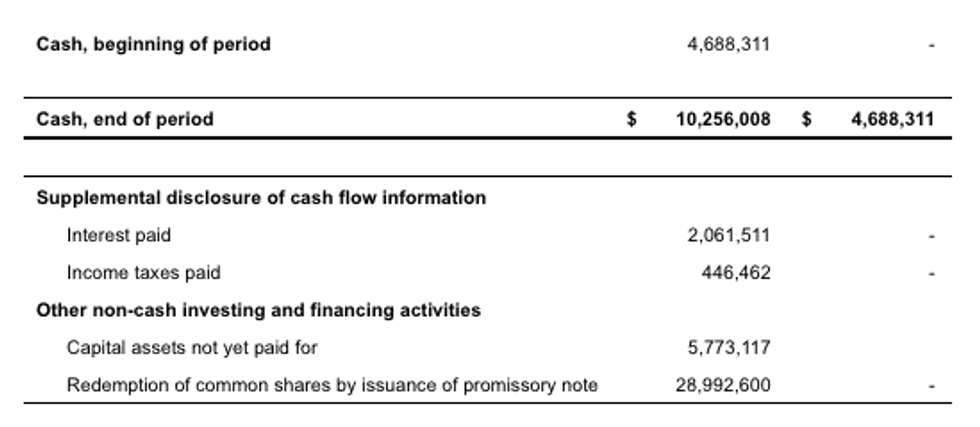

Fourth Quarter & Full Year Fiscal 2019 Financial Statements

The following tables contain financial information for the periods indicated. For full financial information, notes, and management commentary please refer to the MD&A and Financial Statements posted on Green Growth Brands’ Investor Relations site and SEDAR. All financial information is provided in United States dollars, unless otherwise indicated. “Adjusted EBITDA” is equal to net income (loss) before interest, taxes and depreciation and amortization, plus fair value adjustments on sale of inventory and on growth of biological assets, share-based compensation and payments, loss (gain) on equity investments, loss (gain) on foreign exchange, loss (gain) on short-term investments, transaction costs, listing fees and certain one-time non-operating expenses, as determined by management. Management believes this measure provides useful information as it is a commonly used measure in the capital markets and as it is a close proxy for repeatable cash generated by (used for) operations.

Conference Call Information:

Conference ID: 66844833

Local Toronto Dial-in Number: (+1) 416 764 8609

Local Vancouver Dial-in Number: (+1) 778 383 7417

North American Toll-Free Number:(+1) 888 390 0605

The call and replay archive will be accessible on Green Growth Brands’ Investor Relations website.

About Green Growth Brands Inc.

Green Growth Brands creates remarkable experiences in cannabis and CBD. Led by CEO Peter Horvath and a leadership team of consumer-focused retail experts, the company’s brands include CAMP, Seventh Sense Botanical Therapy, The+Source, Green Lily, and Meri + Jayne. The Company also has a licensing agreement with the Greg Norman™ Brand to develop a line of CBD-infused personal care products designed for active wellness. Already driving the strongest sales per square feet in the cannabis industry, GGB is expanding its cannabis operations throughout the U.S its CBD presence at ShopSeventhSense.com, in malls across the country, at DSW and Abercrombie & Fitch stores—and that’s just the beginning. Learn more about the vision at GreenGrowthBrands.com.

Cautionary Statements:

Certain information in this news release constitutes forward-looking statements under applicable securities law. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often identified by terms such as “may”, “should”, “anticipate”, “expect”, “intend”, “forecast” and similar expressions. Forward-looking statements necessarily involve known and unknown risks, including, without limitation, risks associated with general economic conditions; adverse industry events; marketing costs; loss of markets; future legislative and regulatory developments involving medical and recreational marijuana; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; the marijuana industry in the United States, income tax and regulatory matters; the ability of the Company to implement its business strategies; competition; currency and interest rate fluctuations and other risks, including those factors described under the heading “Risks Factors” in the Company’s Annual Information Form dated November 26, 2018 which is available on the Company’s issuer profile on SEDAR.

Readers are cautioned that the foregoing list is not exhaustive. Readers are further cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. The forward-looking statements contained in this release, including, but not limited to, the Company’s ability to execute on its growth strategy, the Company’s plan to open new dispensaries in the remainder of the calendar year, the Company’s vision to become a multi-state operator with retail stores exceeding certain financial thresholds is made as of the date hereof and the Company is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

This announcement does not constitute an offer, invitation or recommendation to subscribe for or purchase any securities and neither this announcement nor anything contained in it shall form the basis of any contract or commitment. In particular, this announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States, or in any other jurisdiction in which such an offer would be illegal.

The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or under the securities laws of any state or other jurisdiction of the United States and may not be offered or sold, directly or indirectly, within the United States, unless the securities have been registered under the Securities Act or an exemption from the registration requirements of the Securities Act is available.

Click here to connect with Green Growth Brands (CSE:GGB) for an Investor Presentation.