Canadian cannabis producer Delta 9 Cannabis took a hit on the stock market after it unveiled the projections for its upcoming Q3 2019 results.

The market was unimpressed with a new set of results guidance from a Canadian cannabis producer in the wake of earnings season.

On Wednesday (November 6), Delta 9 Cannabis (TSX:DN,OTCQX:VRNDF) stated it projects it will report revenues between C$6.3 million and C$6.9 million for its Q3 2019 period, which ended on September 30.

“As the Canadian cannabis industry has faced headwinds over the summer of this year, we have focused on our continued retail store rollout, increasing our production capacity and sell through rates into our provincial markets, and hitting critical milestones on projects in our business to business segment,” John Arbuthnot, CEO of Delta 9, said in a statement.

The firm is hopeful it will announce 871,516 of total cannabis grams produced during its most recent earnings period. Similarly, Delta 9 expects to present its cost per gram at $1.08 for production and C$1.21 for the total cost.

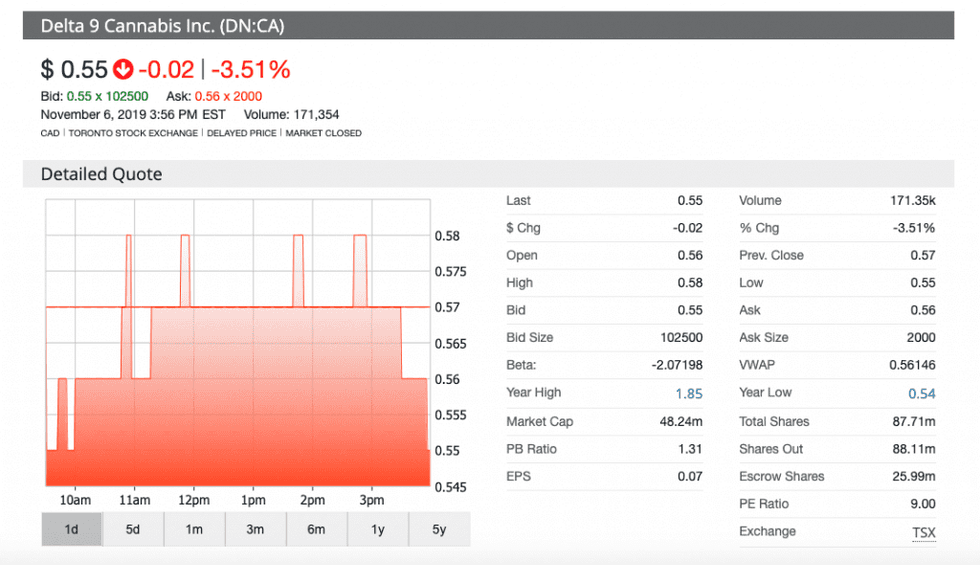

However, despite the projections for the cannabis producer, the market reacted negatively to the company’s news.

Delta 9 opened the trading session at a price of C$0.56, and throughout the day shares of the company fell nearly 4 percent in value to a closing price of $0.55.

The official release of the company’s results is scheduled for next Wednesday (November 13).

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.