CV Sciences Addresses Share Price Drop, Competition Concerns

The CEO of CV Sciences has written to investors to express disappointment in the market’s reaction to his comments on CBD competition.

In a letter to shareholders on Tuesday (August 13), the CEO of San Diego-based CV Sciences (OTCQB:CVSI) defended his company following a double-digit share price drop.

Joseph Dowling, CEO of the hemp-derived cannabidiol (CBD) manufacturer, wrote that the company is disappointed in the market’s reaction to the release of CV Sciences’ Q2 2019 financial report last Tuesday (August 6). During the period, the company achieved its 14th consecutive quarter of revenue growth.

Despite the positive results, the firm had suffered a significant share price drop of nearly 25 percent as of the closing bell on Monday (August 12). This came following commentary from Dowling indicating that the CBD market is set to gain more competitors, which will affect the margin lines for CV Sciences.

Dowling offered his commentary on competition in the space during a conference call with analysts and investors to discuss the Q2 results. During the call, the executive projected that CV Sciences may face stiffer competition in the CBD producer market.

“We pride ourselves on giving comprehensive quarterly updates, and our discussion of increased competition reflects what we see in our business today,” Dowling wrote in his letter, which was published after the call. “But, as I noted on our second quarter conference call, incremental competition may lead to choppy quarter to quarter results.”

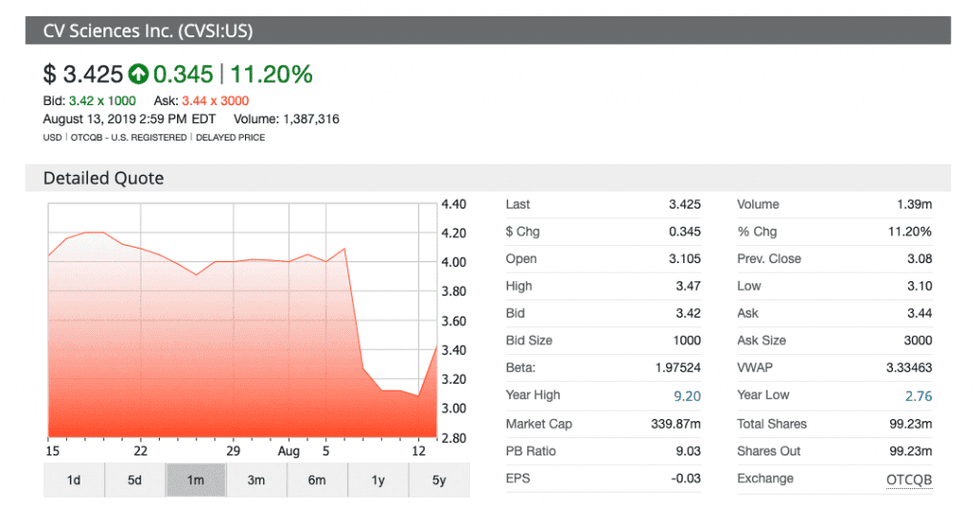

Following Dowling’s letter this Tuesday, the company’s share price jumped back up, opening at US$3.10. As of 2:59 p.m. EDT that day, CV Sciences was trading at US$3.42, an 11.2 percent surge.

As part of its Q2 financials, CV Sciences reported US$16.9 million in revenue — up from US$14.9 million for the previous quarter — and total net income for the quarter of US$1.2 million.

The financials for the company during the quarter saw a downturn compared to Q2 2018, mainly due to increased investment in sales, marketing and research and development activities.

During the quarter, the company reported adjusted earnings before interest, taxes, depreciation and amortization of US$3.6 million.

Dowling believes any increase in competition will not slow the burgeoning CBD market in the US.

In May, a report co-written by BDS Analytics and Arcview Market Research indicated that the collective CBD market could reach US$20 billion in sales across the US by 2024.

“We’re witnessing CBD maturing from a cannabis sub-category into a full-blown industry of its own,” Roy Bingham, co-founder and CEO of BDS Analytics, said in a press release.

The US market can credit the rush for these CBD products to the passing of the farm bill late in 2018, which simultaneously legalized hemp and its derivatives.

CV Sciences, which produces CBD oil under its flagship brand PlusCBD Oil, has made it clear to investors that it wishes to uplist to a senior US exchange.

During the call with investors, the company announced it has retained the services of “special legal counsel” to aid in securing a NASDAQ listing. In July 2018, CV Sciences confirmed that it had filed an application for a NASDAQ listing.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.