CB2 Insights Announces Record Preliminary Unaudited Q3 2019 Revenue of $4.2 Million and Details for Earnings Call

CB2 Insights announced preliminary unaudited revenue of approximately $4.2 million for the three months ended September 30, 2019.

CB2 Insights (CSE:CBII, OTCQB:CBIIF) (“CB2” or the “Company”), a leading data-driven company focused on bringing real-world evidence driven from the point-of-care to the medical cannabis community, announced preliminary unaudited revenue of approximately $4.2 million1 for the three months ended September 30, 2019, representing a 29% growth from the previous quarter. The company also decreased its third quarter adjusted-EBITDA loss by approximately 64% from the previous quarter and saw its first ever month of positive adjusted-EBITDA in the month of August. All figures are reported in Canadian dollars, unless otherwise indicated.

The Company’s achievement in the first nine months of 2019 was, in large part, due to the successful strategic acquisitions of Relaxed Clarity, MedEval Clinics LLC and New Jersey Alternative Medicine (now operating as Canna Care Docs New Jersey). The third quarter of 2019 was the first full reporting period that included the contributions of all three clinical businesses. CB2 now successfully owns and operates one of the largest networks of medical cannabis clinics across the US with a patient registry of 100,000 unique visitors annually. As the team delivers on its efficiency goals and begins to recognize increases in revenue from its technology, data and research services business units, CB2 will look to report full profitability in the coming quarters.

“The continued growth in demand in the market for solutions related to clinically-driven product research has allowed CB2 to start leveraging on our data, technology and CRO capabilities to generate new revenue streams to our already profitable clinical operations in the U.S.,” said Prad Sekar, CEO of CB2 Insights. “We believe we have now arrived at an inflection point in our business and the numbers we are reporting are starting to prove out our multi-dimensional business model. As a team, we will continue to deliver organic growth of our U.S clinical operations, growth in clinical trial and data partnerships, and expand into accretive emerging markets. The Company is now well positioned for continued international growth and ultimately, company-wide profitability.”

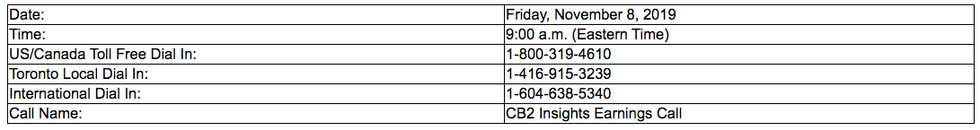

CB2 plans to release its results for the three and nine months ended September 30, 2019 on November 8, 2019, with a conference call to discuss its financial results and provide an update on its business operations at 9:00 am Eastern Time. The call will be hosted by Prad Sekar, CEO of CB2 Insights and Raheel Lalani, VP, Finance of CB2 Insights.

Conference Call Details (phone audio only)

1.The financial information presented in this press release is based on preliminary unaudited financial statements prepared by management, for the third quarter ended September 30, 2019, and is fully qualified by the section in this press release entitled ‘Disclaimer Regarding Financial Information‘.

Financial Measures

This news release makes reference to certain non-IFRS measures, including certain industry metrics. These metrics and measures are not recognized measures under IFRS, do not have meanings prescribed under IFRS and are as a result unlikely to be comparable to similar measures presented by other companies. These measures are provided as information complimentary to those IFRS measures by providing a further understanding of our operating results from the perspective of management. As such, these measures should not be considered in isolation or in lieu of review of our financial information reported under IFRS. This news release uses non-IFRS measures including “EBITDA”, “adjusted EBITDA”. EBITDA and adjusted EBITDA are commonly used operating measures in the industry but may be calculated differently compared to other companies in the industry. These non-IFRS measures, including the industry measures, are used to provide investors with supplementary measures of our operating performance that may not otherwise be apparent when relying solely on IFRS metrics.

About CB2 Insights

CB2 Insights (CSE:CBII) is a global leader in clinical operations, technology & analytics solutions and research and development services with a mission to mainstream medical cannabis into traditional healthcare. Providing immediate market access through its wholly-owned clinical network across 12 jurisdictions, proprietary data-driven technology solutions and comprehensive contract research services designed for those in both the medical cannabis and traditional life sciences industries, CB2 Insights is able to support its partners across the entire data and research spectrum.

CB2’s Clinical Operations business unit leverages extensive experience to develop clinical models with standard operating procedures, advanced workflows, training and ongoing management support. CB2 also owns and operates its own speciality clinics including the brands Canna Care Docs and Relaxed Clarity which assess nearly 100,000 patients seeking medical cannabis treatment to provide immediate market access to US-based product manufacturers for clinical trial and research programs.

The Company has built both electronic data capture (EDC) and clinical data management software (CDMS) which work to support its partners of any size to execute their data and clinical strategies.

CB2 also offers comprehensive contract research organization (CRO) services including full scale clinical trial management, trial design, monitoring and other key research functions used by licensed producers, multi-state operators and traditional pharmaceutical companies entering the medical cannabis space.

For more information please visit www.cb2insights.com.

For additional information, please contact:

Kim Nguyen – Director, Investor Relations

1.855.847.4999 ext. 212

kim.nguyen@cb2insights.com

Disclaimer Regarding Financial Information

The financial information presented in this press release is based on preliminary, unaudited financial statements prepared by management, for the third quarter ended September 30, 2019. Accordingly, such financial information may be subject to change. All information contained in this press release will be qualified with reference to the interim/ unaudited financial results for the three and nine month period ending September 30, 2019, which will be released on November 8, 2019, and will be posted on sedar.com. While the Company does not expect there to be any material changes to the financial information provided in the press release, any variation between the Company’s actual results and the preliminary financial information set forth herein may be material.

Forward Looking Statements

Statements in this news release that are forward-looking statements are subject to various risks and uncertainties concerning the specific factors disclosed here and elsewhere in CB2’s filings with Canadian securities regulators. When used in this news release, words such as “will, could, plan, estimate, expect, intend, may, potential, believe, should,” and similar expressions, are forward-looking statements.

Forward-looking statements may include, without limitation, statements regarding the opportunity to provide services and software to the U.S. cannabis industry.

Although CB2 has attempted to identify important factors that could cause actual results, performance or achievements to differ materially from those contained in the forward-looking statements, there can be other factors that cause results, performance or achievements not to be as anticipated, estimated or intended, including, but not limited to: dependence on obtaining regulatory approvals; investing in target companies or projects which have limited or no operating history and are subject to inconsistent legislation and regulation; change in laws; reliance on management; requirements for additional financing; competition; hindering market growth and state adoption due to inconsistent public opinion and perception of the medical-use and recreational-use marijuana industry; and regulatory or political change.

There can be no assurance that such information will prove to be accurate or that management’s expectations or estimates of future developments, circumstances or results will materialize. As a result of these risks and uncertainties, the results or events predicted in these forward-looking statements may differ materially from actual results or events.

Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this news release are made as of the date of this release. CB2 disclaims any intention or obligation to update or revise such information, except as required by applicable law, and CB2 does not assume any liability for disclosure relating to any other company mentioned herein.

No securities regulator or exchange has reviewed, approved, disapproved, or accepts responsibility for the content of this news release.

Click here to connect with CB2 Insights (CSE:CBII) for an Investor Presentation.