Biome Grow Shows Continued Revenue Growth in Q3 2019

Biome Grow Inc. today released consolidated financial statements for the third quarter and first nine months of fiscal 2019.

Biome Grow Inc. (CSE:BIO, FSE:6OTA, OTCQB:BIOIF) (“Biome” or the “Company”) today released consolidated financial statements for the third quarter and first nine months of fiscal 2019. The unaudited interim consolidated financial statements including the notes thereto, the company’s corresponding Management’s Discussion and Analysis and a supplementary information presentation are available on the company’s web site at www.biomegrow.com under “Investors” and on SEDAR at www.SEDAR.com. All financial information in this press release is reported in Canadian dollars unless otherwise indicated.

Highlights of the Quarter:

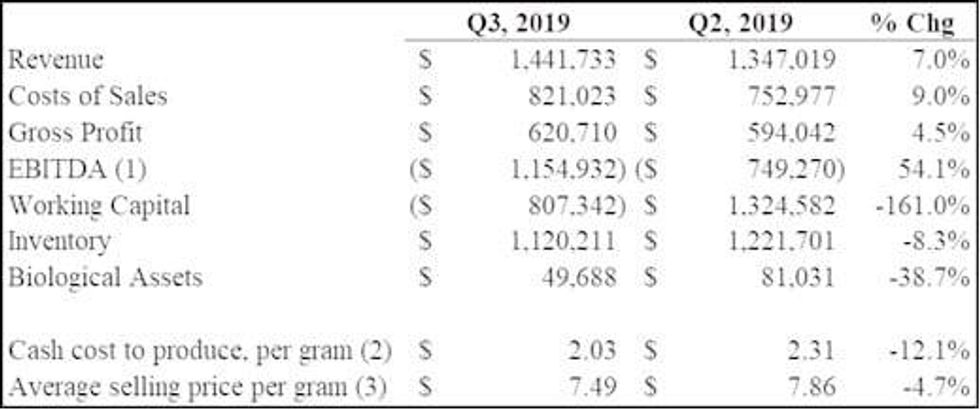

Revenue in Q3 grew 7% sequentially driven by growth in both the volume of product cultivated and by higher volumes in the wholesale business, partially offset by a slightly lower average selling price per gram. Biome sold over 192kg of cannabis in Q3, up 13% over the 170kg sold in Q2 driven by higher wholesale and cultivation volumes resulting from the expansion of its domestic distribution footprint. Gross profit rose in kind, increasing 4.5% over Q3 to $621K.

Cash cost to produce per gram continued to fall in Q3, dropping 12% sequentially to $2.03 from $2.31 in the prior quarter. Average selling price per gram declined a little under 5% to $7.49, reflecting overall market trends in the domestic recreational industry.

The net loss in Q3 widened to $1.5MM from $771K in Q2 due to higher non-cash salaries and wages related to staffing up operations, more professional fees due to legal expenses related to financing activities, and an increase in production and facility expenses to support a ramp up in product volumes. These increases were partially offset by lower advertising and promotion costs compared with Q2.

Biome Grow Inc: Summary of Results from Q3, 2019

Notes:

The Company’s “EBITDA”, “Cash cost to produce, per gram” and “Average selling price per gram” are Non-GAAP metrics used by management that do not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies. Management believes these financial metrics may be useful in assessing its operating performance. The calculations required to reconcile these metrics to IFRS measures are described below:

1. Management defines “EBITDA” as Income (Loss) Before Other Items plus Amortization.

EBITDA = ($1,217,192) + $62,260 = ($1,154,932)

2. Management defines “Cash cost to produce, per gram” as the cost of cultivated product sold divided by the grams of cultivated product produced and sold during the period.

Cash cost to produce, per gram = $121,656/60,060 = $2.03.

3. Management defines “Average selling price per gram” as Revenue in dollars divided by the total number of grams sold during the period.

Average selling price per gram = $1,441,733/192,516 = $7.49.

CEO Khurram Malik said “Biome is pleased to report continued growth in Q3 despite some temporary structural industry impediments and delays in the implementation of automated packaging technology at our Highland Grow facility. The impact of the automation was ultimately reflected in our current Q4 period. With this largely behind us, we are experiencing accelerated growth in Q4 and expect this trend to continue into 2020. As announced yesterday, the company has secured $3 million in gross proceeds, which will primarily be used to dramatically increase the volumes processed at Highland Grow Inc. to meet the demand we are seeing for our high-quality cannabis products. ”

Biome continues to grow its commercial footprint since beginning commercial sales of cannabis in January of 2019.

Biome will host a conference call and audio webcast with Khurram Malik, CEO to discuss the Q3 financial results and financing in more detail at 8:30am Eastern Time November 26, 2019.

Calling Information:

Toll Free Dial-In Number: 1 (866) 211 3199

International Dial-In Number (647) 689 6601

Conference ID 1893809

Date of call: 11/26/2019

Time of call: 830am ET

Webcast information

A live audio webcast will be available at https://event.on24.com/wcc/r/2078387/F9395EFD6C07A9D1AAD6C27AAD87

“Biome also announces that it intend to issue 880,054 common shares to certain employees and consultants of the company in respect of services rendered at an average share price of $0.3013.

For further information, please contact:

Scott Cuthbertson

VP Investor Relations

scuthbertson@biomegrow.com

647-462-8797

www.biomegrow.com

About Biome

Biome has five wholly owned subsidiaries, including: The Back Home Medical Cannabis Corporation, a company incorporated under the laws of the Province of Newfoundland and Labrador and in the late stages of applying for a license under the Cannabis Act; Great Lakes Cannabis, a company incorporated under the laws of the Province of Ontario and in the late stages of applying for a license under the Cannabis Act; Highland Grow Inc., a Nova Scotia company that is licensed to cultivate, process and sell cannabis under the Cannabis Act (Canada); Red Sands Craft Cannabis Co., a company incorporated under the laws of the Province of Prince Edward Island, and; Weed Virtual Retail Inc., a company incorporated under the laws of the Province of Ontario in the business of operating a new virtual reality technology platform focused exclusively on the medical and recreational cannabis markets. Biome is a Canadian-based company with national and international business interests.

Forward-looking Statements

This news release contains forward‐looking statements and forward‐looking information within the meaning of applicable securities laws. These statements relate to future events or future performance. All statements other than statements of historical fact may be forward‐looking statements or information. Generally, forward-looking statements and information may be identified by the use of forward-looking terminology such as “plans”, ” expects” or “does not expect”, “proposed”, “is expected”, “budgets”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. Such forward-looking statements and information reflect management’s current beliefs and are based on assumptions made by and information currently available to Biome. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those expressed or implied in the forward-looking statements, including, among other things: changes to legislation; changes in cannabis research or the general public’s perception of cannabis; crop failure; labour disputes; increases in labour and/or construction costs; rising energy costs; an inability to access financing as needed; and general economic downturn.

Readers are further cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. The forward-looking statements speak only as of the date on which they are made, and Biome, or any of its subsidiaries undertakes no obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law. The forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

Click here to connect with Biome Grow Inc. (CSE:BIO) for an Investor Presentation.