Australis Capital Braces for Clash with Terry Booth Investor Group

The ex-CEO of Aurora Cannabis is at the front of a group of investors demanding a new direction for the cannabis company.

A group of investors led by the former CEO of Aurora Cannabis (NYSE:ACB,TSX:ACB) is setting the stage for a confrontation with cannabis investment firm Australis Capital (AUSA) (CSE:AUSA,OTCQB:AUSAF), an offshoot of the Canadian producer.

AUSA was originally launched by Aurora in 2018 as a separate investment vehicle that would target the US market and attract its own set of investors, but it still has ties to its parent.

A collection of ex-Aurora members are among the leaders of the disgruntled investors, including Terry Booth, founder and former CEO of the Edmonton-based cannabis producer.

Other members of the investor group, known as the Concerned Shareholders of Australis Capital, are former top Aurora employees Jason Dyck and Roger Sykes.

Read on to learn more about who the Concerned Shareholders are, why they’re going head-to-head with AUSA and what they hope to accomplish at the company.

Back and forth between AUSA and investor group

The original point of contention between AUSA and the Concerned Shareholders, and the reason the Concerned Shareholders went public in the first place, relates to a rocky acquisition deal that was first announced by AUSA this past June.

AUSA told the market it planned to acquire fintech company Passport Technology in a transaction worth a combination of 58.7 million of its shares — at the time valued at C$12.2 million — C$9.6 million in cash, a C$3 million payable fee from AUSA’s holdings in Body and Mind (CSE:BAMM,OTCQB:BMMJ) and a separate C$6.6 million payable fee by way of an undisclosed property.

These terms were amended shortly after being announced based on new projections from Passport regarding its business revenue and operating income.

For AUSA, the main benefit was that it would gain immediate revenue and a profitability line. The company said that if the transaction went through it would expect to become EBITDA positive in 2021.

Scott Dowty, at the time the CEO and director of AUSA, was also Passport’s majority shareholder. As such, the company deemed the acquisition a “related-party transaction” that would require special minority shareholder approval to go forward.

AUSA’s first business with Passport dates back to November 2019, when the company confirmed a partnership with the fintech operation to develop its CocoonPod self-service cannabis kiosks.

The interaction resulted in a 10 year exclusivity partnership, with AUSA issuing a payment of US$4.2 million through a combination of US$375,000 in cash, 5 million shares of Body and Mind and an additional 1.9 million shares of AUSA.

As part the Passport acquisition, Dowty said he would step down as CEO of AUSA, but would remain with the company as executive chairman; Cleve Tzung, AUSA’s chief revenue officer, would step up as CEO.

The Concerned Shareholders had questions about the acquisition, and also simply did not like the idea of approaching the fintech industry with this deal. The group went public for the first time with a statement on July 21, calling out the origin and payout of the deal alongside the overall strategy.

In response, AUSA dismissed the group’s concerns and asked investors to look past these comments given that “all but one of the members of the dissident group are involved in litigation against Australis.”

However, just over a week later Passport called off the deal. In its original acquisition announcement, AUSA disclosed it had signed up for a US$2.5 million break fee if the transaction didn’t go forward. There was no indication of how much the company would get if Passport tore up the deal.

On September 3, AUSA confirmed it had reached an agreement to terminate the Passport acquisition that would dismiss the break fee. This announcement included the complete separation of Dowty from the company’s operations.

“We are pleased to have reached an amicable settlement agreement with both Passport and Mr. Dowty,” Tzung said at the time.

Amid the dispute and turmoil, AUSA appointed Harry DeMott as its new CEO on October 5. Tzung stayed with the company as the new chief operations officer, and AUSA also welcomed Sameer Kumar as a new independent member to its board of directors.

DeMott’s experience with the cannabis industry was highlighted by AUSA at the time. He has overseen several investments in the space, and acted as a founding investor with multi-state operator Columbia Care (NEO:CCHW,OTCQX:CCHWF).

Before becoming CEO, DeMott sent a letter to the Concerned Shareholders admitting the company erred with the Passport acquisition attempt.

“In the past few weeks, Australis has transformed itself from a company attempting to get into the financial services business and has returned to its roots as a US cannabis business,” DeMott wrote.

But the management changes did not satisfy the Concerned Shareholders since DeMott was part of the company’s board as a director before taking on the CEO role. In their view, he directly participated in what they described as “value-destroying transactions.” The Concerned Shareholders also questioned DeMott’s lack of experience at the helm of a publicly traded company.

Who are the Concerned Shareholders?

As mentioned, the leaders of the Concerned Shareholders are ex-employees of Aurora, the parent company of AUSA. Aurora confirmed to the Investing News Network (INN) that Dyck served as an Aurora board member between 2015 and August 2020, while Sykes was senior vice president of special projects.

Dyck was also the research and science team lead with Aurora, as well as the chair of its global scientific oversight committee.

According to AUSA, the company and the Concerned Shareholders met directly on September 4 to attempt to hold a dialogue about the direction of the company.

Based on public statements by both parties, the meeting did not help the conversation and instead led to increased tension between the two.

Australis and the Concerned Shareholders are set to face off once again, this time with the future of the company at stake, during the upcoming annual general and special meeting on November 17.

In an attempt to change the direction of the company, the Concerned Shareholders have put forth their own group of nominees for the board of directors. For its part, Australis is asking investors to stick with its own recently overhauled board.

Among their many efforts, the Concerned Shareholders have launched a website and a Twitter account to expand on their message. The social media account had 435 followers as of the time of this writing.

At first, the Concerned Shareholders claimed to represent 6.2 percent of AUSA investors. However, in its most recent statement to fellow investors, the group boasted that it represents 8.45 percent of the company’s common shares.

Additionally, the investor group claims to have “garnered indications of support” from fellow shareholders who represent over 31 percent of the company.

Voting materials from both groups were sent to investors starting on October 13. Investors have a deadline of November 13 at 11:30 a.m. MT to cast their official ballots. At stake is not only what direction the company will move in the future, but likely also the management team that will take it there.

Comment requests for this story were not returned by AUSA or the Concerned Shareholders.

AUSA makes market debut as Aurora sibling

When AUSA launched as the offspring of Aurora on September 19, 2018, former Aurora executive Cam Battley told the market that the spinoff represented an opportunity for investors to get exposure to the US market with the advice and expertise of Aurora.

“The idea is to snap up attractive assets in the US, a very, very fragmented market but with some incredible gems,” Battley, who was fired from Aurora late in 2019, told YouTube finance show Midas Letter in August 2018.

Aurora pursued this model since it wasn’t, and still isn’t, allowed to enter the US cannabis market directly due to the scheduled status of the drug at the federal level. Operating in the US would also pit Aurora against exchange regulators.

In its most recent fiscal year financial report, the Canadian producer gave investors an update on its business relationship with Australis.

In the report, filed on September 24, the producer confirmed it still isn’t capable of exercising its over 22 million AUSA warrants. Aurora has until September 19, 2028, to exercise these warrants.

According to Aurora’s filing, as of June 30, 2020, the warrants held a fair value of C$3.2 million, which represents a sharp decline in value from the C$10.1 million price tag they held in 2019.

When asked for comment on the ongoing dispute between a company it still holds warrants over and its former leading executive, Michelle Lefler, Aurora’s vice president of communications and public relations declined to issue a comment for this story.

AUSA accuses ex-Aurora members of ulterior motives

The AUSA management team hasn’t pulled any punches during the dispute with the Concerned Shareholders. It has signaled that Booth and his allies were directly responsible for the downturn in value at Aurora, and is using that as a reason for investors to take its side.

“The alternative is to provide a Dissident slate of director nominees beholden to Terry (Booth) the opportunity to impair and destroy shareholder value, as they have before,” AUSA’s DeMott said in a letter to shareholders.

Booth was dismissed as Aurora’s CEO earlier this year as part of a major overhaul at the public producer, which included workforce cuts and facility shutdowns.

“While there is still much work to be done, the timing is right to announce my retirement with a thoughtful succession plan in place and the immediate expansion of the Board of Directors,” Booth said.

Following his departure from Aurora, Booth expressed interest in the US market, particularly in the CBD opportunities available. In February, BNN Bloomberg reported that Booth was hopeful changes in the US laws could open the doors to further investment.

Booth also retired as director of Aurora’s board in June, a role he had kept following the executive change, as the company had indicated he would remain to help guide its vision.

In a statement shared in September following an in-person meeting between AUSA and the Concerned Shareholders, AUSA accused Booth of being directly responsible for the “original sins” of the company.

AUSA’s attempts to tie Booth and Aurora’s misgivings together appear to be geared at reminding investors of the significant downturn Aurora has seen.

Investor takeaway

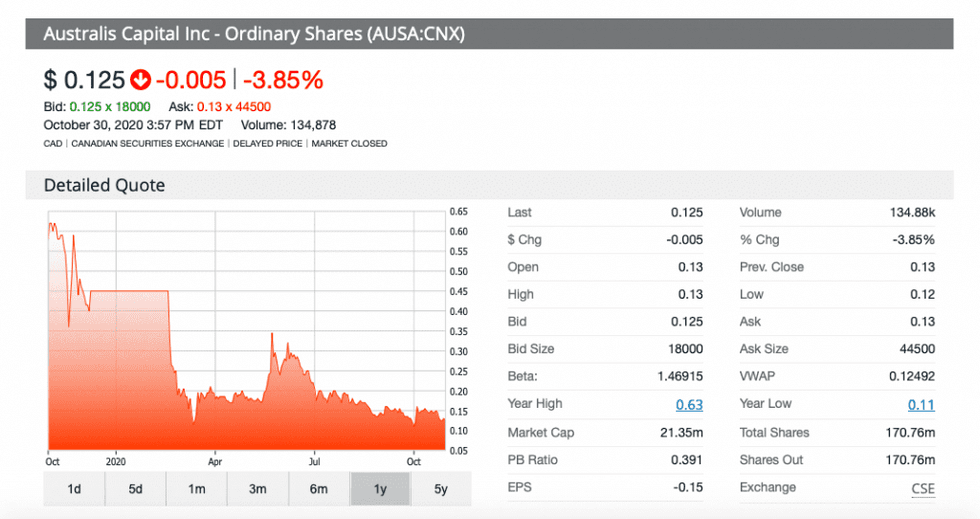

Analyst ratings aren’t available for Australis, but so far this year shareholders have seen the value of the company take a serious hit in the open market.

Over a year-to-date period, its share price had dropped 57.58 percent as of last Friday (October 16) for a closing price of C$0.14. That’s compared to the company’s 52 week high of C$0.63.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.