Aurora Cannabis Posts C$238-million Loss, Experts Raise Questions

Following the release of results from its fiscal 2019 Q2, Aurora Cannabis displayed the plans for its expansion facility in Edmonton.

As Aurora Cannabis (NYSE:ACB,TSX:ACB) moves forward from its quarterly losses by announcing its new expansion will focus on edible products, the Canadian firm faces questions from its most recent report.

Released after trading hours on Monday (February 11), Aurora’s fiscal Q2 2019 results offered a look at the pressure points the company faces as revenues from legalization roll in.

Aurora posted revenues of C$54.2 million thanks in part to Canadian legalization of recreational marijuana, attributing sales of C$21.6 million.

However, despite the rush of legalization, medical sales outpaced recreational ones for Aurora, with Canadian and international medical revenue returning C$26 million for the company, an eight percent increase over the quarter.

“Going forward, Aurora intends to continue prioritizing medical patients in Canada and globally where margins continue to exceed those achieved on the wholesale consumer market,” the company indicated to shareholders.

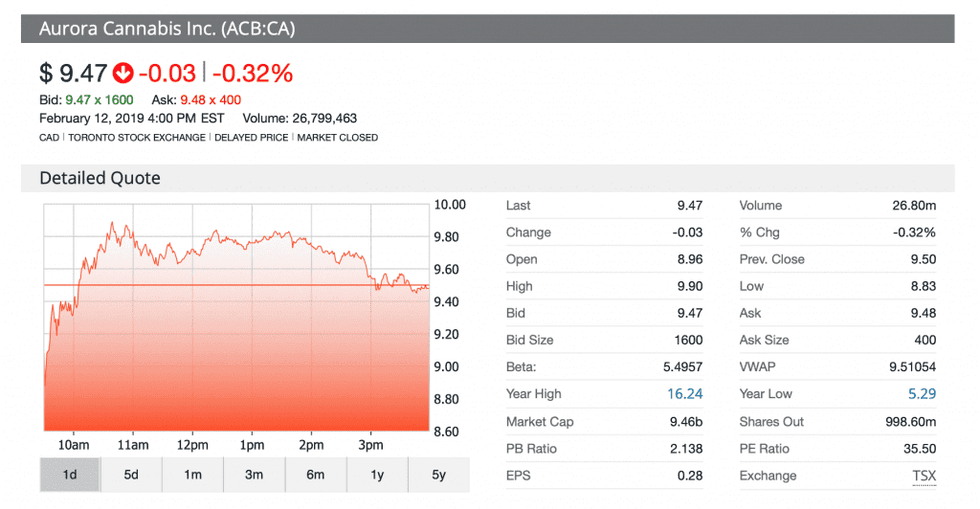

Shares of Aurora dropped at the opening on Tuesday’s trading session to C$8.96 and US$6.78 in Toronto and New York respectively, from C$9.50 and US$7.17 on Monday.

So far in 2019 Aurora is up 36.83 percent in the New York Stock Exchange (NYSE), while the company’s shares in the Toronto Stock Exchange (TSX) are up 33.99 percent.

After the closing bell on Tuesday’s (February 12) trading session, Aurora shares finished at a price of US$7.17 and C$9.47.

Looking ahead, the management team for the Canadian licensed producer (LP) expects to reach positive earnings before interest, tax, depreciation and amortization (EBITDA) by its Q4 of fiscal 2019.

Terry Booth, CEO of Aurora, said the company’s brands are resonating for consumers and its medical products are in “exceptional demand” in Canada and abroad.

Aurora expects to reach just over 150,000 kilograms of marijuana production by March 31.

As reported by the Financial Post, Booth said during a conference call with investors and analysts the supply issues in Canada will take at least five more years to get cleared.

The executive said during the call he expects Aurora to have 25,000 kilograms of dried product ready to be sold by the end of June.

In January, Aurora had provided guidance to shareholders on its quarterly performance indicating it expected revenues between C$50 million and C$55 million.

Experts raise concerns on Aurora and fellow LPs moving forward as attention moves south

In an email response to the Investing News Network (INN) Charles Taerk, president and CEO of Faircourt Asset Management and Doug Waterson, chief financial officer and portfolio manager with Faircourt, lauded Aurora for exporting demand of its product in European nations.

The two advisors, who oversee the Ninepoint Alternative Health Fund, raised a red flag at some of the costs and challenges the LP is facing alongside other Canadian firms.

Taerk and Waterson agreed the gross margin decline this quarter, which they indicated was the lowest for the Canadian firm in the over two years, was a big issue for Aurora investors.

“In light of the higher costs that ACB is experiencing and the time it is taking to get Sky to capacity, it might take ACB longer to achieve lower production costs and better margin management,” Taerk and Waterson wrote to INN.

As the two portfolio managers expect to see continued challenges for Aurora, they have turned their attention south of the border for US plays for their fund.

“Many investors did not anticipate the challenges faced between LPs and the provinces, and that has led to reduced market sentiment in the final weeks of the year,” Taerk and Waterson said.

The duo from Faircourt also noted investors should be worried with the operating expenses for the company, which totaled C$65 million and are only set to go up with international expansions.

“While we understand that international expansion requires investment,we are concerned that operations will not be able to absorb the expenses in a time period that meets investor interest,” Taerk and Waterson said.

New facility will target edibles, set to be constructed for Euro exports

Now dubbed “Aurora Polaris,” the proposed 300,000 square foot expansion facility, adjacent to the company’s Aurora Sky facility in Edmonton, Alberta, will be charged with leading the company’s efforts in the edibles space.

“Its location at the Edmonton International Airport, will assist us to rapidly deliver product to all our target markets, domestically and internationally,” Booth said in a press release.

Aurora’s management indicated it’s constructing this facility with the intention of being EU GMP certified in order to serve the European market as well.

Aurora highlighted the advantage of this facility include cost savings, ease of licensing approval and an increase in facility efficiencies.

“Additionally, this specialized space permits Aurora to adapt to future regulatory changes that are anticipated to be implemented in the coming years, both domestically and internationally,” the Canadian firm indicated to shareholders.

Edible products are expected to be legalized in Canada for recreational consumption by no later than October 17. Recently Bill Blair, Minister of the Cannabis Act, told Bloomberg the actual start of edible sales could come later than the deadline for legalization.

Artist Rendering: Aurora Polaris Facility (CNW Group/Aurora Cannabis).

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.