3 Sixty Reports Record Revenue in the Third Quarter of 2019, Breakeven Adjusted EBITDA, and Significant Sequential Improvement in Net Cash Flow

3 Sixty Risk Solutions Ltd. reported its unaudited financial results for the three month period ended September 30, 2019.

3 Sixty Risk Solutions Ltd. (“3 Sixty” or the “Company”) (CSE:SAFE, OTCQB:SAYFF, FSE:62P2) a leader in the risk management and security services sector of the burgeoning cannabis industry, today reported its unaudited financial results for the three month period ended September 30, 2019 and provided certain additional highlights and updates. Unless otherwise indicated, all references herein to dollars or “$” are to Canadian dollars.

“I am extremely pleased with our performance in the third quarter, particularly our strong organic growth and new long-term contracts, as well as breaking even in Adjusted EBITDA ahead of schedule and our significant improvement in net cash flows,” said Thomas Gerstenecker, CEO and Founder. “These improvements were driven by continued strong organic revenue growth both in Canada and in the U.S., the initial visible results of our announced efforts to realize on cost synergies following acquisitions earlier this year and to improve operational efficiency, and a reduction in one time charges and capital investments that we incurred in the first half of 2019 related to our multiple transactions and corporate change.”

“Our optimized cost structure provides us with financial flexibility to execute against our growth strategy as we remain focused on leading the cannabis security industry in Canada and expanding our services within the U.S.,” Mr. Gerstenecker said.

“Looking ahead, growth of the legal cannabis market in Canada has been slower than anticipated due to the underdeveloped retail store network in many provinces across the country. This has resulted in a small volume of contracts we anticipated beginning in the fourth quarter of 2019 being pushed out to the first quarter of 2020. However, we expect access constraints to the legal cannabis market to reduce in the new year and are encouraged by the commitment of the Ontario provincial government to move to an open allocation of retail stores based on market demand.

Mr. Gerstenecker concluded: “We are reiterating our revenue expectations for 2020, which reflects anticipated growth of 110% to 180% compared to anticipated 2019 revenues. This growth is anticipated to be driven primarily by organic growth, notably benefiting from a full year of operations from INKAS and our U.S. business and the anticipated growth of these business as well as the continued deployment and execution of long-term contracts with licensed producers worth approximately $36 million in annualized predictable revenue that we have secured thus far in 2019. We also anticipate benefiting from certain “tuck in” acquisitions which we continue to explore, with a strategic focus on expansion into strategic locations in the U.S.”

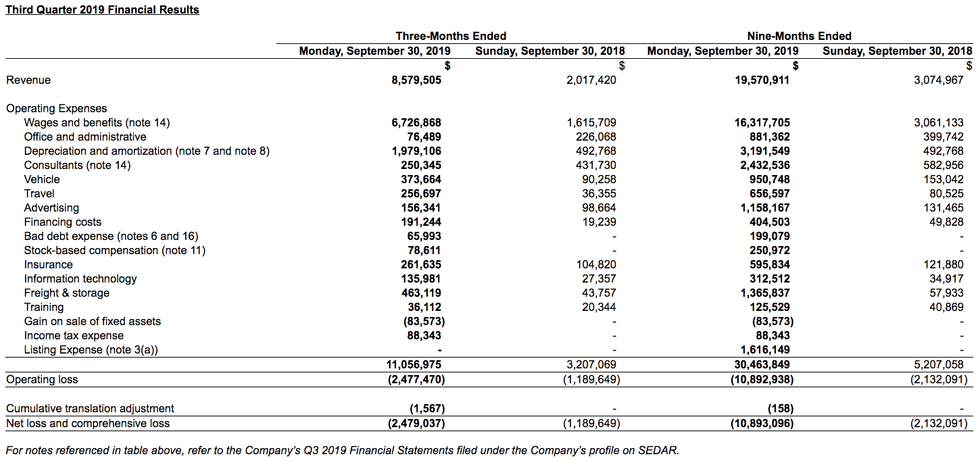

- Revenues – Revenue increased to $8.6 million, a 325% increase over Q3 2018 revenues of $2.0 million driven by a significant growth of the business in Canada and expansion into the U.S. as well as the contribution from acquisition and amalgamation activity in the first half of 2019. Revenue increased sequentially by 12% over Q2 2019 revenue of $7.5 million driven by organic growth in Canada and the U.S.

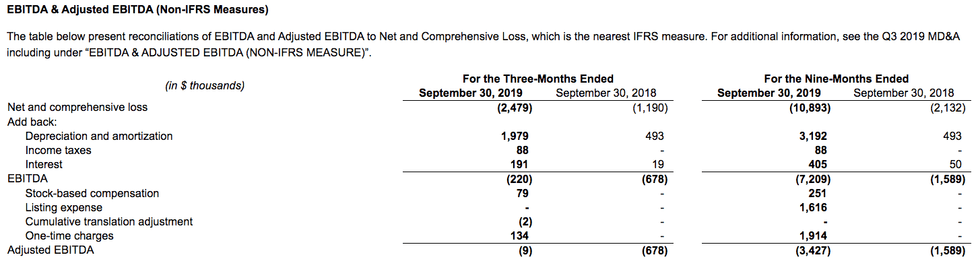

- Adjusted EBITDA – Adjusted EBITDA was essentially breakeven, a significant improvement of $0.7 million as compared to the three-month period ended September 30, 2018 ($0.7 million). Growth was driven by the increase in revenues partially offset by additional operating costs, including labour and infrastructure related to the significant growth and expansion of the Company. In the quarter the Company achieved record revenues and began a cost cutting initiative at the end of the second quarter to decrease operating and overhead expenses, such as labour costs, advertising, promotion and professional fees. Adjusted EBITDA improved by $1.6 million sequentially as compared to Q2 2019 of ($1.6) million, reflecting a $1.0 million increase in revenues and a $0.6 million reduction in cash operating expenses excluding one-time charges.

- Expenses – Total expenses for the three-month period ended September 30, 2019 were $11.1 million, or a $7.8 million increase compared to the three months ended September 30, 2018, when total expenses were $3.2 million. The increase in total expenditures is due to additional operating costs including labour and infrastructure related to the significant growth and expansion of the Company, which has seen record revenue levels. Also included in the increase in expenses is additional depreciation and amortization which was recognized on the intangible assets pertaining to the amalgamation with TCSS and the acquisition of INKAS. A minimal amount of the cost reductions related to the Accelerating Path to Profitability program appeared in Q3, with the reductions anticipated to become more visible and benefit profitability in the latter portion of the fourth quarter and in 2020.

- Net Loss – Net loss of $(2.5) million improved sequentially by $1.1 million over Q2 2019. Net Loss increased to ($2.5) million compared to ($1.2) million in Q3 2018. Net loss in Q3 2019 reflected a $2.0 million non-cash depreciation expense, approximately $0.7 million of which was due to year-to-date adjustment to amortization of intangible assets but incurred during the third quarter.

Accelerating Path to Profitability Update

The Company has realized tangible annual cost savings of $3.5 million (net) through enhanced operational efficiencies, most of which is anticipated to become visible in the fourth quarter and in 2020. The Company maintains its annualized cost reduction target of $4 million to be achieved by the end of 2019 and expects further efficiencies in Q1 2020. These realized and expected cost savings are driven primarily by the reduction of duplicate and redundant costs, notably labour costs, following the acquisition of INKAS in April, as well as ongoing efforts to optimize the Company’s cost structure and a reduction in certain discretionary spending. These reductions are anticipated to accelerate the Company’s path to sustainable profitability while supporting its growth strategy.

U.S. Expansion Update

In Q2 2019, the Company expanded operations to the United States, providing security services to 1933 Industries and multiple dispensaries in Nevada and managed services in New Jersey. The Company anticipates continued expansion within the U.S. potentially including but not limited to Florida, Ohio, Colorado, and Arizona in 2019 and Missouri, New York, and California in 2020.

Canadian Cannabis Industry Update

The slower than anticipated rollout of the legal cannabis retail store network in many provinces in Canada, notably including Ontario, has hampered revenue growth for the licensed, legal industry thus far in 2019. However, the Company continues to anticipate strong organic growth both from market share gains as well as continued growth of the industry. The Company notes the recent commitment by the Ontario provincial government to address access constraints to the legal cannabis market by moving to an open allocation of retail stores based solely on market demand is expected to bode well for future customer volumes.

Financial Guidance2 for Q4 2019 and Fiscal 2020

Management projects an increase in revenue to more than $9.0 million in revenues in Q4 2019, based on predictable recurring revenue which the Company expects to be driven by organic growth.

The Company is reaffirming its 2020 full year consolidated revenue guidance of approximately $60 million to $80 million, as provided on August 20, 2019.

The unaudited expected results, targets and other information contained in this news release and the associated Management’s Discussion and Analysis for the three and nine-months of operations ended September 30, 2019 (the “Q3 2019 MD&A) reflect management’s view of current and future market and business conditions, and based on various assumptions including:

| (i) | No material delays to the deployment and execution of long-term contracts secured with customers or material changes to the terms and conditions in these agreements; |

| (ii) | No material changes in the current operating conditions in certain markets from regulatory changes; |

| (iii) | No adverse legal or regulatory changes that would impact the Company; |

| (iv) | No material changes to current expectations with respect to certain macroeconomic or political events; |

| (v) | No material changes to pricing of legal cannabis or other pricing that impact cannabis-related products; |

| (vi) | No material changes to the expected growth of the market for cannabis-based products and/or the ability of the Company to maintain and attract new clients; |

| (vii) | No material changes in the Company’s estimated aggregate addressable U.S. market, nor material changes or delays to the Company’s expansion plans within the U.S. including completion of identified acquisition opportunities |

| (viii) | No material changes to the Company’s ability to access future funding needed to advance its business and pursue prospective opportunities; |

| (ix) | The Company’s ability to effectively manage growth; |

| (x) | No material change in the Company’s success in achieving competitive margins; |

| (xi) | The Company’s continued success in its ability to develop necessary infrastructure; and, |

| (xii) | No material foreign currency exchange rate fluctuations, particularly against the U.S. dollar. Such guidance, targets and information are based on a U.S. dollar to Canadian dollar exchange rate of 1.33 to 1.00. |

Conference Call

Management will host a conference call to discuss its Q3 financial results and related updates on Tuesday, November 19, 2019 at 9:00am EST.

- To access via tele-conference, please dial 1-888-664-6383 or +1-416-764-8650 ten minutes prior to the scheduled start of the call.

- The playback will be made available approximately two hours after the event at 1-888-390-0541 or +1-416-764-8677. The Conference ID number is 120171 #.

Consolidated Financial Statements, Management’s Discussion and Analysis and Additional Information

The Company’s Condensed interim consolidated financial statements for the three and nine-month periods ended September 30, 2019 and 2018 (the “Q3 2019 Financial Statements”), the Q3 2019 MD&A, this news release, and additional information relating to the Company and its business, can be found on or through SEDAR at www.sedar.com and the Company’s website at www.3sixtysecure.com, as applicable. The financial information presented in this news release was derived from the Q3 2019 Financial Statements.

______________________________

1 Non-IFRS measure. For important information on the Company’s non-IFRS measures and reconciliation to nearest IFRS measures, see below under “EBITDA & Adjusted EBITDA (Non-IFRS Measures)”” and “Non-IFRS Measures”.

2 For important information on risks to the Company’s financial guidance, please refer to the Forward-Looking Information disclaimer in this news release, as well as in the Q3 2019 MD&A under “Forward-Looking Statements” and “Risk Factors”.

About 3 Sixty Risk Solutions Ltd.

3 Sixty Risk Solutions Ltd., operating through its wholly-owned subsidiary, 3 Sixty Secure Corp., is Canada’s leading security service provider to the cannabis sector, transporting millions of dollars of product every month. 3 Sixty now provides enhanced cash management, cannabis security consulting, guarding and secure transport security services to more than 600 customers and more than 100 cannabis licensed producers. 3 Sixty employs over 650 staff, operates a fleet of over 150 vehicles and is one of the largest cash management service providers in Canada. Find out more at www.3sixtysecure.com and follow us on Twitter, Instagram or Facebook.

For further information regarding the Company, please contact:

Carlo Rigillo, Chief Financial Officer, 3 Sixty Secure Corp.

(866) 360-3360,

IR@3sixtysecure.com

Forward-Looking Information

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements include, but are not limited to, the Company’s business and operations and the ability to successfully implement and execute strategic opportunities; the Company’s intention to grow the business and operations by pursuing opportunities domestically and internationally; the Company’s ability to continue reducing costs, including labour, by eliminating redundancies; the Company’s expectations for future results and increased revenue resulting in sustained profitability and growth; the expected growth of the Company from market share gains and industry expansion (including expansion into the U.S. market); the Company’s ongoing relationship with INKAS and continued execution of long-term contracts with licensed producers; the cannabis industry in Canada generally and management’s expectations regarding consumer demand for certain products. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release. Except as required by law, 3 Sixty assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

This news release also contains future-oriented financial information and financial outlook information (collectively, “FOFI”) about 3 Sixty’s prospective results of operations including, without limitation, cash flow and various components thereof, annualized revenue and other metrics, all of which are subject to the same assumptions, risk factors, limitations, and qualifications as set forth above and in addition are grounded on the assumption of the continued performance of the Company’s long-term customers contracts and no early termination of same. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on FOFI. 3 Sixty’s actual results, performance or achievement could differ materially from those expressed in, or implied by, these FOFI, or if any of them do so, what benefits 3 Sixty will derive therefrom. The FOFI do not purport to present the Company’s financial condition in accordance with IFRS, and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. 3 Sixty has included the FOFI in order to provide readers with a more complete perspective on 3 Sixty’s future operations and such information may not be appropriate for other purposes. 3 Sixty disclaims any intention or obligation to update or revise any FOFI statements, whether as a result of new information, future events or otherwise, except as required by law. The inclusion of the FOFI in the earnings disclosure should not be regarded as an indication that 3 Sixty considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Non-IFRS Measures

This news release references non-IFRS measures including EBITDA and Adjusted EBITDA to help evaluate its performance and liquidity as well as to assess potential acquisitions.

The Company believes these measures will provide investors with useful supplemental information about the financial and operational performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to the measures used by management in operating its business, identifying and evaluating trends, and making decisions. The Company believes that such non-IFRS financial measures provide useful information about its underlying, core operating results and trends, enhance the overall understanding of its past performance and future prospects and allow for greater transparency with respect to measures used by management in its financial and operational decision-making.

Although management believes these non-IFRS financial measures and key metrics are important in evaluating the Company, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. They are not recognized measures under IFRS and do not have standardized meanings prescribed by IFRS. These measures may be different from non-IFRS financial measures used by other companies and may not be comparable to similar meanings prescribed by other companies, limiting their usefulness for comparison purposes. Moreover, presentation of certain of these measures is provided for period-over-period comparison purposes, and investors should be cautioned that the effect of the adjustments thereto provided herein have an actual effect on the Company’s operating results.

The Company provides the following non-IFRS measures in this news release:

EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION (“EBITDA”)

EBITDA refers to earnings or loss before interest, taxes, depreciation and amortization. EBITDA is a term not recognized under IFRS and may not be comparable to similar measures presented by other companies. The Company considers EBITDA as a metric to provide additional information and indicate the Company’s ability to generate cash and to fund future growth through capital investment.

ADJUSTED EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION (“ADJUSTED EBITDA”)

Adjusted EBITDA is used by management as a supplemental measure to review and assess operating performance and trends on a comparable basis. The Company defines Adjusted EBITDA as EBITDA adjusted for the impact of stock-based compensation, advertising and marketing expenses related to readying the Company for its amalgamation and reverse takeover transaction, and other non-recurring costs the Company deems unrelated to current operations and one-time in nature.

For additional information on the Company’s non-IFRS measures and the reasons why it believes such measures are useful, see above and the Q3 2019 MD&A, including under the headings “Non-IFRS Measures”.

Click here to connect with 3 Sixty Secure Corp (CSE:SAFE) for an Investor Presentation.