Crypto Market Update: Crypto Czar Says Banks and Crypto Companies Will Merge

Elsewhere in the crypto space, US President Donald Trump said he expects to sign the long-delayed market structure bill “very soon,” reviving momentum for legislation that stalled last week.

Here's a quick recap of the crypto landscape for Wednesday (January 21) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

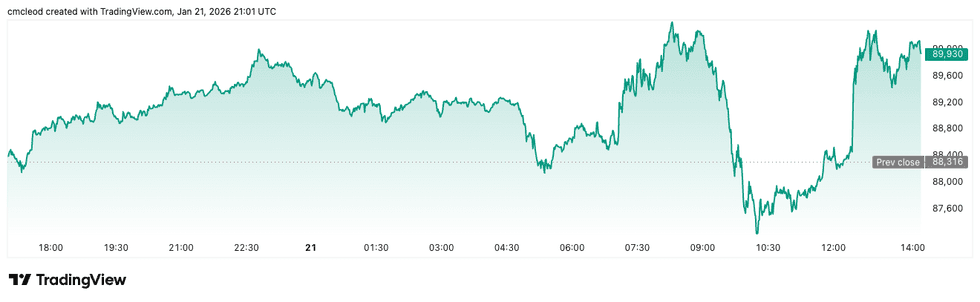

Bitcoin (BTC) was priced at US$90,066.08, up by 0.6 percent over 24 hours.

Bitcoin price performance, January 21, 2026.

Chart via TradingView.

After Tuesday's (January 20) selloff, the Bitcoin price rose after US President Donald Trump’s speech in Davos, Switzerland, where he said he expects to sign the crypto market structure bill “very soon.”

During his address, Trump also said he supported the GENIUS Act, which he signed into law in July 2025, because it was “politically popular,” adding, “much more importantly, we have to make it so that China doesn’t get hold of it … once they have that hold, we’re not going to be able to get it back.”

In an email, Samer Hasn, senior market analyst at XS.com, maintained that the current Bitcoin market correction is being driven by a combination of escalating geopolitical risks, including Trump’s ultimatum regarding the annexation of Greenland and Middle East tensions, as well as tightening global liquidity.

"The institutional appetite for digital assets is also showing signs of fatigue, with US spot Bitcoin ETFs reversing course to post nearly US$500 million in outflows over just two sessions," he wrote.

"This erratic on-off flow suggests that the record inflows seen last week were driven by speculative hot money rather than the solid, long-term accumulation required to sustain a bull market."

Ether (ETH) was priced at US$3,026.90, up by 0.9 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.97, up by 3.3 percent over 24 hours.

- Solana (SOL) was trading at US$130.88, up by 2.5 percent over 24 hours.

Today's crypto news to know

Crypto czar says banks and crypto companies will merge

During an interview with CNBC's Squawk Box, David Sacks, White House artificial intelligence and crypto czar, accompanied by Michael Kratsios, Office of Science and Technology Policy director, said banks and crypto companies will eventually merge into one digital asset industry once the market structure bill passes through Congress.

"After the bill passes, the banks are going to get fully into the crypto industry. So we’re not going to have a separate banking industry and crypto, it’s going to be one digital asset industry. Over time, the banks like the idea of paying yield because they're going to be in the stablecoin business," Sacks said from Davos.

Galaxy to launch US$100 million crypto hedge fund

Galaxy Digital (NASDAQ:GLXY) is reportedly planning to launch a US$100 million hedge fund, according to the Financial Times, which cited people familiar with the matter and internal sources close to the firm.

The fund is set to launch in Q1 of this year, with up to 30 percent of its assets invested in crypto tokens and the rest in financial services stocks impacted by changes in digital asset technologies and laws.

Bitget: Macro reset reframes Bitcoin’s role as risk appetite cools

The crypto market is entering 2026 under a markedly different macro backdrop, as geopolitical tensions, trade disputes and shifting interest rate expectations force investors to reassess risk.

According to Bitget CMO Ignacio Aguirre, capital is rotating back toward traditional safe havens, with gold reclaiming its defensive role, while Bitcoin is trading more like a risk asset amid tighter liquidity.

The roughly US$1.3 trillion erased from US equities underscores a broader repricing rather than a market anomaly, reflecting how policy uncertainty typically drives investors to pull back first before selectively re-entering.

Aguirre noted that similar patterns played out during the 2008 financial crisis and the 2022 crypto downturn, where sharp contractions ultimately set the stage for renewed growth.

In the near term, Bitcoin could face additional pressure and test lower support levels before finding stability.

Longer term, however, structural factors such as improving infrastructure and institutional participation continue to support a bullish thesis. The adjustment, Aguirre argued, is part of crypto’s maturation.

DeFi groups push back on FTC’s approach to non-custodial systems

Major crypto policy groups are urging the US Federal Trade Commission (FTC) to rethink how it applies consumer protection rules to decentralized finance. The appeal comes as Congress debates broader crypto legislation, raising concerns that regulatory overlap could create confusion.

In a joint letter, industry organizations, including the Crypto Council for Innovation and the Blockchain Association, warn that enforcement models designed for custodial finance do not translate cleanly to non-custodial systems.

They argue that imposing centralized safeguards such as kill switches or circuit breakers could weaken, rather than enhance, security by undermining decentralization. The groups further emphasize that developers who do not control user funds should not be treated as financial intermediaries. Overly prescriptive standards, they said, risk stifling innovation and driving responsible development outside the US.

Steak 'n Shake announces Bitcoin bonus for hourly employees

Steak ’n Shake is launching a Bitcoin bonus program for hourly employees, offering US$0.21 worth of Bitcoin per hour.

Announced on Wednesday via X, the rewards will be subject to a two year vesting period. The initiative expands the chain's partnership with Fold following a 2025 pilot program.

The move also reinforces Steak ’n Shake’s aggressive Bitcoin strategy, which includes accepting Bitcoin payments and a recent US$10 million Bitcoin purchase to be added to its corporate Bitcoin reserve.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.