Moneta Porcupine Mines: Developing One of the Largest Undeveloped Gold Projects in North America

Moneta Porcupine Mines (TSX:ME) has launched its campaign on the Investing News Network.

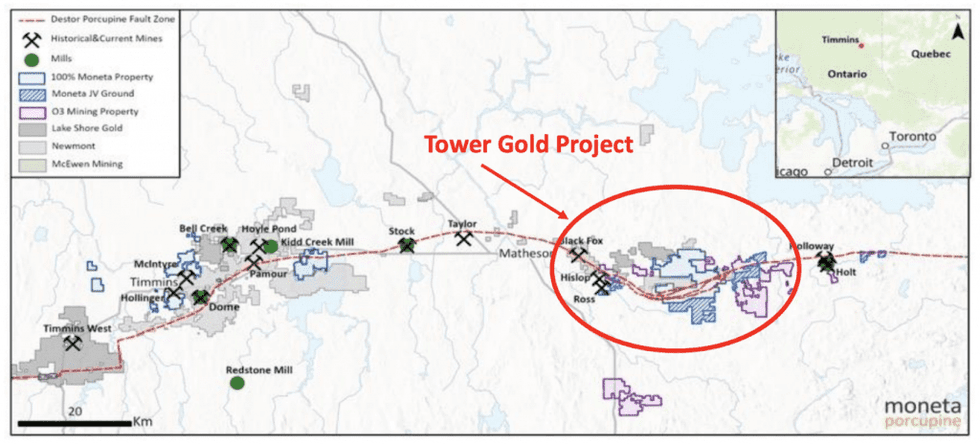

Moneta Porcupine Mines (TSX:ME) focuses 2021 on testing the significant resource expansion potential identified at Golden Highway and Garrison to expand the total gold resource endowment on its highly prospective flagship Tower Gold Project on the Destor Porcupine Fault corridor in the prolific Timmins gold camp in Ontario, Canada. It is expected that the expanded resource base will result in a significantly expanded scope and production profile in the planned updatedPEA study which will address the combined project.

Tower Gold Project hosts a total gold resource of 4.0 million ounces indicated and 4.4 million ounces inferred. It is a combination of the Golden Highway Gold project and the adjacent Garrison Gold project acquired from O3 Mining (TSXV:OIII, OTCQX:OIIIF). The Garrison gold project consists of the large Garrison open pit gold resource containing 1.8 Moz indicated and 1.1 Moz inferred resources.

Moneta Porcupine Mines has a robust capital structure and strategic shareholder portfolio. The company’s market cap stands at CAD$213 million with 557.5 million shares outstanding and no debt. The company is supported by a loyal and strong institutional shareholder base, significant insider ownership, the backing and support of O3 Mining and a good retail investor following.

Moneta Porcupine Mines’ Company Highlights

- Moneta Porcupine Mines Inc. is a gold exploration company exploring and developing gold projects along the Destor Porcupine Fault Zone corridor in the prolific Timmins Gold Camp in Ontario.

- Moneta Porcupine has one of the largest underdeveloped gold mining projects in North America after acquiring O3 Mining’s mining projects. This acquisition adds an additional 73 percent to the company’s exploration land package.

- Project consolidation presents the company with substantial economic benefits through operational and developmental synergies and widespread gold mineralization with regional scale opportunities.

- The company holds 26,343 hectares of prospective land in the Timmins Gold Camp, including a joint venture with Kirkland Lake Gold Corp.

- The Tower gold and South West projects have a completed PEA and demonstrate excellent economics. These PEAs warrant exciting additional exploration across the highly prospective projects.

- The South West deposit boasts an average annual free cash flow at CAD$49 million with an after-tax IRR of 30 percent and a 3.4-year pay-back after tax. The property also boasts lower quartile cash costs and significant annual production levels with low initial capital.

- Moneta Porcupine is well-positioned and capitalized to advance the development of its combined entity and create the next gold mine in Timmins.