Ionic Rare Earths: Low Capital Operations With the Potential for High Margins

Ionic Rare Earths (IonicRE) has launched its campaign on the Investing News Network.

Ionic Rare Earths (ASX:IXR, or “IonicRE”) aims to create rare opportunities for investors by operating a low capital operation with a high-margin product. The company’s Makuutu project has a post-tax long-term free cash flow estimate of US$766 million over 11 years. This is expected to grow dramatically in the next 12 months as the company increases the resources to increase the potential life at Makuutu beyond 30 years.

Makuutu is an advanced-stage, ionic adsorption clay (IAC) hosted rare earth element (REE) project highlighted by near-surface mineralisation, significant exploration upside, excellent metallurgical characteristics, and access to tier one infrastructure. The clay-hosted geology at Makuutu is similar to major IAC rare earths projects in southern China, which are responsible for the majority of global supply of low-cost, high value Heavy REOs (>95% originating from IAC).

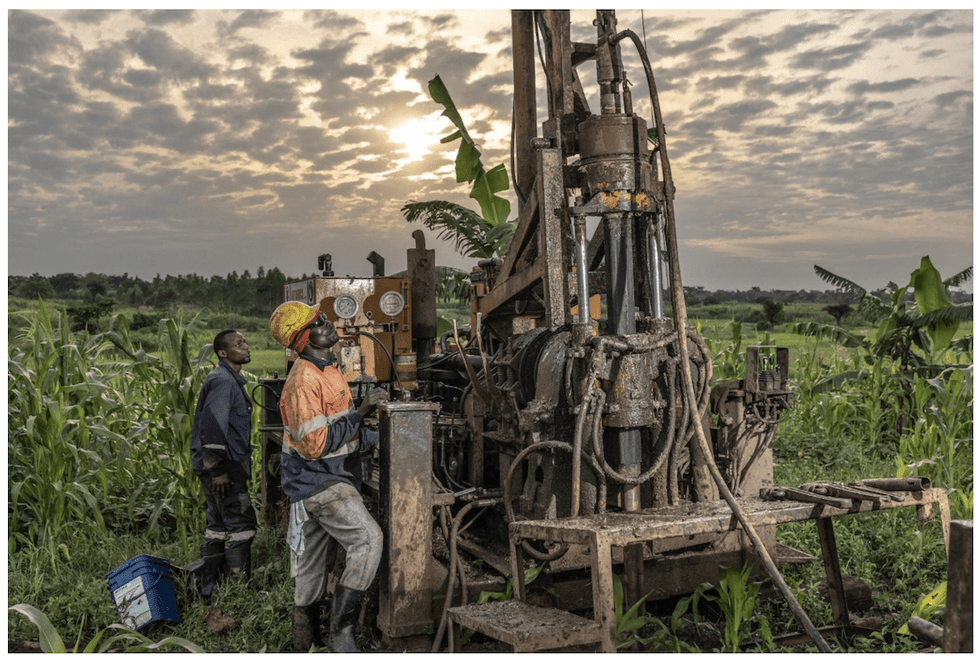

Phase 4 infill drilling at Makuutu which is expected to net a significant increase in resources at Makuutu.

Ionic Rare Earth’s Company Highlights

- Ionic Rare Elements is an exploration and mining company that is cultivating a promising basket of rare earth metals, which includes magnet rare earths neodymium, praseodymium, dysprosium and terbium, in high demand to feed the insatiable demand for Evs and offshore wind turbines

- Makuutu’s unique rare earth basket has the full list of all individual REEs required for the future industries dependent upon a secure and stable supply

- The Makuutu project is a low-capital development that will produce a high-margin product

- Rare earth metals already have many applications, but a forecast demand of these technology metals already exceeds potential supply indicating that long term REE procing is set for significant gains

- The Makuutu project is considered the third-largest scandium resource globally, and has the potential to produce many other in-demand REEs

- IonicRE is dedicated to developing and extracting value from the Makuutu project with a potential of extending the to 2050 and beyond

- IonicRE is planning on developing heavy rare earth refining capacity and supplying western markets as the next step in maximising the value of the Makuutu basket in a climate of strained supply.