Gran Colombia Gold Corp. has released its unaudited interim condensed consolidated financial statements and accompanying management’s discussion and analysis for the three and six months ended June 30, 2021

GRAN COLOMBIA ANNOUNCES SECOND QUARTER AND FIRST HALF 2021 RESULTS

Gran Colombia Gold Corp. has released its unaudited interim condensed consolidated financial statements and accompanying management’s discussion and analysis (MD&A) for the three and six months ended June 30, 2021. All financial figures contained herein are expressed in United States dollars unless otherwise noted.

Second quarter and first half 2021 highlights

- Gran Colombia has completed a major step forward in its strategy to grow through diversification, completing the acquisition on June 4, 2021, of all the shares of Gold X Mining Corp. it did not already own and then closing a $300-million offering on Aug. 9, 2021, of 6.875 per cent senior unsecured notes due 2026 to finance the development of the Toroparu project in Guyana, to prepay the remaining $18.0-million balance of its gold notes and for general corporate purposes. The company is nearing completion of an updated preliminary economic assessment (PEA) for the Toroparu project incorporating the recently announced high-grade results from the 2020 to 2021 drilling program undertaken by Gold X.

- The company added a 27-per-cent equity interest in Denarius Silver Corp. to its portfolio in the first half of 2021, giving it exposure to the Lomero-Poyatos polymetallic deposit located in Spain, in close proximity to the Matsa JV (joint venture) project in the Iberian pyrite belt, and to the Guia Antigua and Zancudo projects in Colombia.

- In February, 2021, Gran Colombia also successfully brought its spin out of the Marmato mining assets to a conclusion, one in which the company has a continuing equity ownership of 44 per cent in Aris Gold Corp. The Marmato operating and financial results are only consolidated up to Feb. 4, 2021, and thereafter the company equity accounts for its investment in Aris.

- Gran Colombia published its inaugural sustainability report in June, 2021. The report reflects a focused effort on measuring and disclosing the company’s environmental, social and governance (ESG) priorities and performance moving forward. The company remains committed to the health and safety of its employees, and through COMFAMA Colombia, was the first mining company in Antioquia to secure vaccines for employees and their families. Gran Colombia has purchased 8,000 vaccines (16,000 doses), created educational vaccine campaigns and has administered over 5,000 first doses with second doses beginning mid-August.

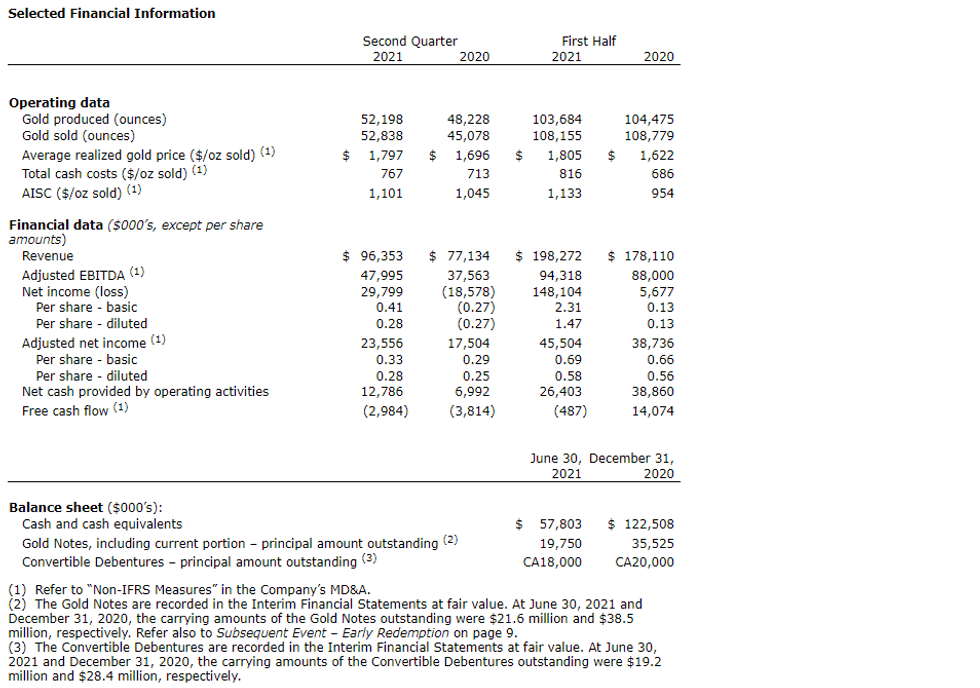

- Gran Colombia’s gold production from its Segovia operations totalled 52,198 ounces in the second quarter of 2021 compared with 44,377 ounces in the second quarter of 2020. Total gold production from Segovia for the first half of 2021 amounted to 101,256 ounces compared with 94,723 ounces in the first half last year. In July, 2021, Segovia’s gold production, which reflected the impact of a planned four-day maintenance shutdown at the plant, was 15,258 ounces. This brings the company’s trailing 12 months total gold production from its Segovia operations at the end of July, 2021 to 201,688 ounces, up 3 per cent over 2020. The company remains on track with its annual production guidance of 200,000 to 220,000 ounces of gold from Segovia in 2021. Including Marmato production up to Feb. 4, 2021, consolidated gold production for the first half of 2021 was 103,684 ounces compared with 104,475 ounces in the first half last year.

- Consolidated revenue amounted to $96.4-million and $198.3-million in the second quarter and first half of 2021, respectively, up from $77.1-million and $178.1-million in the second quarter and first half, respectively, of 2020. The year-over-year increase in revenue largely reflects an increase in the company’s realized gold price (1) which averaged $1,805 per ounce sold in the first half of 2021 compared with an average of $1,622 per ounce sold in the first half last year.

- At the Segovia operations, total cash costs (1) averaged $767 per ounce in the second quarter of 2021, compared with $654 per ounce in the second quarter of 2020, bringing the average for the first half of 2021 to $796 per ounce compared with $625 per ounce in the first half last year. The year-over-year increase in Segovia’s total cash cost per ounce in the second quarter and first half of 2021 reflects (i) an increase in contractor and artisanal mining payment rates (which had not changed since 2017) implemented in the third quarter of 2020 in response to the current gold market conditions, (ii) higher spot gold prices which increased production taxes on a per-ounce basis, and (iii) additional costs to maintain the necessary COVID-19 protocols required to protect the health and safety of Segovia’s workers and the local communities. Including Marmato, consolidated total cash costs were $816 per ounce in the first half of 2021 compared with $686 per ounce in the first half last year.

- All-in sustaining costs (AISC) (1) per ounce sold for the Segovia operations were $1,101 and $1,110 in the second quarter and first half, respectively, of 2021 compared with $965 and $890 in the second quarter and first half, respectively, of 2020. The year-over-year increase in Segovia’s AISC in 2021 reflects (i) the increased total cash costs as described above and (ii) an increase in mine development and other sustaining capital expenditures. Sustaining capital expenditures at Segovia amounted to $19.9-million in the first half of 2021, up from $13.0-million in the first half last year which reflected a slowdown in activity in the second quarter of 2020 during the early stages of the COVID-19 national quarantine in Colombia that delayed many of the company’s initiatives until later in 2020. Including Marmato, consolidated AISC in the first half of 2021 was $1,133 per ounce compared with $954 per ounce in the first half last year.

- Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization)(1) amounted to $48.0-million for the second quarter of 2021 compared with $37.6-million in the second quarter last year. This brings the total adjusted EBITDA for the first half of 2021 to $94.3-million, up from $88.0-million in the first half of 2020. The company’s trailing 12 months adjusted EBITDA at the end of June, 2021, stood at $194.1-million compared with $187.8-million in 2020.

- Net cash provided by operating activities in the second quarter of 2021 was $12.8-million compared with $7.0-million in the second quarter last year. Operating cash flow in the second quarter each year typically bears the heaviest impact of income tax payments in Colombia which amounted to $49.3-million in the second quarter of 2021, up from $35.3-million in the second quarter last year. For the first half of 2021, net cash provided by operating activities amounted to $26.4-million compared with $38.9-million in the first half last year reflecting the increased level of income tax payments in 2021 and $8.8-million of change of control payments made by Aris related to the Aris transaction.

- Free cash flow (1) in the second quarter of 2021, which reflected the increased levels of sustaining capital expenditures and income tax payments this year, was negative $3.0-million compared with negative $3.8-million in the second quarter of 2020. Free cash flow for the first half of 2021 was negative $500,000 compared with $14.1-million in the first half of 2020. The company’s free cash flow, adjusted to exclude Aris, in the first half of 2021 was $11.8-million compared with $20.1-million in the first half last year, reflecting an increased level of income tax payments and capital expenditures at Segovia in the first half of 2021 compared with the first half last year.

- The company’s balance sheet continued to reflect solid liquidity with total cash of $57.8-million and working capital of $59.3-million at the end of June 2021.

- The company returned a total of $7.6-million to shareholders in the first half of 2021 with payment of its monthly dividends totalling $4.4-million and the repurchase of 702,000 shares at a cost of $3.2-million.

- Income from operations in the second quarter of 2021 was $39.6-million, up from $30.4-million in the second quarter last year largely on the strength of higher realized gold prices and higher production volume offset partially by the increase in Segovia’s total cash cost per ounce compared with the second quarter last year. Income from operations in the first half of 2021 amounted to $78.7-million compared with $71.3-million in the first half of 2020 despite including five fewer months of operating results from Marmato due to the loss of control of Aris at the beginning of February, 2021. In the first half of 2021, the increase in realized gold prices together with lower G&A (general and administrative) and share-based compensation expense more than mitigated the impact of Segovia’s higher cash costs per ounce on income from operations.

- The company reported net income of $29.8-million (41 cents per share) in the second quarter of 2021 compared with a net loss of $18.6-million (27 cents per share) in the second quarter of 2020, reflecting the $9.2-million improvement in income from operations as noted above and a gain on financial instruments of $1.5-million in the second quarter of 2021 compared with a loss on financial instruments of $35.4-million in the second quarter of 2020. For the first half of 2021, net income amounted to $148.1-million ($2.31 per share) compared with $5.7-million (13 cents per share) in the first half last year. Net income in the first half of 2021 reflected the $7.4-million improvement in income from operations as noted above and also benefited from the $56.9-million gain on loss of control of Aris, the $44.3-million gain on financial instruments (compared with a $18.9-million loss on financial instruments in the first half last year) and the $8.9-million gain on sale of the Zancudo project. Net income in the first half of 2021 included Aris transaction costs of $9.8-million while net income in the first half of 2020 included Bluenose RTO (reverse takeover) transaction costs of $16.7-million.

- Adjusted net income (1) for the second quarter of 2021 was $23.6-million (33 cents per share) compared with $17.5-million (29 cents per share) in the second quarter last year. For the first half of 2021, adjusted net income improved to $45.5-million (69 cents per share) from $38.7-million (66 cents per share) in the first half last year. The year-over-year improvement in adjusted net income in the second quarter and first half of 2021 largely reflects the factors noted above regarding income from operations partially offset by an increase in income tax expense.

- The company’s continuing drilling program at Segovia continues to provide encouraging results as announced in press releases dated June 9, 2021, and July 12, 2021. Gran Colombia is carrying out 60,000 metres of drilling at Segovia in 2021 with 40,000 metres dedicated to the continuing in-mine and near-mine drill program at its four operating mines and the other 20,000 metres is aimed at testing its highest-priority brownfield targets on the 24 known veins in its mining title that it is not currently mining.

Second quarter 2021 results webcast

As a reminder, Gran Colombia will host a conference call and webcast on Friday, Aug. 13, 2021, at 9 a.m. Eastern Time to discuss the results.

Webcast and call-in details are as follows:

Live event: Edge Media website

Canada toll/international: 1-514-841-2157

North America toll-free: 1-866-215-5508

Colombia toll-free: 01-800-9-156-924

Conference ID: 50186481

A replay of the webcast will be available on the company website from Friday, Aug. 13, 2021, until Friday, Sept. 10, 2021.

About Gran Colombia Gold Corp.

Gran Colombia is a mid-tier gold producer with a proven record of mine building and operating in Latin America. In Colombia, the company is currently the largest underground gold and silver producer with several mines in operation at its high-grade Segovia operations. In Guyana, the company is advancing the Toroparu project, one of the largest undeveloped gold projects in the Americas. Gran Colombia also owns an approximately 44-per-cent equity interest in Aris Gold Corp. (Toronto Stock Exchange: ARIS) (Colombia: Marmato), an approximately 27-per-cent equity interest in Denarius Silver Corp. (TSX Venture Exchange: DSLV) (Spain: Lomero-Poyatos and Colombia: Guia Antigua and Zancudo) and an approximately 26-per-cent equity interest in Western Atlas Resources Inc. (TSX-V: WA) (Nunavut: Meadowbank).

We seek Safe Harbor.