(TheNewswire)

These new intercepts verify the continuity of mineralization at shallow depth and confirm extension of the multiple mineralized structures

Granada Gold Mine Inc. (TSXV:GGM) (OTC:GBBFF) (Frankfurt:B6D) (the "Company" or "Granada") is pleased to announce additional results from its on-going drill program at its Granada Gold project with multiple new gold assays from its GR-21-22, GR-21-23, GR-21-24 and GR-21-25 drill holes with grades up to 31.30 gt over 1.00m, 11.70 gt over 1.00m, and 10.05 gt over 0.50m

Drilling Highlights

-

Drill holes GR-21-22, GR-21-23, GR-21-24 and GR-21-25 were designed to confirm the presence of gold mineralization at shallow depth.

-

The drill holes were aimed to fill gaps in the SGS mineral resources envelopes, with the potential of increasing the tonnage of the high-grade, open-pit resource grade of 2 grams per tonne gold.

-

GR-21-22 intersected

-

1.25g/t Au over 7.75m

-

-

GR-21-23 intersected

-

5.54 g/t Au over 6.00m, including 31.30 g/t Au over 1.00m

-

-

GR-21-24 intersected

-

0.78g/t Au over 11.70m, including 5.40 g/t Au over 0.60m

-

-

GR-21- 25 intersected

-

1.14 g/t Au over 5.1m, including 10.05 g/t Au over 0.50m

-

"The assay results from these drill holes prove the continuity of mineralization along the main Granada central structure. Also, the 30,000-meter drill program we conducted over the past year has confirmed that the average assays of the down-dip results of the mineralized structure are consistently higher than the previous perpendicular-to-structure drill results. The company is planning another bulk sample similar in size as the previous one taken to get a better understanding of the correlation to drill data results. We expect the bulk sample results to give a more representative grade of the mineralized vein zone," commented Frank J. Basa, P.Eng., President and CEO.

A 500-tonne bulk sample of mineralized material was taken in the fall of 2020 (Press Release June 16, 2021) based on drill holes GR-19-A, -B and -C. The processing of this bulk sample is progressing well at Temiskaming Testing Labs, in Ontario, Canada. To date, 400 tonnes have been processed with the remaining 100 tonnes to be processed by the first quarter of 2022. Visible gold has been encountered during processing. The previous sample of 1,220 kilograms returned 55.6 grams per tonne of physical gold (Press Release August 11, 2020). The company is targeting a minimum open-pit resource grade of 2 grams per tonne.

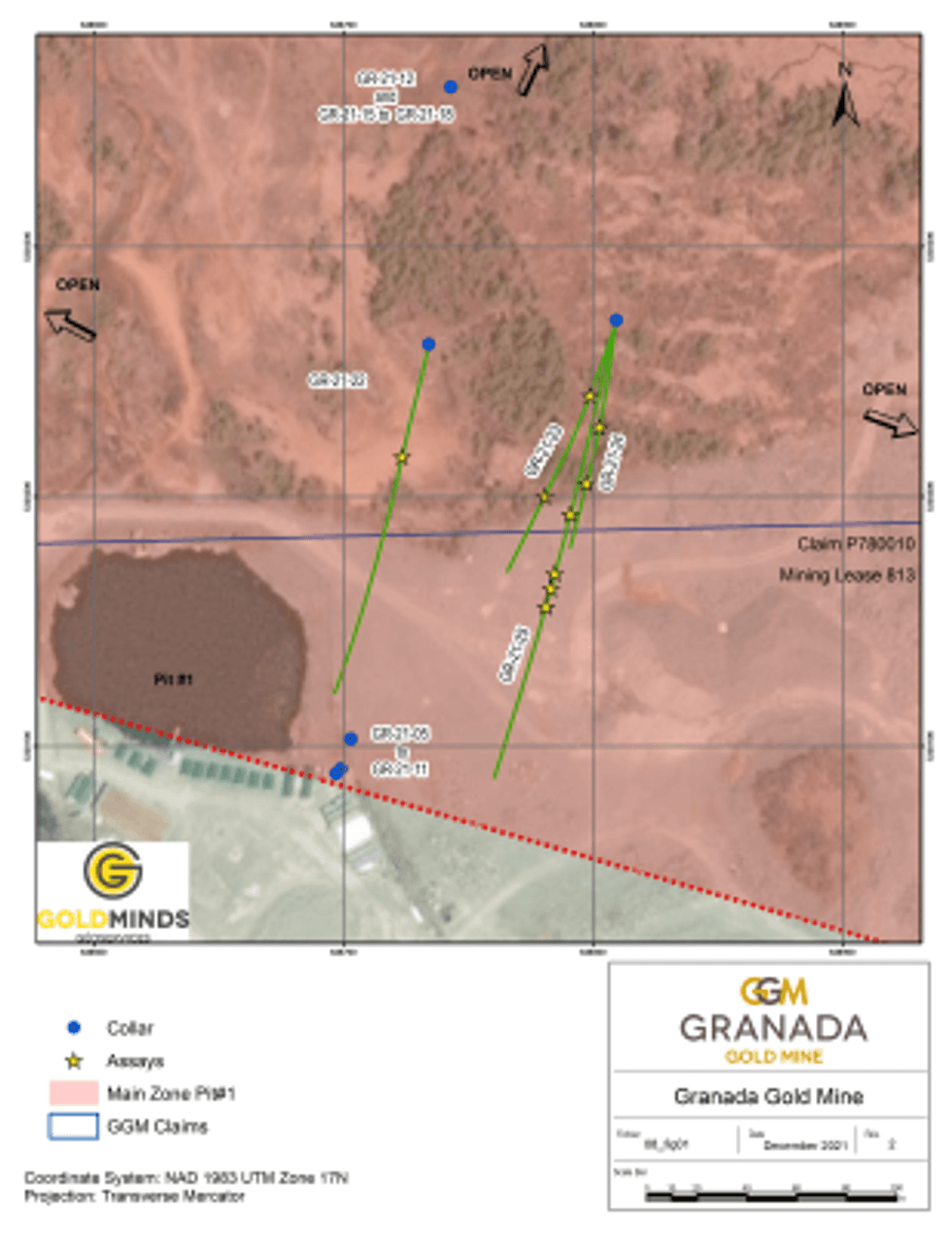

Figure 1: Plan Map Showing Drill Hole Traces and Significant Assay Locations Immediately Northeast of Pit #1.

Click Image To View Full Size

Table 1: Sample Details

| Hole ID | Target Location | From (m) | To (m) | Length (m) | Au (g/t) |

| GR-21-22 | Northeast of Pit#1 | 111.70 | 112.90 | 1.20 | 2.37 |

| GR-21-22 | Northeast of Pit#1 | 165.90 | 173.65 | 7.75 | 1.25 |

| GR-21-22 | Northeast of Pit#1 | 190.25 | 194.00 | 3.75 | 1.10 |

| GR-21-23 | Northeast of Pit#1 | 135.50 | 141.50 | 6.00 | 5.54 |

| Including | Northeast of Pit#1 | 135.50 | 136.50 | 1.00 | 31.30 |

| GR-21-23 | Northeast of Pit#1 | 188.00 | 193.00 | 5.00 | 0.86 |

| GR-21-23 | Northeast of Pit#1 | 214.50 | 221.60 | 7.10 | 2.44 |

| Including | Northeast of Pit#1 | 214.50 | 215.50 | 1.00 | 11.70 |

| GR-21-24 | Northeast of Pit#1 | 243.75 | 255.45 | 11.70 | 0.78 |

| Including | Northeast of Pit#1 | 247.70 | 248.30 | 0.60 | 5.40 |

| Including | Northeast of Pit#1 | 254.90 | 255.45 | 0.55 | 4.99 |

| GR-21-24 | Northeast of Pit#1 | 336.30 | 340.70 | 4.40 | 0.57 |

| GR-21-24 | Northeast of Pit#1 | 425.85 | 426.35 | 0.50 | 5.73 |

| GR-21-25 | Northeast of Pit#1 | 169.05 | 170.20 | 1.15 | 2.82 |

| GR-21-25 | Northeast of Pit#1 | 182.45 | 189.00 | 6.55 | 1.01 |

| GR-21-25 | Northeast of Pit#1 | 201.00 | 206.10 | 5.10 | 1.14 |

| Including | Northeast of Pit#1 | 205.60 | 206.10 | 0.50 | 10.05 |

| GR-21-25 | Northeast of Pit#1 | 258.80 | 261.00 | 2.20 | 3.54 |

| GR-21-25 | Northeast of Pit#1 | 273.20 | 276.70 | 3.50 | 2.43 |

| GR-21-25 | Northeast of Pit#1 | 289.00 | 291.50 | 2.50 | 2.43 |

| including | Northeast of Pit#1 | 290.00 | 290.55 | 0.55 | 10.75 |

Please note: Bolded intervals represent assay composite calculations. Non-bolded intervals represent single assays. G/t refers to grams per tonne. Intervals are core length with no capping applied.

Location

The Granada Gold project is located near Rouyn-Noranda adjacent to the prolific Cadillac Break shear zone, which is hosted in Pontiac metasedimentary rocks, granites, and younger syenite sills along the Granada shear zone (LONG Bars Zone). The project is located on the same side of the Cadillac Fault as the Canadian Malartic mine property, which has historically produced 12.7 million Ounces of gold from 1935 to 2010 with an additional 5 million ounces as of June 18, 2020 (Canadian Malartic Technical Report of March 25, 2021 and Le Citoyen, June 19, 2020).

Qualified person

The technical information in this news release has been reviewed by Claude Duplessis, P.Eng., GoldMinds Geoservices Inc., a member of the Québec Order of Engineers, and is a qualified person in accordance with the National Instrument 43- 101 standards.

Quality Control and Reporting Protocols

The 2021 assay results are from ALS laboratory in Val d'Or. The screen metallic fire assay method is pre-selected by the geologist or geological engineer when samples contain visible gold. The drill program, quality assurance, quality control (QAQC), and interpretation of results is performed by qualified persons employing procedures consistent with NI 43-101 and industry best practices. Standards and blanks are included with every 20 samples for QAQC purposes for this program in addition to the lab QAQC.

Mineral Resource Estimate

On March 15, 2021 the Company released an updated NI 43-101 resource estimate for the Granada Gold project (Please see January 29, 2021 news release) with a combined total of 713,000 gold ounces of measured, indicated, and inferred. This estimate contains 351,000 gold ounces of combined measured, indicated, and inferred for the open pit and 362,000 gold ounces of combined measured, indicated, and inferred for the underground. Please see Table 2 below for full details. Report reference: Granada Gold Project Mineral Resource Estimate Update, Rouyn-Noranda, Quebec, Canada authored by Yann Camus, P.Eng. and Maxime Dupéré, B.Sc, P.Geo., SGS Canada Inc. with an effective date of December 15, 2020 and signature date of March 15, 2021.

Table 2: Mineral Resource Estimate Showing Tonnes, Average Grade, and Gold Ounces

| Type | Category | Tonnes | Avg Grade Au (g/t) | Gold Ounces |

| Open Pit | Measured | 3,756,000 | 1.89 | 228,000 |

| Indicated | 1,357,000 | 2.55 | 111,000 | |

| Measured + Indicated | 5,113,000 | 2.06 | 339,000 | |

| Inferred | 34,000 | 11.29 | 12,000 | |

| Underground | Measured | 37,000 | 4.22 | 5,000 |

| Indicated | 807,000 | 4.02 | 104,000 | |

| Measured + Indicated | 844,000 | 4.03 | 109,000 | |

| Inferred | 1,244,000 | 6.33 | 253,000 |

About Granada Gold Mine Inc.

Granada Gold Mine Inc. continues to develop and explore its 100% owned Granada Gold Property near Rouyn-Noranda, Quebec which is adjacent to the prolific Cadillac Break. The Company owns 14.73 square kilometers of land in a combination of mining leases and claims. The company is currently undergoing a large drill program with 30,000m out of 120,000m complete. The drills are currently paused to provide the technical team with the necessary time to evaluate and assimilate existing data.

The Granada Shear Zone and the South Shear Zone contain, based on historical detailed mapping as well as from current and historical drilling, up to twenty-two mineralized structures trending east-west over five and a half kilometers. Three of these structures were mined historically from four shafts and three open pits. Historical underground grades were 8 to 10 grams per tonne gold from two shafts down to 236 m and 498 m with open pit grades from 3.5 to 5 grams per tonne gold.

The property includes the former Granada Gold underground mine which produced more than 50,000 ounces of gold at 10 grams per tonne gold in the 1930's from two shafts before a fire destroyed the surface buildings. In the 1990s, Granada Resources extracted a bulk sample (Pit #1) of 87,311 tonnes grading 5.17 g/t Au. They also extracted a bulk sample (Pit # 2) of 22,095 tonnes grading 3.46 g/t Au.

"Frank J. Basa"

Frank J. Basa, P. Eng.

Chief Executive Officer

For further information, Contact:

Frank J. Basa, P.Eng.

Chief Executive Officer

P: 416-625-2342

Or:

Wayne Cheveldayoff,

Corporate Communications

P: 416-710-2410

E: waynecheveldayoff@gmail.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements.

Copyright (c) 2021 TheNewswire - All rights reserved.