Almonty Industries (TSXV:AII) announced its financial results for the three and nine months period ended June 30, which showed a revenue of $8.7 million and earnings from mining operations of $1.6 million for Q3 2015.

Almonty Industries (TSXV:AII) announced its financial results for the three and nine months period ended June 30, which showed a revenue of $8.7 million and earnings from mining operations of $1.6 million for Q3 2015.

As quoted in the press release:

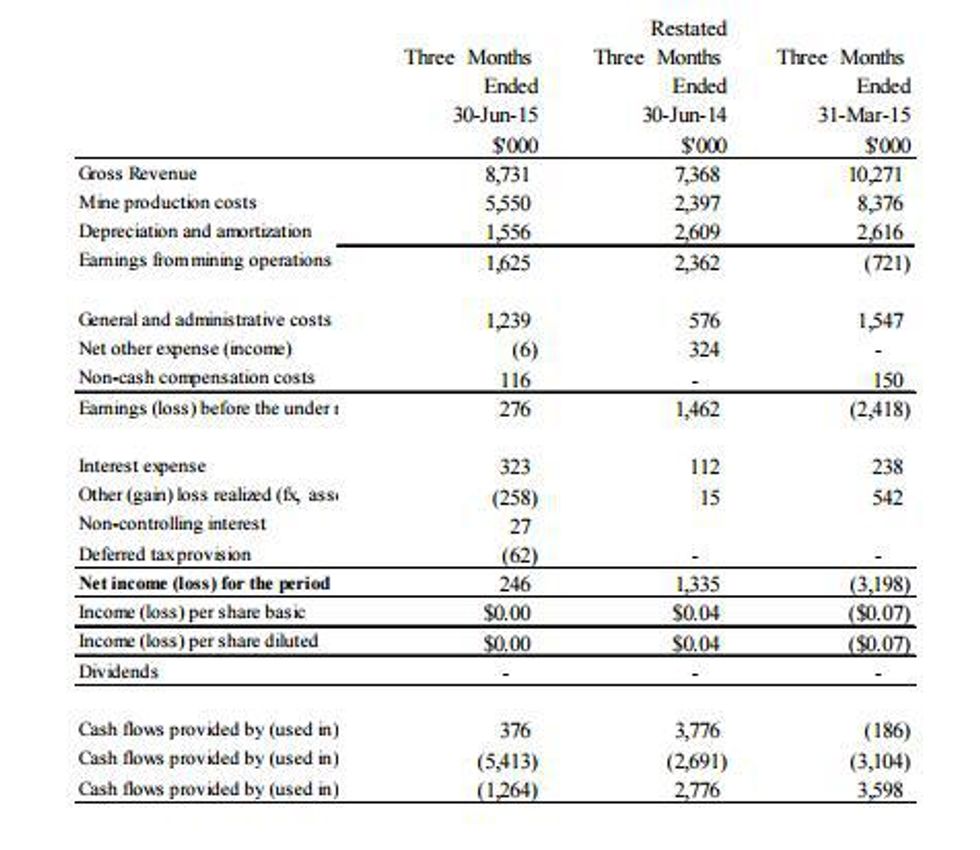

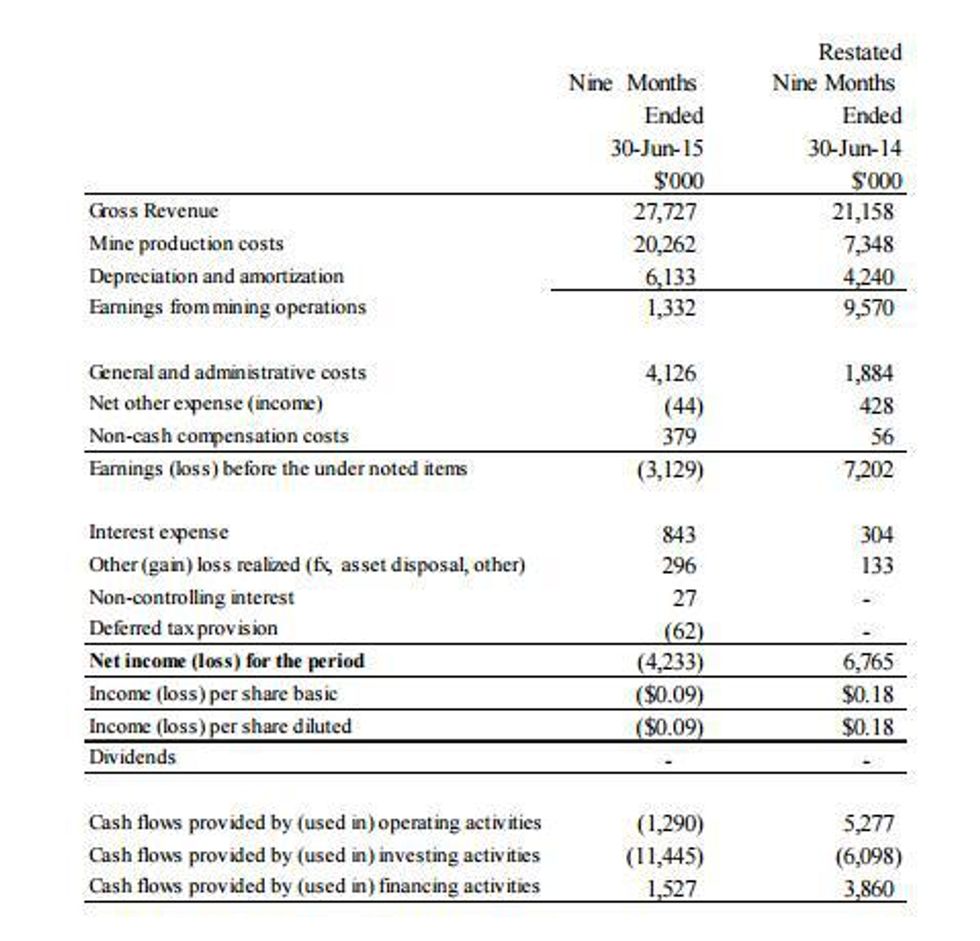

The following financial information is for the periods from April 1 to June 30, 2015; from April 1 to June 30, 2014; from October 1 to June 30, 2015; from October 1 to June 30, 2014; and, from January 1, to March 31, 2015. Historical information has been restated to reflect the new accounting policies that have been adopted.

Lewis Black, president and CEO of Almonty, commented:

The commodity price continued to decline during Q3, 2015, down over 14.2% when compared to Q2 2015 and over 33.2% since Q4 2014. Our continued focus on cost reductions at Los Santos and operating improvements at Wolfram Camp enable Almonty to show positive cash flow from operations during the quarter. The optimization of Wolfram Camp is ongoing and we expect to show continued improvement in unit production costs there once we have completed the optimization process. We are also encouraged by the strong show of support received from the shareholders of Woulfe Mining Corp. and look forward to completing the acquisition of Woulfe as soon as practical.

Click here to read the full Almonty Industries (TSXV:AII) press release.