Southern Energy: Acquiring and Developing Significant Natural Gas and Oil Resources in the Southeast U.S. Gulf States

Southern Energy (TSXV:SOU)

Southern Energy (TSXV:SOU) anticipates significant growth in the next 18 to 24 months as it focuses on acquiring and developing conventional natural gas and light oil resources in the southeast U.S. Gulf States of Mississippi, Louisiana, and East Texas.

Southern’s emphasis on incorporating technological advancement in its development plans gives the company a competitive edge. In the past 5 years management has put together a massive proprietary digital database of over 25,000 wells within the Gulf Coast focus area, which allows the company to geologically map areas much quicker and across millions of acres at one time. This highly valuable data also optimizes acquisition evaluation workflow and the company has evaluated over 100 assets for possible acquisition.

Southern Energy’s Company Highlights

- Southern Energy 100 percent focused on consolidating and developing its Gulf Coast oil and natural gas operations, where they leverage exceptional resource pricing, low-risk and high cash margin potential.

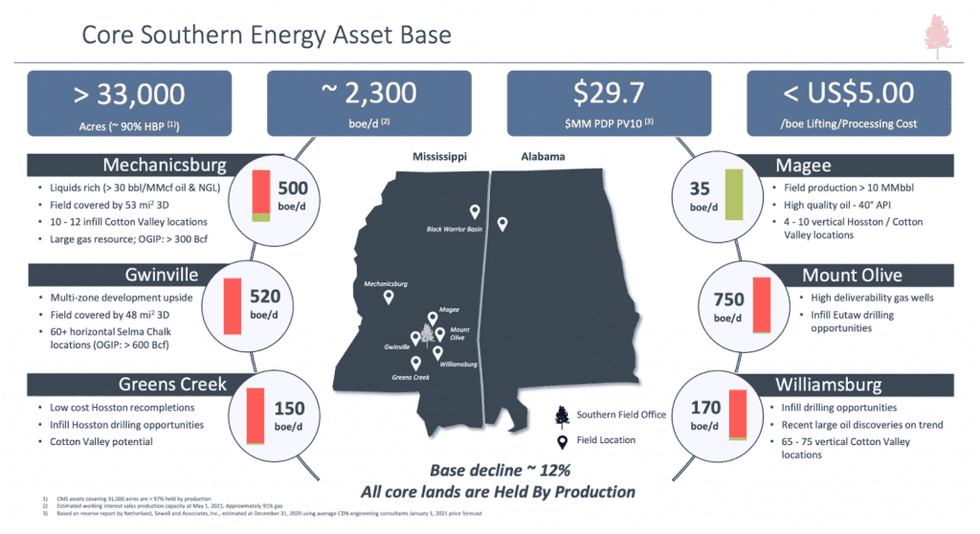

- The company currently operates in two counties in Alabama, twelve countries in Mississippi and holds a high working interest in more than 30,000 net acres of favorable land positioning.

- Southern has a robust core asset base consisting of the main Mechanicsburg, Gwinville and Green Creeks assets and highly prospective Magee, Mount Olive and Williamsburg targets.

- As an early-stage company, Southern hosts exceptional growth potential and expansion opportunities, including projected listing on London markets in the near future. The company could see growth from its CAD$20 million market capitalization to upwards of CAD$200 million.

- Southern Energy leverages strong institutional investor support for its business plan execution and projected international expansion in the future.

- The company has an expert management and technical team with extensive experience in profitably developing assets with horizontal drilling and modern unconventional completion techniques and enhanced oil recovery methods.