(TheNewswire)

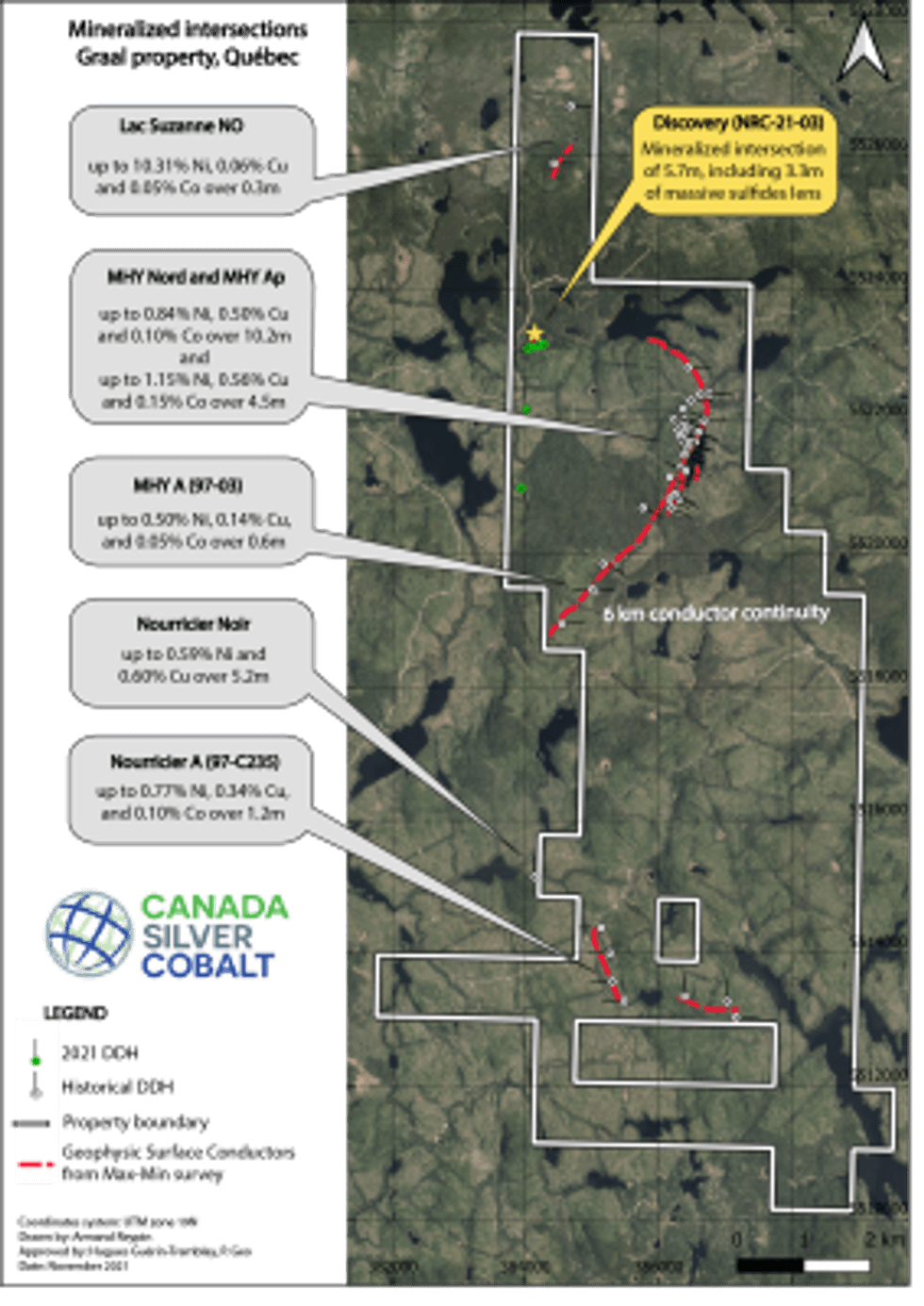

The consolidation of properties at Graal allows the Company to hold 6 kilometers of land (strike length) containing near-surface Nickel, Copper, and Cobalt mineralization based on historical drilling and the current drill program

Coquitlam, BC TheNewswire - November 29, 2021 - Canada Silver Cobalt Works Inc. (TSXV:CCW) (OTC:CCWOF) (Frankfurt:4T9B) (the "Company" or "Canada Silver Cobalt") is pleased to announce that the conclusion of the latest acquisition completes the consolidation of 6 kilometers of mineralized strike length. The land included in the new acquisition from SOQUEM Inc. and Mines Coulon Inc (Press Release November 22, 2021) bolsters the potential at the Graal property with further geophysical anomalies with conductor continuity and historical drill holes containing Nickel, Copper, and Cobalt near surface.

Highlights :

-

•• 6-kilometer strike length mineralized with near-surface copper, nickel, cobalt

-

•• Aiming for potential target of 30 to 60 million tonnes EV metals based on only the MHY sector

-

•• Recently drilled mineralization (XRF values up to 2.79% Ni and 25.68% Cu) (News Release November 24, 2021) not included in potential target calculation

Based on historical drill hole information, the mineralized strike length drilled in the past highlights a potential target of near-surface tonnage of 30 to 60 million tonnes at a grade range of 0.60% to 0.80% Nickel and 0.30% to 0.50% Copper with 0.10% to 0.15% Cobalt for the MHY sector (see map below). This calculation excludes the newly discovered mineralization (NRC-21-03) (see Company Press Release November 24, 2021), the northern Lac Suzanne portion, and the south portion of Nourricier sector. This estimation does not take into account any potential at depth which is currently being explored.

Please note that the quantity and grade of this potential target calculation is conceptual in nature, and there has been insufficient exploration to define a mineral resource. It is uncertain if further exploration will result in the target being delineated as a mineral resource. The potential target primary evaluation is a calculation of the length multiplied by the thickness of intersection by the density of 3.3 to 4.0 t/m3 multiplied by the depth extension of 150 to 250m based on historical drill holes.

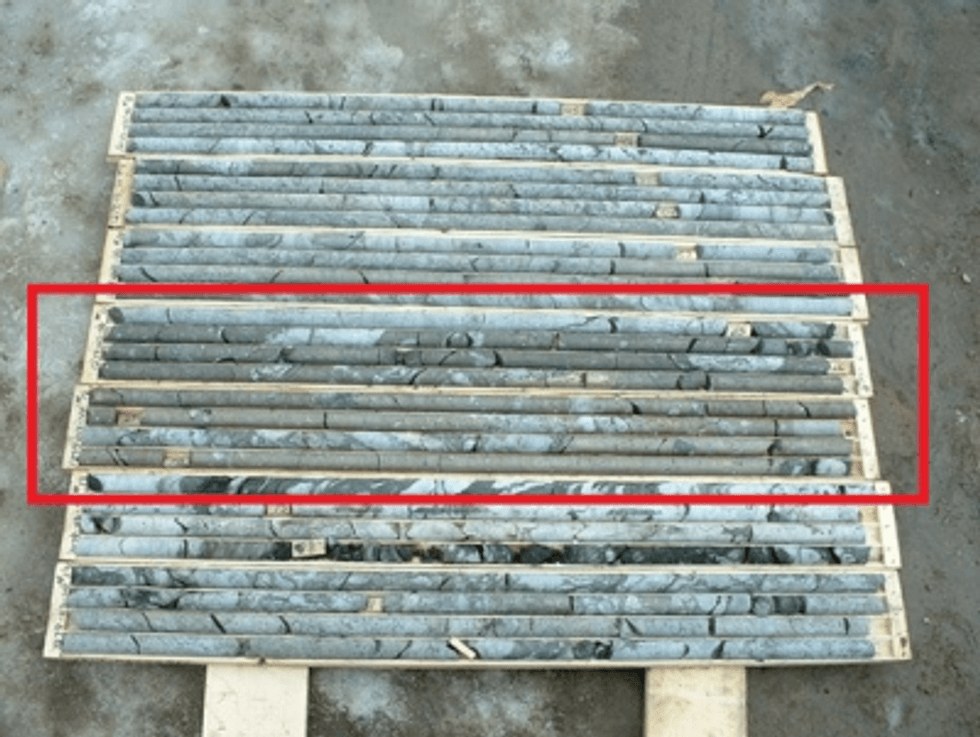

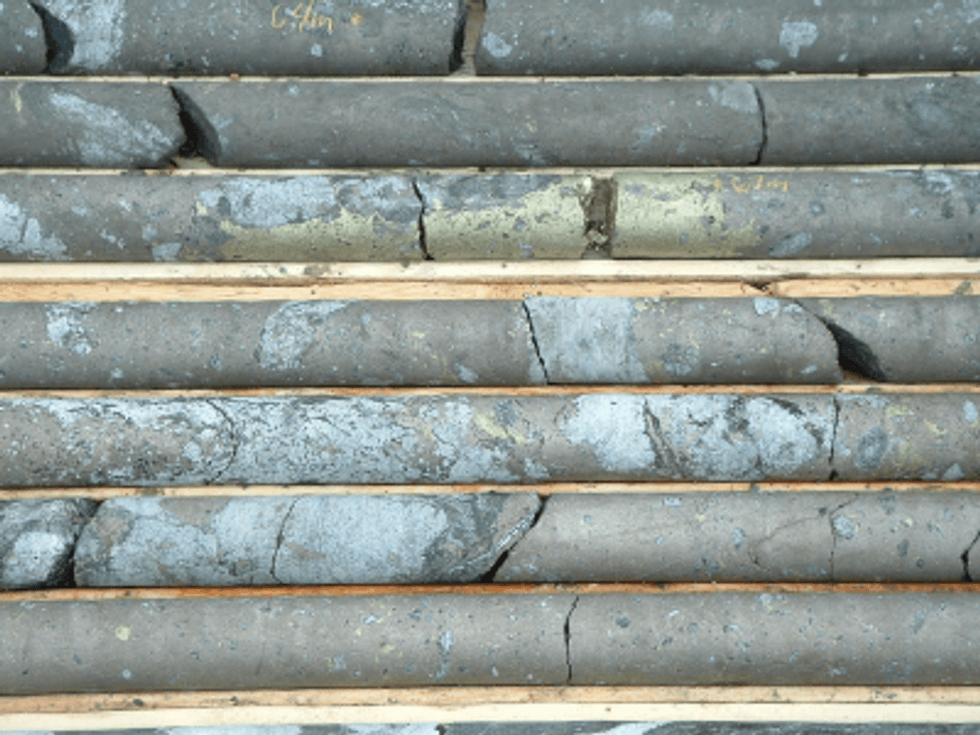

The company has started receiving technical information from SOQUEM. The following pictures focus on core from DDH # 1279-03-40 from 2003 where SOQUEM intersected 10.25 meters with 1.03% Nickel with 0.8% Copper (source SOQUEM & Virginia Inc. drill report of April 2003 – Project Chute des Passes (1279) By Isabelle Roy Geo. – ALS Chemex Chimitec including a QA/QC)) This information has been used to prepare the potential target values. Historical core pictures are shown in Figures 2 & 3. The company will soon have access to all historical data as well as any core preserved at SOQUEM storage facility in Chibougamau.

Matt Halliday, P.Geo., President, COO and VP Exploration commented: "We have accumulated a strategic land package across Ontario and Quebec. This is just the beginning. From what we see already at Graal we have put together the right pieces. It seems all the elements are there to develop a new world-class camp with a vision of EV & Critical metals development. The evidence points to a large deposit; and we are working to develop it and continue to be a leader in the critical metals space."

Click Image To View Full Size

Figure 1: Property boundary with intersections and the mineralized conductor extent

Click Image To View Full Size

Figure 2: Zoomed out core photo of historical drill hole DDH 1279-03-40 showing massive sulfide intersection in the MHY sector

Click Image To View Full Size

Figure 3: Zoomed in core photo of historical drill hole DDH 1279-03-40 showing the massive sulphides

Qualified person

The technical information in this news release has been reviewed by Claude Duplessis, P.Eng., GoldMinds Geoservices Inc., a member of the Québec Order of Engineers, and is a qualified person in accordance with the National Instrument 43- 101 standards.

About Canada Silver Cobalt Works Inc.

Canada Silver Cobalt Works Inc. recently discovered a major high-grade silver vein system at Castle East located 1.5 km from its 100%-owned, past-producing Castle Mine near Gowganda in the prolific and world-class silver-cobalt mining district of Northern Ontario. This discovery has the highest silver resource grade in the world, with recent drill intercepts of up to 89,853 grams/tonne silver (2,621 oz/ton Ag). A drill program is underway to expand the size of the deposit with an update to the resource estimate scheduled for Q1 2022.

In May 2020, based on a small initial drill program, the Company published the region's first 43-101 resource estimate that contained a total of 7.56 million ounces of silver in Inferred resources, comprising very high-grade silver (8,582 grams per tonne un-cut or 250.2 oz/ton) in 27,400 tonnes of material from two sections (1A and 1B) of the Castle East Robinson Zone, beginning at a vertical depth of approximately 400 meters. Note that mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to Canada Silver Cobalt Works Press Release May 28, 2020, for the resource estimate. Report reference: Rachidi, M. 2020, NI 43-101 Technical Report Mineral Resource Estimate for Castle East, Robinson Zone, Ontario, Canada, with an effective date of May 28, 2020, and a signature date of July 13, 2020.

Canada Silver Cobalt's flagship silver-cobalt Castle mine and 78 sq. km Castle Property feature strong exploration upside for silver, cobalt, nickel, gold, and copper. With underground access at the fully owned Castle Mine, an exceptional high-grade silver discovery at Castle East, a pilot plant to produce cobalt-rich gravity concentrates on site, a processing facility (TTL Laboratories) in the town of Cobalt, and a proprietary hydrometallurgical process known as Re-2Ox (for the creation of technical-grade cobalt sulphate as well as nickel-manganese-cobalt (NMC) formulations), Canada Silver Cobalt is strategically positioned to become a Canadian leader in the silver-cobalt space. More information at www.canadasilvercobaltworks.com.

"Frank J. Basa"

Frank J. Basa, P. Eng.

Chief Executive Officer

For further information, contact:

Frank J. Basa, P.Eng.

Chief Executive Officer

416-625-2342

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution Regarding Forward-Looking Statements

This news release may contain forward-looking statements which include, but are not limited to, comments regarding the Offering and comments that involve other future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address the Offering, resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, future financings, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. No assurance can be given that the Offering will close on the terms and conditions set out in this news release or at all. General business conditions are factors that could cause actual results to vary materially from forward-looking statements. A detailed discussion of the risk factors encountered by Canada Silver Cobalt is available in the Company's Annual Information Form dated July 19, 2021 for the fiscal year ended December 31, 2020 available under the Company's profile on SEDAR at www.sedar.com.

Copyright (c) 2021 TheNewswire - All rights reserved.