May 07, 2024

Honeymoon is exceeding key feasibility study estimates; First uranium sales set for July

Boss Energy Limited (ASX: BOE; OTCQX: BQSSF) is pleased to advise that the commissioning process at its Honeymoon uranium project is proceeding to plan, with key metrics exceeding feasibility study forecasts.

Highlights

- Commissioning process advancing well, with key metrics ahead of feasibility study (FS) estimates, including:

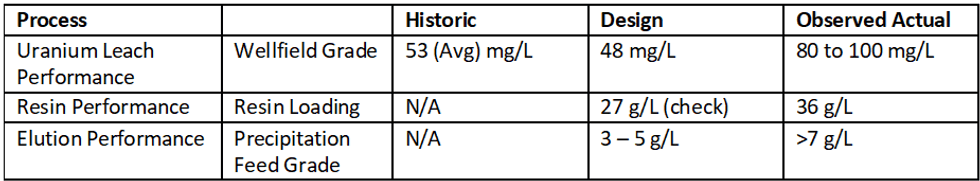

- Wellfields averaging 80 - 100mg/L vs FS estimate of 47mg/L (~100% uplift)

- Ion Exchange loaded resin recoverability is virtually 100%

- Resin loading averaging 36g/L vs FS estimate of 27 g/L (~33% uplift)

- Elution performance > 7g/L vs a targeted range of 3 – 5 g/L

- First uranium sale is expected to occur in July with cash to be received in Q3 2024

- Boss remains highly leveraged to rising uranium price, with sales contracts covering just 1.8Mlbs over eight years

This outperformance is reflected in results of the uranium-rich Pregnant Leach Solution (PLS) from the wellfields, IX column resin loading and high grade IX column eluate.

The focus is now on optimisation of the ion exchange, elution and precipitation processes to achieve continuous operations.

Production update

Tenors from the individual wellfields into the PLS are averaging 80 - 100 mg/L. Honeymoon’s feasibility study assumed PLS grade of 47 mg/L based on results from the project’s previous operation.

The lixiviant chemistry, as proved during the field leach trial, is now demonstrating superior performance at commercial throughput rates. The increased leach efficiency leads to a more efficient loading on the ion exchange resin, effectively lowering operating costs as less reagents and power are required per drum of uranium.

A critical factor in resin performance is the actual loading of uranium from the PLS onto the ion exchange resin. Demonstrated loading rates of up to 36g/L are 33% higher than feasibility estimates. This means Honeymoon’s ion exchange circuit is currently making more uranium per cycle than designed. The cost of processing a cycle of ion exchange resin is fixed, which means that higher resin loading will drive a more efficient use of reagents.

Stripping of uranium from the loaded resin is virtually 100%, also demonstrating that the ion exchange process is working as designed, resulting in a high grade concentrated eluate greater than 7g/L.

First Sale of Product

Boss has sought from the outset to align its production strategy and timetable with the global uranium market, maximising its ability to capitalise on favourable supply and demand fundamentals.

As at 31 March 2024, Boss had ~$300m in liquid assets, no debt and diversity of supply with no jurisdictional risk. This strong balance sheet has provided Boss with flexibility to choose when it enters into contracts and to select pricing mechanisms which maximise our exposure to market upside while limiting risk in softer market conditions.

To date, Boss has entered into two binding sales agreement to sell 1.8Mlbs U308 to major European / US power utilities over eight years from 2024 to 2032. The Company intends to enter into further as the uranium price rises.

Boss’s contracting strategy is to monitor the markets and layer in contracts, predominantly market related, to optimise future pricing and, in the near term, to ensure profitability and cash flow as production ramps up. First delivery into these contracts is planned to occur in July 2024 with payment expected in that quarter.

Boss Managing Director Duncan Craib said: “We are very pleased with the commissioning progress to date. We are meeting or exceeding key feasibility study forecasts and the processing technology is performing as our extensive testwork showed it would.

“These early production results provide confidence that we are on-track to meet our ramp up targets. Ramp-up timing has been designed to align with a rising uranium market. We believe we will be hitting our straps as the uranium price rises in the near term”.

Click here for the full ASX Release

This article includes content from Boss Energy Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BOE:AU

The Conversation (0)

27 June 2024

Boss Energy Limited

Multi-mine uranium producer in Australia and the US

Multi-mine uranium producer in Australia and the US Keep Reading...

28 January 2025

December 2024 Quarterly Results Presentation

Boss Energy Limited (BOE:AU) has announced December 2024 Quarterly Results PresentationDownload the PDF here. Keep Reading...

28 January 2025

Quarterly Cashflow Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Cashflow Report - December 2024Download the PDF here. Keep Reading...

28 January 2025

Quarterly Activities Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Activities Report - December 2024Download the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

27 January

Standard Uranium CEO Outlines Athabasca Exploration Plans and Uranium Market Outlook

Standard Uranium (TSXV:STND,OTCQB:STTDF) is advancing an ambitious exploration strategy in Saskatchewan’s Athabasca Basin, according to CEO and Chairman John Bey, who spoke with the Investing News Network at the 2026 Vancouver Resource Investment Conference.The company is preparing for a... Keep Reading...

23 January

Investment establishes valuation of C$50M for the polymetallic Häggån project

Aura Energy Limited (ASX: AEE, AIM: AURA) (“Aura” or “the Company”) is pleased to announce that MMCAP International Inc. SPC (‘MMCAP’) and certain other strategic investors (together the ‘Strategic Investors’) will provide funding of C$10 million for a 19.7% interest in the Company’s... Keep Reading...

21 January

Laramide Exits Kazakhstan Uranium Project After Government Policy Shifts

Laramide Resources (TSX:LAM,OTCQX:LMRXF) has pulled out of a greenfield uranium exploration venture in Kazakhstan, citing policy changes that it says have effectively shut the door on economically viable foreign investment in the country’s uranium sector.The Toronto-based company announced on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00