April 27, 2022

Corazon takes full control of the Miriam Nickel Sulphide Project

Corazon Mining Limited (ASX: CZN) (Corazon or Company) is pleased to announce it has further progressed its rights to acquire 100% of the Miriam Nickel Sulphide Project (Miriam or Project) near Coolgardie in Western Australia’s Goldfields minerals district.

Previously, the Company announced it had entered into an agreement with Limelight Industries Pty Ltd (Vendor) to acquire 100% of the Miriam Project (ASX announcements 26 July and 15 October 2021); the Company is now pleased to advise it has successfully completed Stage 2 of the acquisition. Corazon will acquire a 100% interest in the Project (and take control and management of the Project) in consideration of the payment to the Vendors of $400,000 and a 2% net smelter return royalty, pursuant to the Option Agreement, details of which are included in this ASX announcement.

The completion of Stage 2 sees Corazon being entitled to 100% of the Project and taking sole control and management of the Project, on behalf of all parties, with the Vendor retaining the right to mine mullock dumps (for gold mineralisation) and to metal detect on the area for the first three (3) years post grant of the relevant tenure.

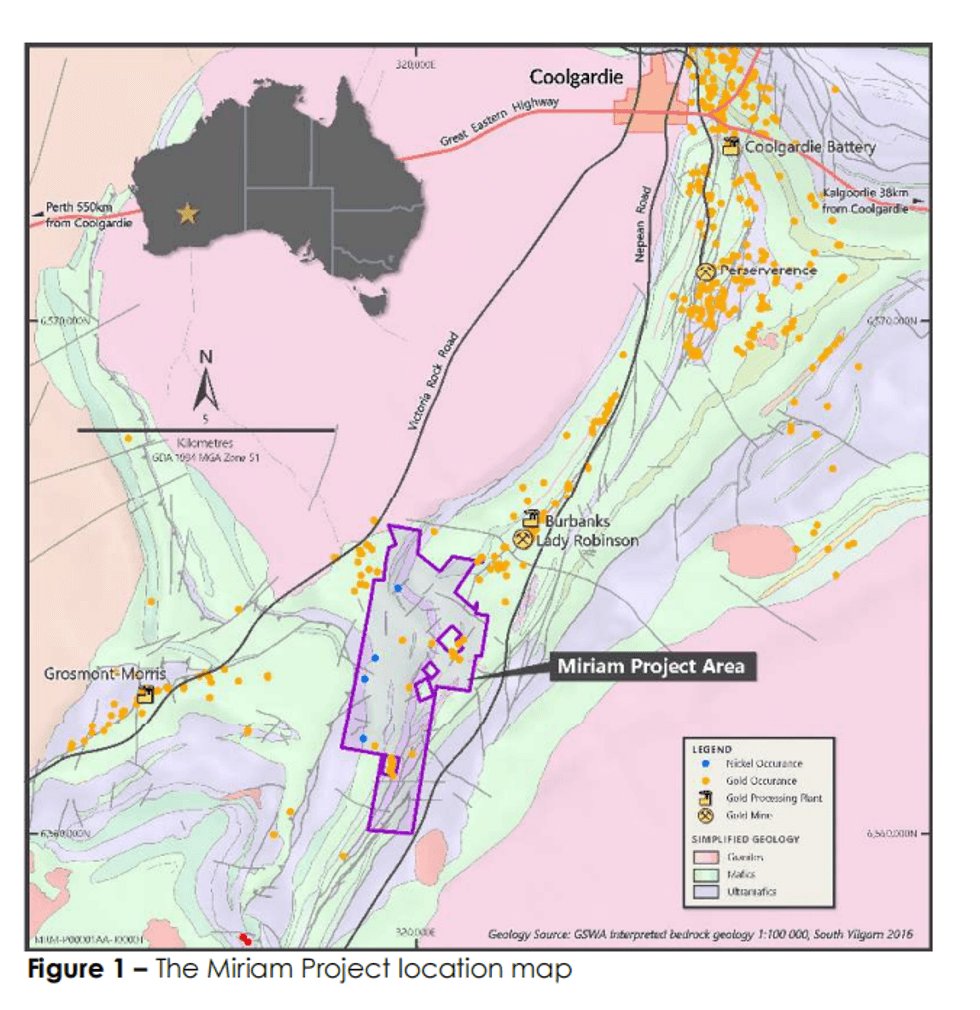

Miriam is a highly prospective nickel exploration project that represents a strategic addition to Corazon’s portfolio of nickel sulphide assets. The Project is located approximately 10 kilometres south-southwest of Coolgardie on an ultramafic trend, which also hosts Auroch Minerals’ (ASX: AOU) Nepean Nickel Deposit.

Corazon is enthusiastic about the Project’s exploration potential. Drilling undertaken predominantly in the 1960s and 1970s at the Miriam Nickel Deposit intersected ‘high nickel tenor’ massive and disseminated sulphides. Corazon has highlighted extensions to areas of known mineralisation as the initial priority exploration focus.

Highlights

- Stage 2 in the acquisiton process for the Miriam Nickel Sulphide Project has been completed

- Corazon has assumed sole management of the Project and is progressing the grant of tenure as a priority

- Work programs under development will focus on modern, high-powered geophysics to test areas of known mineralisation for follow-up drilling

About the Miriam Project

The Miriam Project is located approximately 10 kilometres south-southwest of Coolgardie on a trend of ultramafics best identified by the Miriam and Nepean nickel deposits (Auroch Minerals, ASX: AOU).

The Miriam Project covers an area of about 6 kilometres by 1.5 kilometers and comprises five Prospecting Licence applications (P15/6135 to P15/6139 inclusive).

In 1969, Anaconda Australia Limited discovered the Miriam Deposit, located within the Project, and conducted most of the known nickel exploration during the late 1960s and early 1970s. This work defined the core of the Miriam Deposit over a strike of about 150 meters and to a depth of at least 150 metres below surface. In places, subsequent drilling extended the drilled depth to about 300 metres below surface.

Referenced open-file documents (ASX announcement, 26 July 2021) detailing historical work defines a nickel-copper endowment for the Miriam Deposit. This work is not compliant with current JORC standards, and further drilling is required for the definition of a JORC resource estimate at Miriam.

Much of the historical drilling, which tested the ultramafic sequence north and south of the Miriam Deposit, was shallow percussion drilling that did not penetrate the overlying oxidised zone, and many of the holes did not reached the ultramafic footwall target. There is extensive untested opportunity to target nickel sulphide mineralisation at depth and along strike from previous drilling.

Click here for the full ASX Release

This article includes content from OCorazon Mining Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CZN

Sign up to get your FREE

Corazon Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

26 August 2025

Corazon Mining

A high-grade gold explorer in a proven Australian gold province, with a strategic portfolio of battery and base metal assets.

A high-grade gold explorer in a proven Australian gold province, with a strategic portfolio of battery and base metal assets. Keep Reading...

05 February

Acquisition of “Thompson Falls” High-Grade Antimony Project Adjacent to America’s only Antimony Smelter

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”), a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce the Company’s newly-acquired Thompson Falls Antimony... Keep Reading...

04 February

4km Gold Anomaly Defined at Two Pools

Corazon Mining (CZN:AU) has announced 4km Gold Anomaly Defined at Two PoolsDownload the PDF here. Keep Reading...

28 January

Quarterly Appendix 5B Cash Flow Report

Corazon Mining (CZN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

Quarterly Activities Report

Corazon Mining (CZN:AU) has announced Quarterly Activities ReportDownload the PDF here. Keep Reading...

13 January

Eastern Metals Recommences ASX Trading – Aiming to Unlock High-Potential Copper Discoveries in New Brunswick, Canada

Eastern Metals Ltd (ASX: EMS) (Eastern Metals or the Company) (to be renamed Raptor Metals Ltd (ASX: RAP)) is pleased to advise it has recommenced trading on the Australian Securities Exchange (ASX) today following its acquisition of Raptor Resources Limited (Raptor Resources). HIGHLIGHTS... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Sign up to get your FREE

Corazon Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00