Tech Weekly: Stocks Rally After SCOTUS Ruling on Trump's Tariffs

Explore this week’s top tech news and market movers, plus key catalysts to watch next week.

Welcome to the Investing News Network's weekly brief on tech news and tech stocks driving the market.

We also break down next week's catalysts to watch to help you prepare for the week ahead.

In this article:

This week's tech sector performance

The US market kicked off the holiday‑shortened week with many tech stocks opening lower after Alibaba (NYSE:BABA) unveiled its new AI model, Qwen 3.5, on Monday (February 16), amplifying concerns about risks from the Chinese market. Major indices closed little changed after a day of subdued trading.

In correspondence with INN, Eugenia Mykuliak of B2PRIME Group said she views the current pullback as an “adjustment” rather than “true fear,” as investors move past the 2025 AI euphoria and start asking practical questions about whether AI investments are generating returns.

This caution, she added, is compounded by uncertainty in the broader macro backdrop, driving down stocks in AI‑exposed sectors. She concluded that this process reflects a maturing market, predicting that in 2026, capital will concentrate around firms with clear, monetizable AI strategies.

Futures gained ground on Wednesday morning (February 17) ahead of the release of the FOMC minutes from its latest meeting, which highlighted a divide: some participants favored another rate hike if inflation remains above target, directly contradicting market expectations of additional cuts amid forecasts of economic weakness.

Also on Wednesday, Federal Reserve Governor Michael Barr outlined three potential scenarios for how AI could impact the labor market during a speech at the New York Association for Business Economics.

The first, and currently favored, scenario is gradual adoption, where slow AI integration minimizes job loss and any brief skill mismatch is addressed through training. The second scenario is rapid advancement, where AI outpaces the labor market, potentially rendering many people “unemployable.” In this case, fast‑moving AI startups could displace older firms, triggering mass unemployment and requiring a complete overhaul of the social safety net to share productivity gains.

The third possibility suggests that electricity or capital shortages will limit AI’s full potential, making it an indispensable tool but not a truly revolutionary force. Barr concluded that the degree of disruption will ultimately depend on societal investment in creating new jobs, training workers, and implementing mitigation strategies.

Stocks rallied midday but pulled back in a late‑session softening tied in part to the release of the FOMC minutes. A volatile session in tech saw the Nasdaq Composite (INDEXNASDAQ:.IXIC) pare earlier strength, finishing up 0.8 percent.

On Thursday (February 19), the market retraced the mid‑week bounce, with the Nasdaq closing down 0.3 percent.

Friday’s PCE report suggested inflation could be reigniting, keeping rate‑sensitive equities range‑bound in early trading, but the Supreme Court's decision to strike down US President Trump's global tariffs caused a rally in Wall Street's heavyweights in the afternoon.

3 tech stocks moving markets this week

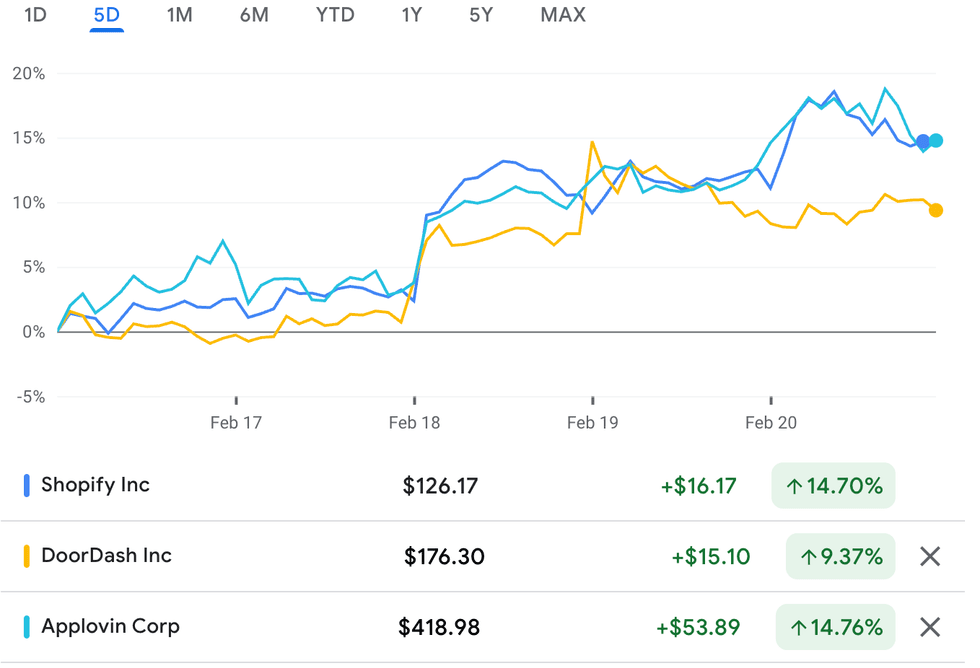

1. Shopify (NYSE:SHOP)

Shopify led NDXT gainers, advancing 14.73 percent. Phillip Securities upgraded the stock to “Strong‑Buy”.

2. AppLovin (NASDAQ:APP)

AppLovin saw a 14.68 percent gain, extending its post‑earnings rally.

2. DoorDash (NASDAQ:DASH)

DoorDash advanced by 9.36 percent after Bank of America (NYSE:BAC) raised its price target to U$272, citing AI and chatbot efficiencies as well as grocery expansion, while Citizens analyst Andrew Boone reiterated “market outperform” on strong order growth and unchanged 2026 EBITDA outlook.

Top tech news of the week

- AI toolmaker Legora, which provides products that automate rote legal tasks, is reportedly in talks to raise funds that would triple its valuation to US$6 billion. Legora was one of the companies highlighted in the AI‑fear selloff of legal‑software stocks.

- Apple (NASDAQ:AAPL) is reportedly planning a major product launch for March 4, with several new devices expected in the coming weeks. Sources for Bloomberg’s Mark Gurman said the company is working on new smart glasses, an AI pendant and AirPods featuring enhanced AI capabilities.

- Meta Platforms (NASDAQ:META) and NVIDIA (NASDAQ:NVDA) announced an expanded strategic partnership that would see Meta utilizing “millions” of NVIDIA's AI chips in its hyperscale data centers. This caused a rise in NVIDIA shares in after-hours trading on Tuesday, which extended into premarket on Wednesday.

- Palantir Technologies (NASDAQ:PLTR) was upgraded to “outperform” from “neutral” at Mizuho. This week, the software data company said it’s moving its headquarters from Denver to Miami’s South Beach.

- Shares of Palo Alto Networks (NASDAQ:PANW) tumbled after the company cut its full-year earnings guidance to US$3.65 to US$3.70 from US$3.80 to US$3.90.

- Shares of data storage solutions company Sandisk (NASDAQ:SNDK) lost ground after it announced that Western Digital (NASDAQ:WDC), its former parent that still owns a large stake, plans to sell a US$3.17 billion stake.

- According to a regulatory filing from Tuesday, Berkshire Hathaway (NYSE:BRK.A,NYSE:BRK.B) has reduced its stake in Amazon (NASDAQ:AMZN), cutting it by over 75 percent in the fourth quarter of 2025.

- A Bank of America (NYSE:BAC) global fund manager survey released this week indicates that 35 percent of investors believe companies are overspending on AI. 54 percent of Americans expressed a similar view in a YouGov/Economist poll, with most also reporting distrust in AI and fear of job displacement.

- The India AI Impact Summit began on Monday, drawing global AI and political figures. Blackstone (NYSE:BX) announced it is leading a $600 million equity investment in Indian AI cloud startup Neysa. Additionally, Advanced Micro Devices (NASDAQ:AMD) revealed an expanded partnership with Tata Consultancy Services to deploy up to 200 megawatts of AI infrastructure capacity in India.

- The summit also saw Reliance Industries (NSE:RELIANCE) and Jio pledge about US$110 billion for sovereign AI compute, the Adani Group commit US$100 billion to AI data centers, and Yotta Data Services unveil a more than US$2 billion AI‑computing hub, alongside a US$150 million AI‑venture fund from Qualcomm (NASDAQ:QCOM) and expanded OpenAI-Tata (NSE:TCS) and L&T-NVIDIA partnerships.

- Anthropic launched Claude Sonnet 4.6, described by the company as “a full upgrade of the model’s skills across coding, computer use, long-context reasoning, agent planning, knowledge work and design.”

- Canada unveiled its defense industrial strategy, which ties AI, robotics, cybersecurity and space tech directly into its plan. Prime Minister Mark Carney said the strategy aims to steer hundreds of billions of dollars of procurement and capital investment toward Canadian‑based technology and defense tech firms over the next decade.

- Figma (NYSE:FIG) shares jumped 16 percent following the release of its Q4 and FY 2025 earnings report, which showed accelerated revenue growth.

- Alphabet (NASDAQ:GOOGL) released Gemini 3.1 Pro, dubbed by the company as “a smarter model for your most complex tasks.”

- OpenAI is reportedly nearing the final stage of a new funding round that could exceed US$100 billion, a record-breaking deal that would provide more capital for its AI tools, per Bloomberg sources.

Tech ETF performance

Tech exchange-traded funds (ETFs) track baskets of major tech stocks, meaning their performance helps investors gauge the overall performance of the niches they cover.

This week, the iShares Semiconductor ETF (NASDAQ:SOXX) advanced by 1.83 percent, while the Invesco PHLX Semiconductor ETF (NASDAQ:SOXQ) advanced by 1.77 percent.

The VanEck Semiconductor ETF (NASDAQ:SMH) also increased by 1.76 percent.

Tech news to watch next week

Next week, tech‑focused investors will be watching NVIDIA's Q4 print on February 25 as the key driver of sentiment across semiconductor and other AI‑related names.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.