September 04, 2024

True North Copper Limited (ASX:TNC) (True North, TNC or the Company) is pleased to announce results from a systematic rock chip sampling campaign at the Aquila and Ivena North prospects, part of its 100% owned Mt Oxide Project, located 140km north of Mt Isa in Queensland.

HIGHLIGHTS

- Assay results received from a successful rock chip sampling program at the Aquila and Ivena North prospects, part of TNC’s 100% owned Mt Oxide Project in Queensland.

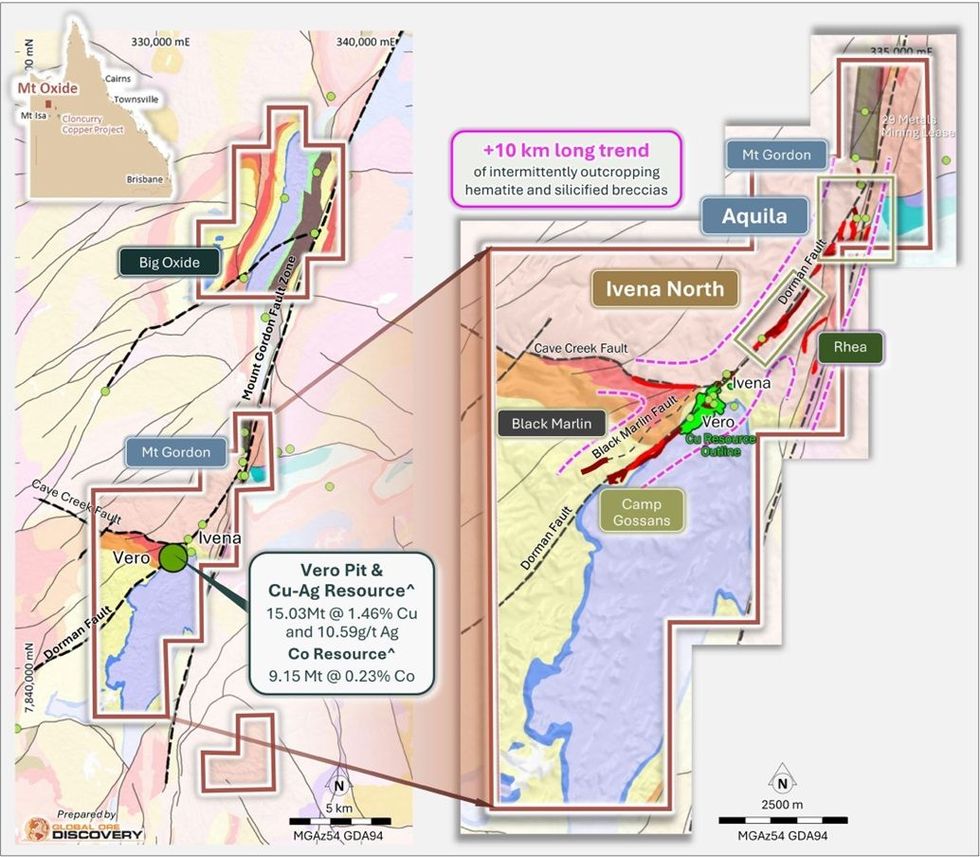

- Aquila and Ivena North are both part of the larger Dorman Fault Mineral System, a +10km long trend that hosts the Vero Cu-Ag-Co Resource and the Camp Gossans Prospect.

- At Aquila, sampling has highlighted six zones of anomalous Cu, Co & As associated with multiple gossanous breccia structures up to 30m wide.

- Aquila B Trend: +180m long and +30m wide Cu +/- Co-As-Ag within a 440m long fault breccia with visible copper oxide mineralisation. The trend includes rock chip channels returning 3.6m @ 0.49% Cu with a peak assay of 0.94% Cu.

- Aquila A Trend: +20m long and up to 12m wide Cu-As-Sb anomalous zone within +210m strike of hematite altered hydrothermal breccias, returning up to 0.05% Cu and 12.7g/t Ag and anomalous pathfinders.

- Aquila D Trend: +100m long and up to 4m wide Cu-Co trend associated with a historical prospecting pit with strong copper oxide mineralisation, and a peak assay of 0.87% Cu.

- At Ivena North, sampling has identified Cu, Co & As trends within two geochemically anomalous zones from multiple gossanous breccia structures that are up to 25m wide.

- Ivena North A Trend – +130m long and up to 15m wide Cu-Co-As trend within a +580m strike of hydrothermal breccia and gossans that returned assays up to 1.38% Cu and anomalous As +/- Ag-Sb-Bi-Mo.

- A combined 680m strike length of mapped hematite silica gossans remains under-sampled between the Aquila and Mt Gordon Prospects.

- Rock chip results will be integrated with ongoing mapping and results from the Queensland Government-funded MIMDAS IP and MT survey, which is currently underway along the Dorman Fault Mineral System.

The rock chip sampling program has successfully identified new broad zones of strongly anomalous copper and pathfinder elements. The copper grades and pathfinder anomalism returned in the samples are at levels consistent with other outcropping leached gossans associated with historic drill discoveries in the region.

The Ivena North and Aquila prospects are located along strike northwest of the high-grade Vero Cu-Ag-Co resource (Vero). Both prospects are high priority exploration targets for TNC, with a MIMDAS Induced Polarisation (IP) and Magnetotellurics (MT) geophysical survey continuing at Mt Oxide to test for geophysical anomalies coincident with outcropping geochemically anomalous gossans1, 3.

COMMENT

True North Copper’s Managing Director, Bevan Jones said:

“Our exploration team has been working hard to systematically map and sample the +10km Dorman fault trend at Mt Oxide. Multiple gossans have been identified, and rock chip results from the gossans are revealing large areas of wider and stronger mineralisation on which to focus our future exploration work, including the ongoing MIMDAS geophysical survey.

We are also remobilising the on-ground team to systematically collect additional rock chip samples over the newly discovered Black Marlin and Rhea structures. Further geophysical results are filtering through, and updates will be released soon. We are potentially building a significant district at Mt Oxide with multiple high priority targets which have never been drilled. Our next steps include prioritisation of these targets, designing and planning upcoming drill programs, and securing the necessary permits for on-ground access.”

Summary of Results

During Q4 CY23, TNC’s Discovery Team initiated a prospectivity analysis of the Dorman Fault Mineral System, host to the Vero Cu-Ag-Co Resource (Vero) (15.03Mt @ 1.46% Cu and 10.59g/t Ag M, I & I, refer Table 1)4. Geological and structural mapping delineated a +10km highly prospective corridor of intermittently outcropping gossanous and silica breccias with no drilling, surface sampling or effective geophysics. Since completion of this work, TNC has collected 388 rock chip samples, including 243.5m of rock chip channel samples at the Ivena North and Aquila Prospects where TNC is currently acquiring MIMDAS IP and MT as part of its Queensland Government Collaborative Exploration Initiative (CEI) grant3.

Analysis of the assay results has highlighted eight high priority geochemically anomalous zones within the larger, structurally complex footprint at both prospects with two of these zones remaining open to the north. These anomalies have similar pathfinder geochemical signatures and are within the order of magnitude of the results from Camp Gossans4 south of Vero, which are considered analogous to the leached gossan outcrops at the Esperanza South deposit4.

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

16h

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

23h

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00