Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) ("Getchell" or the "Company") a leading Nevada focused Gold and Copper exploration company is pleased to present the results from the geological modeling of the highly successful 2020 drill program at the Company's flagship Fondaway Canyon Gold Project in Nevada ("Fondaway" or "Project").

Key Highlights

- The new geological model has significantly expanded the previously modelled extents of the gold mineralization;

- Thick zones of gold mineralization are projected 800m down dip from surface;

- The gold zones remain open laterally and down-dip;

- The Phase One 2021 drill program, commencing in May, will be designed to further delineate and quantify the near surface gold inventory; and,

- New video showing the 3D mineralization model is available for viewing on the Company's website.

"Not only has the 2020 drill program provided a dramatic expansion to the known gold zones at Fondaway Canyon, but the close fit of the results to our geological model greatly adds to the confidence and potential of the gold mineralizing system at Fondaway Canyon," stated Mike Sieb, President, Getchell Gold Corp.

Fondaway Canyon Gold Project

Fondaway is an advanced stage gold property with a large historic resource located in Churchill County, Nevada comprising 171 unpatented lode claims totaling 1,186 hectares (2,932 acres). Gold was first discovered in Fondaway Canyon in 1977 and over the intervening 40+ years has been the subject of multiple exploration campaigns along a 3.5km E-W gold mineralized corridor (Figure 1) totaling 735 reverse circulation and core drill holes, small-scale open pit mining of the oxidized zone at surface, and underground development limited to exploration and bulk sampling.

The historic resource estimate*, comprised of Indicated resources of 409,000 oz. Au contained in 2,050,000 tonnes grading 6.18 g/t and Inferred resources of 660,000 oz. Au contained in 3,200,000 tonnes grading 6.4 g/t, is predominately localized on the Paperweight, Half Moon, and Colorado gold zones within the Central Area of the Project.

Figure 2 shows a 3D model of the historic drilling by past operators, the individual gold intercepts on the drill traces and the modelled gold domain based on drill intervals grading >1g/t Au**. The 2016 gold mineralization model shows:

- Gold mineralization is evident at surface on the Paperweight and Half Moon shear veins, and at the historic Colorado Pit; and,

- The vertical projection of the mineralization below surface is limited to the areas of denser drilling.

** The modelled gold domain highlights areas where gold intervals have been geologically linked and projected. The modelled gold domain is solely for exploration planning purposes and does not indicate a mineral resource. A qualified person has not done sufficient work to classify a current mineral resource estimate at Fondaway Canyon.

Figure 1: Fondaway Canyon Plan Map showing gold mineralized corridor.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/3941/79645_7694082df45cf8d3_001full.jpg

Figure 2: Fondaway Canyon 3D Drill Model Showing 2016 Gold Domain.**

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/3941/79645_7694082df45cf8d3_002full.jpg

2020 Drill Results - Central Area

The 2020 drill program at Fondaway Canyon consisted of 6 holes drilled for a total 1,996 metres (6,550 feet) and was completed in November. Five of the six drill holes were collared within the Central Target Area, a 1,000 x 700 metre highly mineralized NE-SW extensional zone within the central portion of the 3.5 km long E-W trending Fondaway Canyon gold mineralized corridor. The Central Target Area is a nexus for the gold mineralizing system observed at the Project with five drill holes focusing on two NE-SW oriented sections (the Colorado - Pack Rat and the Half Moon - South Pit sections) (Figure 3).

The drill program in the Central Target Area was designed to address two primary objectives:

- Extend the known mineralization; and,

- Characterize the known mineralization to assist with geological and resource modelling.

Figure 3: Fondaway Canyon Central Area Plan Map showing 2020 drill hole locations and gold intercepts.

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/3941/79645_7694082df45cf8d3_003full.jpg

The 2020 drill program was highly successful revealing the presence of a thick zone of mineralization and continuity projected down-dip from surface on both sections drilled (for further details refer to Company news releases dated January 27 and February 10, 2021). Table 1 and 2 presents a summary of the notable gold intervals from holes FCG20-02 to FCG20-06 and Figure 4 displays the drill results as a 3D model.

Highly noteworthy in Figure 4 is the dramatic increase in the projection of the gold mineralized zones, compared to the 2016 model, supported by the geological interpretation of the 2020 drill results. The thick zones of gold mineralization are shown to extend down from surface and then dip shallowly to the southwest. The down dip trace of the mineralization, on both sections drilled, is a considerable 800 metres in length. The Colorado SW Extension Zone and the North Fork Gold Zone are on the same stratigraphic plane and remain open laterally and at depth.

The Central Area exhibits significant potential to continue delineating and expanding the sizable body of mineralization demonstrated by the 2020 drill program. This will be a primary objective for the forthcoming Phase One drill program commencing in May.

Figure 4: Fondaway Canyon 3D Model Showing 2020 Drill Results and 2021 Gold Domain.**

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/3941/79645_7694082df45cf8d3_004full.jpg

The Company has produced a new video showing the historic 3D mineralization model in comparison to the current significantly expanded geological-mineralization model. The video is now available for viewing on the Company's website: https://getchellgold.com/investors/videos/.

Colorado - Pack Rat Section Results

Drill holes FCG20-02 and 03 were both collared from the historic Colorado Pit and successfully extended the known gold mineralization towards the southwest (Figure 5).

Hole FCG20-02, drilled to the southwest along a plane connecting the Colorado Pit to Pack Rat zone, encountered a wide mineralized structural zone between a drill depth of 150 and 300 metres. The mineralization was encountered where predicted by the geological model and down-dip from the Colorado Zone. Within the breadth of the mineralization encountered, two gold zones are highlighted.

- 1.9 g/t Au over 43.5 metres including 4.2 g/t Au over 14.9 metres; and,

- 1.1 g/t Au over 12.3 metres.

Hole FCG20-03, drilled to the south as a step out from FCG20-02, encountered the mineralized structural zone between 150 and 290 metres downhole, approximately 120 metres ESE of the FCG20-02 main structural zone intercepts. The primary gold intercepts are highlighted:

- 4.3 g/t Au over 21.1 metres including 8.7 g/t Au over 9.4m and including 14.6 g/t Au over 3.4m; and,

- 2.0 g/t Au over 49.0m (188.3 to 237.3m).

Figure 5: Fondaway Canyon 3D Gold Domain Model - Colorado to Pack Rat (NE-SW) Section, 150m wide slice.

To view an enhanced version of Figure 5, please visit:

https://orders.newsfilecorp.com/files/3941/79645_7694082df45cf8d3_005full.jpg

The broad Colorado structural zone that hosts the gold mineralization encountered in FCG20-02 and FCG20-03 has a true thickness of approximately 100 metres, dips shallowly to the SW and is comprised of strongly sheared, brecciated and bleached sedimentary rocks.

Hole FCG20-02 intersected a significant new structural zone of high-grade gold mineralization higher up in the hole than expected. Of 17 consecutive samples extending 21.9 metres down hole, only one sample assayed less than 1 g/t Au with the highest sample grading 25.5 g/t Au (1.7m sample). The mineralized interval graded 6.2 g/t Au over 21.9 metres including 9.6 g/t Au over 12.0 metres and including 20.4 g/t Au over 3.2 metres.

Drill holes FCG20-05 and 06, were collared on the same pad near the canyon floor and drilled to the northeast along a plane connecting the Colorado Pit to Pack Rat zone and on plane with hole FCG20-02. Holes FCG20-05 and 06 were designed to test the down-dip extension of the mineralization observed at surface at the historic Colorado Pit and the mineralization encountered in holes FGC20-02 and 03.

Both holes, FCG20-05 and 06, encountered broad 100-metre-thick zones of gold mineralization within the Colorado SW Extension Gold Target Zone. FCG20-05 encountered the Colorado SW Extension Gold Zone between 175 and 270 metres down hole while FCG20-06 encountered the zone between 165 and 285 metres downhole. The following notable gold intercepts are highlighted:

FGC20-05

- 1.8 g/t Au over 90.0 m including 3.0 g/t Au over 45.3 m and including 4.4 g/t Au over 11.1m;

- 6.3 g/t Au over 3.3 m; and,

- 0.6 g/t Au over 28.0 m.

FGC20-06

- 1.5 g/t Au over 37.7 m including 2.1 g/t Au over 19.2 m; and,

- 1.1 g/t Au over 38.3 m including 2.5 g/t Au over 10.6 m.

The strongly mineralized interval encountered in FCG20-05 represents a 150-200m step out to the southwest from the mineralization intersected in hole FC20-02 and is open laterally and down-dip.

Of note is hole FC17-01, a hole drilled in 2017 by a previous operator and shown in Figure 4 and Figure 5. Hole FC17-01 encountered a significant intercept of gold mineralization at the bottom of the hole, is 250 metres distant from hole FCG20-05, and is within and on plunge with the projection of the down-dip extension of the Colorado SW Extension Gold Zone indicating a significant potential further extension to the Colorado SW Extension Gold Zone.

New North Fork Zone and Half Moon Shear Vein Drill Results

Drill hole FCG20-04 was collared north of where the Half Moon Vein is exposed on surface and drilled to the southwest. FCG20-04 was designed to (i) pierce the Half Moon vein to characterize the mineralization; and (ii) extend the gold mineralization intersected in hole FC17-04, drilled in 2017 by a previous operator, down-dip to the southwest (Figure 6).

Figure 6: Fondaway Canyon 3D Gold Domain Model - Half Moon to North Fork Gold Zone (NE-SW) Section, 150m slice.

To view an enhanced version of Figure 6, please visit:

https://orders.newsfilecorp.com/files/3941/79645_7694082df45cf8d3_006full.jpg

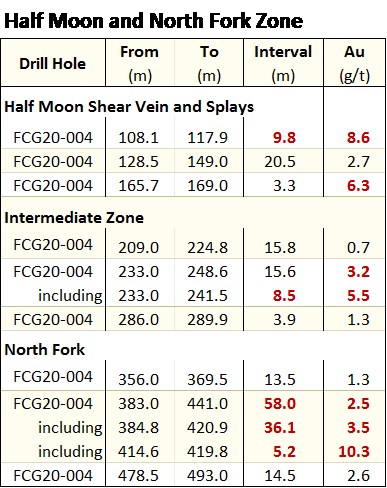

Hole FCG20-04 encountered the high-grade Half Moon Shear Vein 108.1m down hole and 54m vertically below surface. In addition, two notable gold intercepts were encountered further down the hole that are interpreted to be splays of the main Half Moon Gold Shear Vein. The three Half Moon Shear Vein related gold intercepts are highlighted below.

- 8.6 g/t Au over 9.8 metres (main Half Moon Shear Vein);

- 2.7 g/t Au over 20.5 metres; and,

- 6.3 g/t Au over 3.3 metres.

In addition, hole FCG20-04 encountered a broad 144 metre intercept of gold mineralization, newly identified as the North Fork Gold Zone, extending to the bottom of the hole with the final sample of hole FCG20-04 returning 7.9 g/t Au over 1.0 m indicating the lower extent of the North Fork Gold Zone was not reached. Within the North Fork broad zone of mineralization, the following notable gold intercepts are highlighted:

- 2.5 g/t Au over 58.0 m including 3.5 g/t Au over 36.1 m;

- 2.8 g/t Au over 13.4 m; and,

- the last sample grades 7.9 g/t Au over 1.0 m.

The newly identified North Fork Gold Zone is geologically modelled as a 100m thick shallowly dipping to the southwest zone of gold mineralization and the results observed in FCG20-04 support this model. In addition, the North Fork Gold Zone represents a 200m step out to the southwest from hole FC17-04 and is open laterally and down-dip. As can be observed in the plan map of the area (Figure 3), there are no adjacent holes that have targeted the North Fork Gold Zone's depth horizon.

Of note is hole FC17-05, a hole drilled in 2017 by a previous operator and shown in Figure 4 and Figure 6. Hole FC17-05 encountered a significant intercept of gold mineralization at the bottom of the hole, is 300 metres distant from the end of hole FCG20-04, and is within and on plunge with the projected window of the down-dip extension of the North Fork gold zone indicating a significant further potential extension to the North Fork Gold Zone.

Table 1: Colorado SW Extension Zone - Gold Grade Interval Highlights

To view an enhanced version of Table 1, please visit:

https://orders.newsfilecorp.com/files/3941/79645_7694082df45cf8d3_007full.jpg

Table 2: Half Moon and North Fork Gold Zones - Gold Grade Interval Highlights

To view an enhanced version of Table 2, please visit:

https://orders.newsfilecorp.com/files/3941/79645_7694082df45cf8d3_008full.jpg

Table 3: Fondaway Canyon 2020 Drill Locations and Orientation (UTM metres - NAD83 Z11N)

To view an enhanced version of Table 3, please visit:

https://orders.newsfilecorp.com/files/3941/79645_getchelltable3.jpg

Scott Frostad, P.Geo., is the Qualified Person (as defined in NI 43-101) who reviewed and approved the content and scientific and technical information in the news release.

The 2020 drill core was cut at Bureau Veritas Laboratories' ("BVL") facilities in Sparks, Nevada, with the samples analyzed for gold and multi-element analysis in BVL's Sparks, Nevada and Vancouver, BC laboratories respectively. Gold values were produced by fire assay with an Atomic Absorption finish on a 30-gram sample (BV code FA430) with over limits re-analyzed using method FA530 (30g Fire Assay with gravimetric finish). The multi-element analysis was performed by ICP-MS following aqua regia digestion on a 30g sample (BV code AQ250). Quality control measures in the field included the systematic insertion of standards and blanks.

*Fondaway Canyon Historic Resource Estimate

The historic resource estimate was completed by Techbase International Ltd of Reno, Nevada, and it is contained within a NI 43-101 report dated April 3, 2017 that was commissioned by Canarc Resource Corp of Vancouver, B.C., Canada. The resource estimate was compiled only from drill holes that could be validated (591 holes @ 49,086 m), a sufficient amount to deem the historic resource as reliable. Using Techbase software, a method of polygons was used along each mineralized shear vein. With a minimum 0.10 opt (3.43 g/t) Au and 6 feet (1.8 m) horizontal vein width used as cut-off parameters, twelve mineralized shear veins had sufficient composited intercepts within the sulfide mineralization for the estimate. No capping or cutting of grades was applied. The historical resource estimate used classifications in accordance with NI 43-101 standards, namely, "indicated" and "inferred". A review and/or re-calculation of the historic resource is required by an independent Qualified Person to confirm these as current resources as defined by NI 43-101. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources; and the issuer is not treating the historical estimate as current mineral resources.

****The company reminds Shareholders that the Q2 2021 Getchell Gold Shareholder Update Meeting is April 21, 4pm EDT, 1 PM PDT. All interested Investors and Media are welcome to register: https://app.livestorm.co/getchell-gold/getchell-gold-april-2021-shareholder-update?type=detailed

About Getchell Gold Corp.

The Company is a Nevada focused gold and copper exploration company trading on the (CSE: GTCH) and (OTCQB: GGLDF). Getchell Gold is primarily directing its efforts on its most advanced stage asset, Fondaway Canyon, a past gold producer with a significant in-the-ground historic resource estimate. Complementing Getchell's asset portfolio is Dixie Comstock, a past gold producer with a historic resource and two earlier stage exploration projects, Star and Hot Springs Peak. Getchell has the option to acquire 100% of the Fondaway Canyon and Dixie Comstock properties, Churchill County, Nevada.

The Company reiterates that its near-term strategy to advance its assets is not impacted by the COVID-19 Corona virus. The Company continues to monitor the situation and is in compliance with all government guidelines.

For further information please visit the Company's website at www.getchellgold.com or contact the Company at info@getchellgold.com.

Mr. William Wagener, Chairman & CEO

Getchell Gold Corp.

+1 303 517 8764

info@getchellgold.com

The Canadian Securities Exchange has not reviewed this press release and does not accept responsibility for the adequacy or accuracy of this news release. Not for distribution to U.S. news wire services or dissemination in the United States.

Certain information contained herein constitutes "forward-looking information" under Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the private placement and the completion thereof and the use of proceeds. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "will" or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including: the receipt of all necessary regulatory approvals, use of proceeds from the financing, capital expenditures and other costs, and financing and additional capital requirements. Although management of Getchell have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/79645