May 26, 2024

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to announce strong copper assay results from its Vista Montana Prospect where sampling programs have confirmed the presence of a large, at surface, copper bearing system (Figure 1). The Vista Montana Prospect forms part of the Lana Corina Project1 in Chile.

HIGHLIGHTS

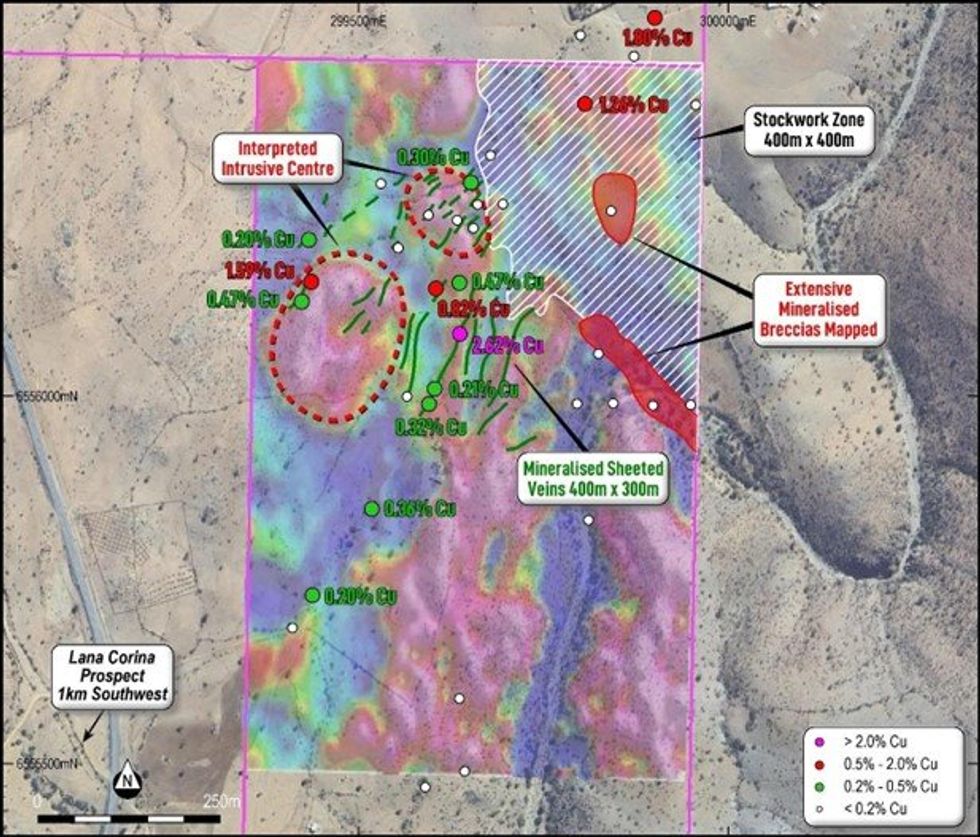

- Reconnaissance rock-chip samples collected at the Vista Montana Prospect return high-grade results, of up to 2.62% Cu (Figure 1).

- Sample results define an area of anomalous copper 1km-long by 400m wide.

- Results to be followed up with geological mapping and further systematic sampling.

- Drilling continues at Lana Corina within the >3km prospective corridor which hosts the Vista Montana and Lana Corina prospects (Figure 2).

Culpeo Minerals’ Managing Director, Max Tuesley, commented:

“Our exploration strategy at Vista Montana focuses on areas where major structures intersect the interpreted prospective intrusive centres and where outcropping copper mineralisation has been mapped.

Achieving such high-grade copper results from first-pass surface sampling over a 1km-long by 400m area is an extremely promising outcome. We will continue to refine our exploration model with the addition of further sampling and mapping to develop targets for the first phase of drilling at the Vista Montana Project.”

SAMPLING RESULTS

The Vista Montana surface sampling programme included 54 samples, which identified outcropping copper-mineralisation in close proximity to interpreted major geological structures, coinciding with the recognition of possible porphyry intrusive centres (Figure 1). Results confirm a 1km-long by 400m-wide, copper bearing sheeted vein swarm, with grades of up to 2.62% Cu returned from multiple copper-quartz veins.

The orientation of the sheeted veins is conformable to the overall northeast direction of the Lana Corina – Vista Montana mineralised corridor (>3km) and indicates a strong link between the two prospect areas. The mineralised host rocks consist of porphyry intrusives, similar to those observed at Lana Corina, within highly altered volcanic lithologies. A full table of results is attached in Appendix B.

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CPO:AU

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

3h

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00