November 07, 2023

GTI Energy Ltd (ASX: GTR) (GTI or Company) is pleased to advise that permitting is completed, and bonds are now in place to begin drilling at its 100% owned Lo Herma ISR Uranium Project (Lo Herma) located in Wyoming’s prolific Powder River Basin (Figures 1 & 2). This initial program of up to 26-holes (~15,000 ft or ~4,600 m), will utilise mud rotary drilling and down hole gamma logging.

- Permits and bonds in place for drilling to start mid-November at the Lo Herma ISR Uranium Project in Wyoming’s Powder River Basin.

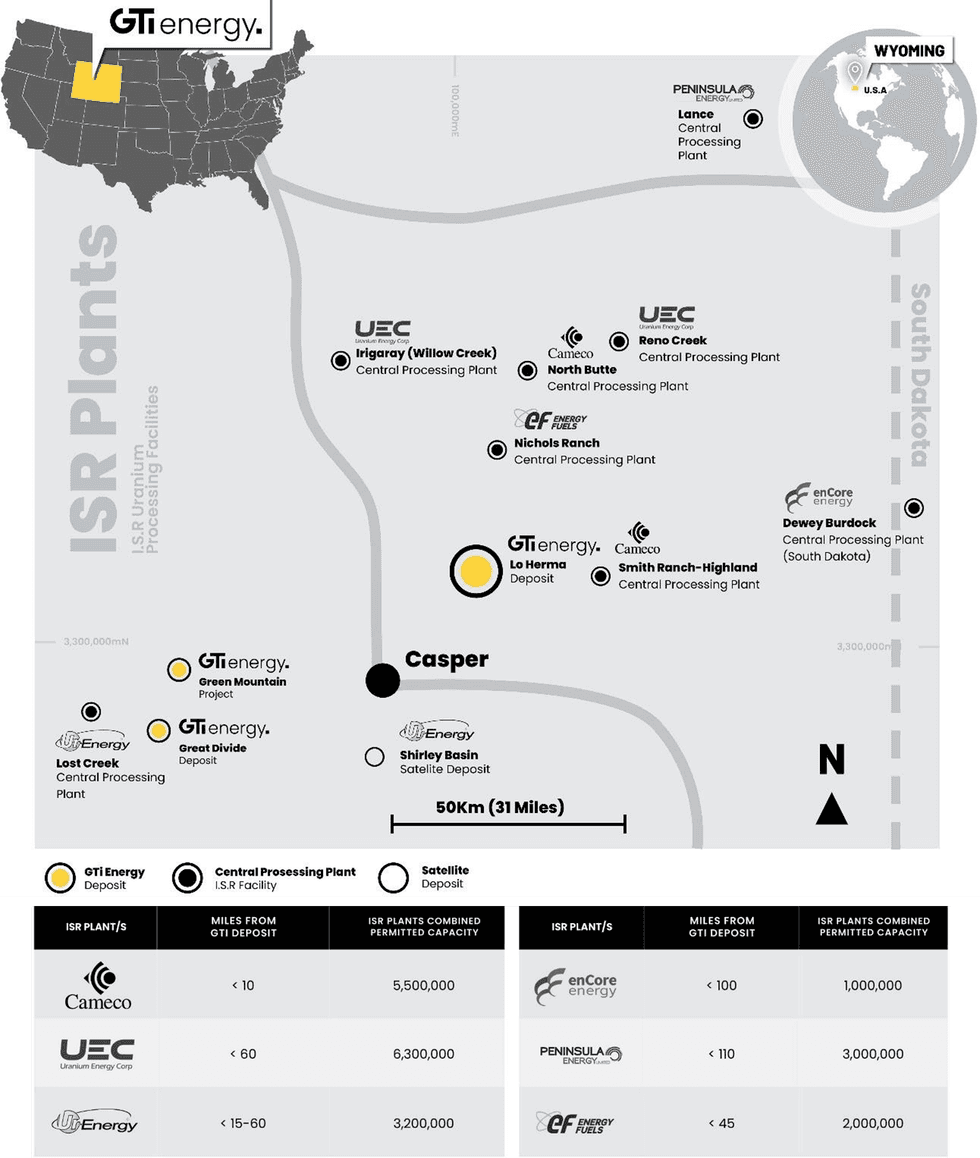

- Lo Herma is ~10miles from the US’s largest ISR U3O8 production plant at Cameco’s Smith Ranch-Hyland & ~60 miles from UEC’s Irigaray & Energy Fuels’ Nichols Ranch

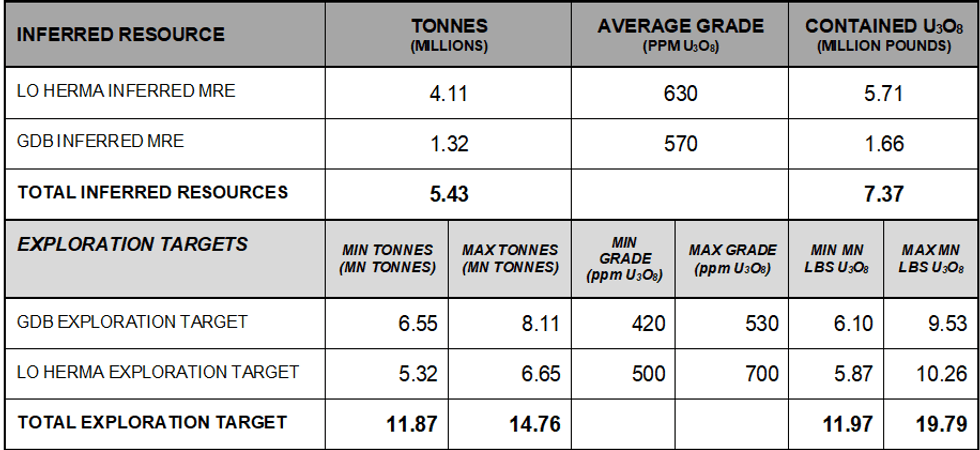

- Initial drilling of up to 26 holes (~15,000ft/~4,600m) to validate and upgrade the maiden JORC inferred resource of 5.7Mlbs U3O8 at average grade 630ppm

- Drilling to also target exploration potential along trend in the Wasatch Formation & in the deeper Fort Union Formation which Cameco produces from ~10 miles west.

- New strategic claim staking in progress to grow the Lo Herma project area

- Promising results received from recent aerial geophysical survey at Lo Herma

- Green Mountain aerial geophysics results to be delivered in the coming weeks

View a Web Broadcast supporting this announcement at weblink: www.gtienergy.au/web-broadcast/

GTI has also secured an additional strategic area of 28 lode claims, contiguous with the existing land position at Lo Herma (Figure 2). The new claims contain historical drill holes & hold excellent exploration potential particularly within the under-explored deeper Fort Union formation sands.

Final results from the recent aerial radiometric & magnetic surveys have been received, providing valuable geophysical data for Lo Herma, Green Mountain, & Loki West. At Lo Herma, the radiometric map (Figure 4) confirmed our exploration hypothesis & assists with the characterization of mineralized REDOX trends, previously projected across the property. The suite of aerial geophysical survey products will be invaluable in planning future exploration.

GTI Executive Director & CEO Bruce Lane commented “we are delighted to be heading back into the field for our maiden drill program at Lo Herma. This campaign is designed to verify the large body of historical data used to prepare the Lo Herma JORC inferred resource whilst upgrading & potentially extending that resource. Our near term objective is to build sufficient data from this drilling & a follow-up campaign in 2024, to support a preliminary economic assessment for the project."

LO HERMA URANIUM PROJECT – LOCATION & BACKGROUND

The Lo Herma ISR Uranium Project (Lo Herma) is located in Converse County, Powder River Basin (PRB), Wyoming (WY). The Project lies approximately 15 miles north of the town of Glenrock and close to seven (7) permitted ISR uranium production facilities. These facilities include UEC’s Willow Creek (Irigaray & Christensen Ranch) & Reno Creek ISR plants, Cameco’s Smith Ranch-Highland ISR facilities and Energy Fuels Nichols Ranch ISR plant (Figure 1). The Powder River Basin has extensive ISR uranium production history with numerous defined ISR uranium resources, central processing plants (CPP) & satellite deposits (Figure 1). The Powder River Basin has been the backbone of Wyoming U3O8 production since the 1970s.

As reported to ASX on 14 March 2023, a comprehensive historical data package, with an estimated replacement value of ~$15m, was purchased for the Lo Herma project in March of 2023. The data package includes original drill data for roughly 1,771 drill holes, from the 1970’s and 1980’s, pertaining to the Lo Herma region. 1,391 original drill hole logs were digitised for gamma count per second (CPS) data and converted to eU3O8% grades. 845 of the drill holes were located on GTI’s current land position & used to prepare the Mineral Resource Estimate.

An initial exploration target for the Lo Herma project was previously announced to the ASX on 4 April 2023. An additional data package containing previously unavailable drill maps with geologically interpreted redox trends was subsequently secured by GTI as announced to the ASX on 27 June 2023. The additional redox trend interpretations allowed for an update of the previously reported Lo Herma exploration target (Table 1).

The potential quantity and grade of the Exploration Targets is conceptual in nature and there has been insufficient exploration to estimate a JORC-compliant Mineral Resource Estimate. It is uncertain if further exploration will result in the estimation of a Mineral Resource in the defined exploration target areas.

DRILLING PERMITS APPROVED

Final regulatory approvals have been received to begin drilling at Lo Herma. The initial drilling program is a 26-hole (~15,000ft/~4,600m) campaign to both confirm a subset of historical drill holes as well as explore untested locations and depths. Drilling is expected to average 500 feet with a maximum potential depth of 1,500 feet. Commencement of drilling operations is anticipated to kick off mid-November pending contractor schedules and weather conditions.

Several of the drill holes are sited to target locations for confirmation of the historical drilling data. If conditions allow, the drillers will attempt to recover rock core samples of the mineralized zone for metallurgical testing. In addition to the confirmatory drilling, drill holes have been planned to test the alteration conditions of the host sand units across the property and geologic strata. This will help in further refining the locations of the projected REDOX trends and in improving targets for future exploration. These stratigraphic holes will also bring the benefit of testing the deeper sand units of the Fort Union formation which were historically underexplored.

This initial program is part of a larger permitted campaign totalling 68 holes with the balance of the campaign to be refined & assessed for execution during 2024 subject to results.

ADDITIONS TO LO HERMA LAND POSITION

GTI has secured an area of 28 additional Lode Claims (approximately 566 acres) at Lo Herma. The ground is contiguous with the main claim block at Lo Herma. The potential of this area came to GTI’s attention through further review of the historical drill data package, indicating that this ground is highly prospective for mineralization in deeper sands within the Fort Union formation.

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTR:AU

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 December 2025

American Uranium

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming Keep Reading...

11 August 2025

Snow Lake Completes Due Diligence and Confirms Placement

GTI Energy (GTR:AU) has announced Snow Lake Completes Due Diligence and Confirms PlacementDownload the PDF here. Keep Reading...

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

GTI Energy (GTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 July 2025

Lo Herma Drilling Permit & Contract Confirmed

GTI Energy (GTR:AU) has announced Lo Herma Drilling Permit & Contract ConfirmedDownload the PDF here. Keep Reading...

14 July 2025

Company Update - Name Change to 'American Uranium Limited'

GTI Energy (GTR:AU) has announced Company Update - Name Change to 'American Uranium Limited'Download the PDF here. Keep Reading...

10 July 2025

Placement Shares Issued & Drilling Approval Expected August

GTI Energy (GTR:AU) has announced Placement Shares Issued & Drilling Approval Expected AugustDownload the PDF here. Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Trading Halt

3h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00