- WORLD EDITIONAustraliaNorth AmericaWorld

December 19, 2023

GTI Energy Ltd (ASX: GTR) (GTI or Company) is pleased to advise that the initial drilling program has been completed at its 100% owned Lo Herma ISR Uranium Project (Lo Herma), located in Wyoming’s prolific Powder River Basin (Figures 1 & 2). Twenty-six (26) drillholes were advanced, totalling 4,250m (14,000 ft), with operations finalised on 11 December 2023.

- Initial 26-hole drilling program completed on time & on budget at Lo Herma

- Results have successfully verified the historical Lo Herma drill hole database

- Exploration potential confirmed along trend in the Wasatch Formation and at depth in the Fort Union Formation

- New claims staked at Lo Herma show promising exploration potential in the deeper Fort Union Formation which Cameco produces from ~10 miles east.

- Planning in progress for expanded 2024 drill program targeting resource expansion, upgrade of current resource classification & hydrogeologic data collection

This initial drill program successfully validated the historical data package, used in preparing the Mineral Resource Estimate (MRE) for Lo Herma, through comparative analysis of stratigraphy & mineralised intercepts from new drill holes collocated with historical drill holes. Additional drill hole locations tested extensions of known mineralised trends and informed on redox conditions across several host sands to help refine and develop an expanded drill program planned at Lo Herma for 2024. These exploration holes confirmed the previously interpreted exploration potential at Lo Herma.

In addition, the Lo Herma land package was expanded through staking of 28 additional claims in December to cover extensions of interpreted trends as defined by the acquired historical data package. The historical data package includes several drill holes within the 28 new claims which contain mineralisation in a deeper Fort Union formation host sand. GTI is currently evaluating how the new claims and data impact the exploration target for the property and 2024 drill plans.

GTI Executive Director & CEO Bruce Lane commented “We are very pleased that initial drilling has successfully verified the large body of historical data used to prepare the Lo Herma JORC inferred resource. In addition, the drilling confirmed exploration potential along trend in the Wasatch formation and at depth in the Fort Union formation. The program was completed on time & budget with the data generated to be used to refine follow-up drilling in 2024. The drilling in 2024 is expected to upgrade the category of portions of the mineral resource & ultimately support a preliminary economic assessment for the project.”

LO HERMA URANIUM PROJECT – LOCATION & BACKGROUND

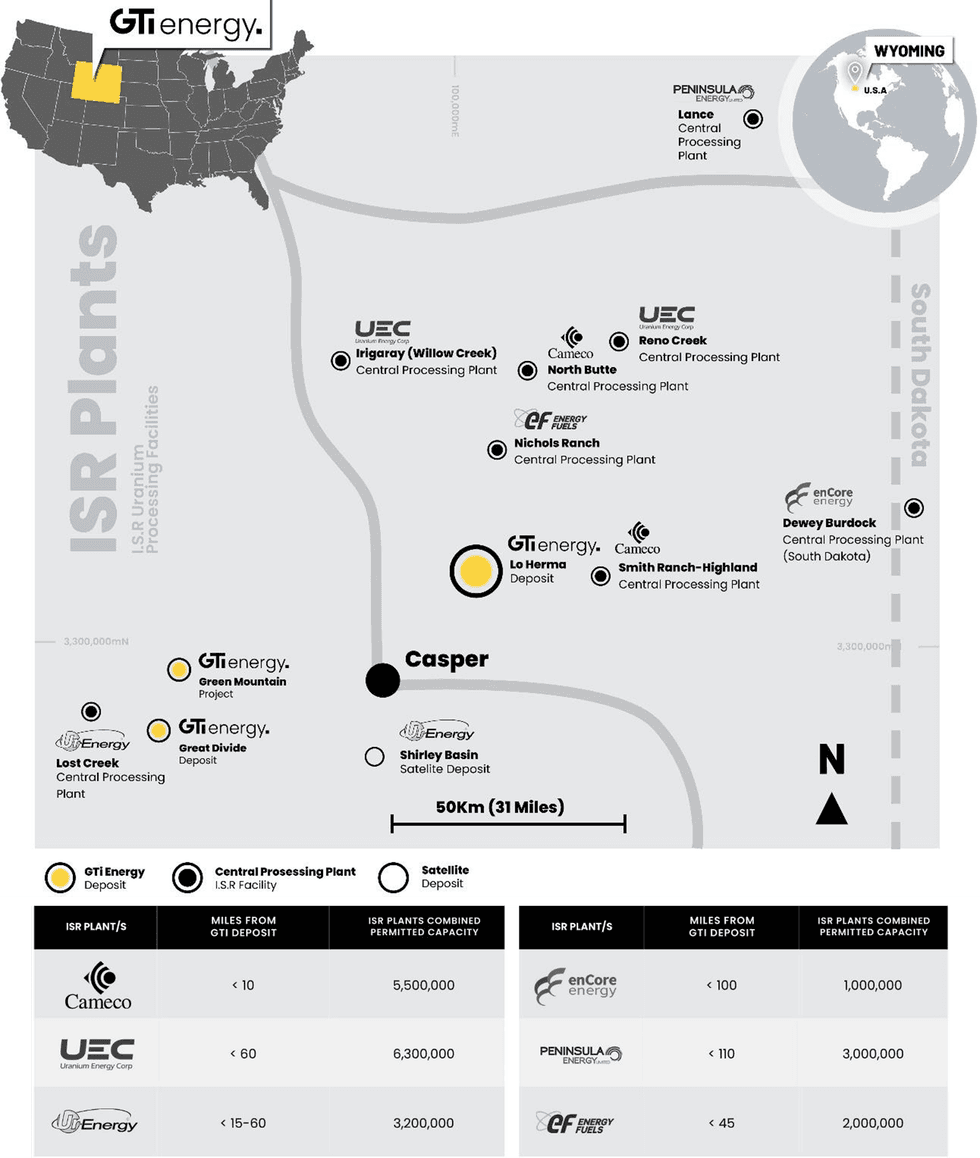

The Lo Herma ISR Uranium Project (Lo Herma) is located in Converse County, Powder River Basin (PRB), Wyoming (WY). The Project lies approximately 15 miles north of the town of Glenrock and close to seven (7) permitted ISR uranium production facilities. These facilities include UEC’s Willow Creek (Irigaray & Christensen Ranch) & Reno Creek ISR plants, Cameco’s Smith Ranch-Highland ISR facilities and Energy Fuels Nichols Ranch ISR plant (Figure 1). The Powder River Basin has extensive ISR uranium production history with numerous defined ISR uranium resources, central processing plants (CPP) & satellite deposits (Figure 1). The Powder River Basin has been the backbone of Wyoming U3O8 production since the 1970s.

As reported to ASX on 14 March 2023, a comprehensive historical data package, with an estimated replacement value of ~$15m, was purchased for the Lo Herma project in March of 2023. The data package includes original drill data for roughly 1,771 drill holes, from the 1970’s and 1980’s, pertaining to the Lo Herma region.

A total of 1,391 original drill hole logs were digitised for gamma count per second (CPS) data and converted to eU3O8% grades. 833 of these drill holes were located on GTI’s land position & used to prepare the MRE. 21 additional drill holes are located in the newly claimed area in Section 4 of Township 36N, Range 75W. Along with the 26 drill holes completed in this initial program, GTI now holds data from 880 drill holes within the current Lo Herma mineral holdings.

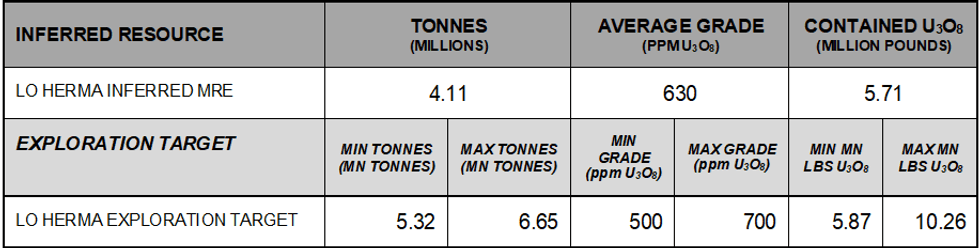

An initial Exploration Target for the Lo Herma project was previously announced to the ASX on 4 April 2023. An additional data package containing previously unavailable drill maps with geologically interpreted redox trends was subsequently secured by GTI as announced to the ASX on 27 June 2023 (refer to Table 1). Additional redox trends can now be interpolated based on the recent drilling and acquisition of the newly located mineral claims, however the Exploration Target has not been updated. GTI plans to update the mineral resource and exploration target estimates following execution of planned & permitted drilling during 2024.

DRILLING RESULTS

The initial drilling program was completed 11 December 2023, with 26 mud rotary drill holes totalling 4,250m (14,000 ft). The drill targets were designed for verification of the historical drilling data, to test extensions of the mineralised redox trends, and explore the stratigraphic and oxidation conditions of the host sands in underexplored portions of the Lo Herma property.

Of 26 holes drilled, 6 holes met the minimum grade cutoff of 200 ppm eU3O8 & the total hole grade-thickness (GT) target of minimum 0.2 GT. Two drill holes met the minimum grade cutoff, but not the minimum GT. Fourteen (14) drill holes demonstrated trace mineralization but did not meet the grade cutoff. Four (4) drill holes were barren of any indication of mineralization. The best mineralized intercept was encountered in hole LH-23-006, with 19.0 feet with an average of 390 ppm eU3O8 for a total intercept grade-thickness of 0.741. The highest-grade intercept was encountered in hole LH-23-025, with 3.5 feet with an average of 800 ppm eU3O8, containing an internal 0.5 ft (~15 cm) interval of 1,890 ppm eU3O8.

Uranium assay values were obtained by probing the drill holes with a wireline geophysical sonde which includes a calibrated gamma detector, spontaneous potential, resistivity, and downhole drift detectors. The gamma detector senses natural gamma radiation emanations from the rock formations intercepted by the drill hole. The gamma levels are recorded on the geophysical logs. Using calibration, correction, and conversion factors, the measured gamma radiation is converted to an equivalent uranium ore grade (eU3O8) and compiled into uranium intercepts based on a minimum cutoff grade of 200 ppm eU3O8 in half-foot intervals. This is the industry standard method for uranium exploration in the US and is discussed in further detail in the JORC tables. The reader is cautioned that the reported uranium grades may not reflect actual uranium concentrations due to the potential for disequilibrium between uranium and its gamma emitting daughter products.

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTR:AU

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 December 2025

American Uranium

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming Keep Reading...

11 August 2025

Snow Lake Completes Due Diligence and Confirms Placement

GTI Energy (GTR:AU) has announced Snow Lake Completes Due Diligence and Confirms PlacementDownload the PDF here. Keep Reading...

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

GTI Energy (GTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 July 2025

Lo Herma Drilling Permit & Contract Confirmed

GTI Energy (GTR:AU) has announced Lo Herma Drilling Permit & Contract ConfirmedDownload the PDF here. Keep Reading...

14 July 2025

Company Update - Name Change to 'American Uranium Limited'

GTI Energy (GTR:AU) has announced Company Update - Name Change to 'American Uranium Limited'Download the PDF here. Keep Reading...

10 July 2025

Placement Shares Issued & Drilling Approval Expected August

GTI Energy (GTR:AU) has announced Placement Shares Issued & Drilling Approval Expected AugustDownload the PDF here. Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

Latest News

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00