Guyana Goldfields Updates Feasibility Study for Aurora Project

Guyana Goldfields Inc. (TSX:GUY) released an updated feasibility study for its Aurora gold project. The new study looks at an open-pit/deferred underground mining scenario and is based on a gold price of US$1,000 per ounce.

Guyana Goldfields Inc. (TSX:GUY) released an updated feasibility study for its Aurora gold project. The new study looks at an open-pit/deferred underground mining scenario and is based on a gold price of US$1,000 per ounce.

As quoted in the press release:

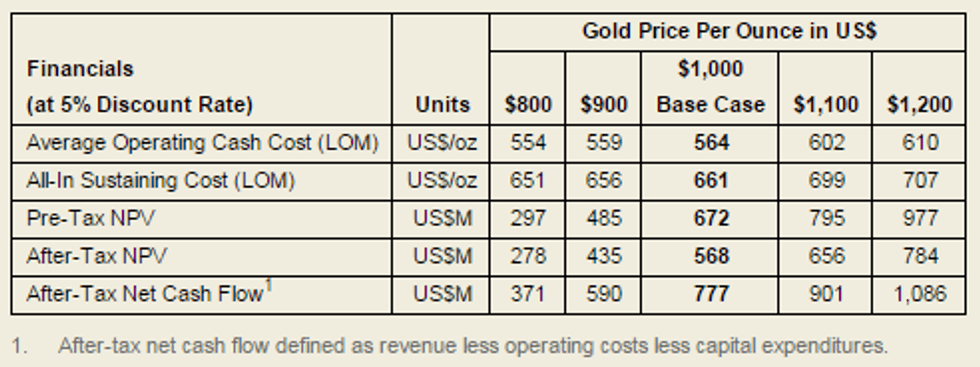

The mine plan produces 2,865,726 ounces of gold at an average life of mine (“LOM”) grade of 2.94 grams per tonne (“g/t”) gold over an initial 16 year mine life at an all-in sustaining cost (“AISC”) of US$661 per ounce. Average annual gold production over the LOM is 188,000 ounces, and averages 200,000 ounces per year over the period from 2017 – 2028. Gold production peaks in year 2023 at 231,000 ounces. Gold production is staged with an initial open pit mill throughput rate of 5,000 tonnes per day (“tpd”) from the Rory’s Knoll deposit expanding to 8,000 tpd in early 2017 with the inclusion of other open pit feeds from the Aleck Hill and Mad Kiss deposits. Underground mining at Rory’s Knoll commences in year 2022 and lasts for nine years.

Project economics are as follows:

Scott A. Caldwell, president and CEO of Guyana Goldfields, commented:

Operating results to date and this updated FS confirm the economic strength of the Aurora deposit. Good grade, great metallurgy, low operating and capital costs allow GGI to stand out amongst its industry peers.

Click here to read the full Guyana Goldfields Inc. (TSX:GUY) press release.