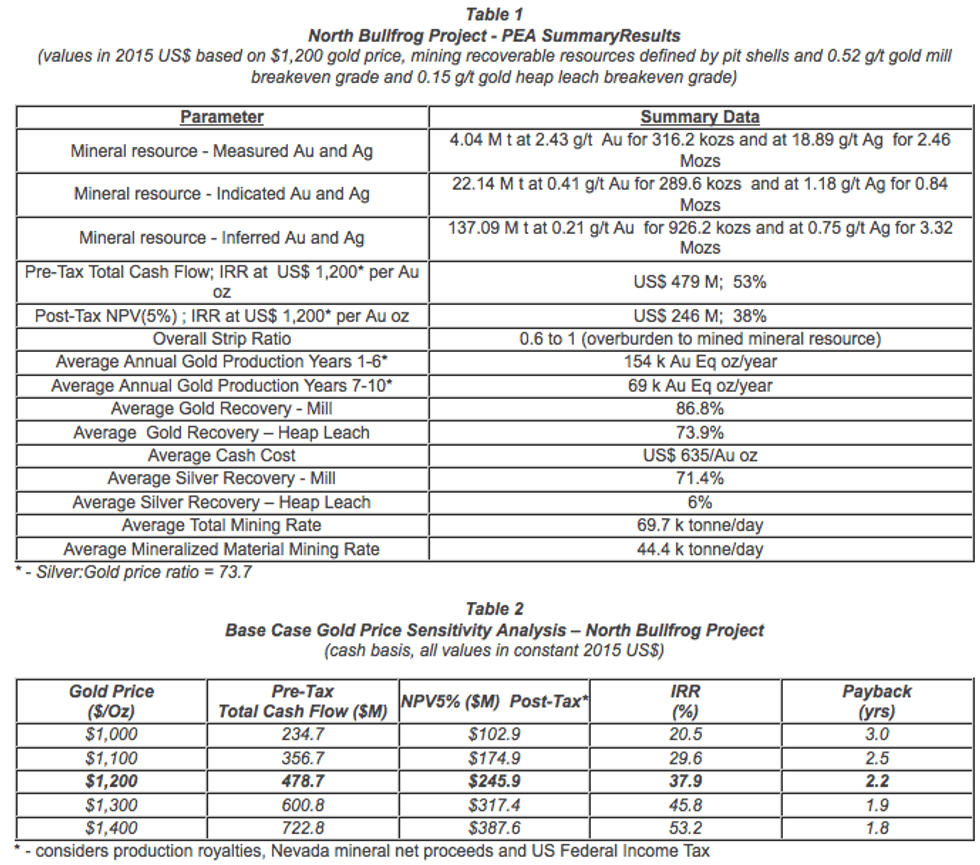

Corvus Gold Releases PEA Results for the North Bullfrog Project in Nevada: Pre-Tax Total Cash Flow $479M, IRR of 53%; NPV $246M, IRR of 38%; Cash Cost per gold oz: $635

Corvus Gold Inc. (TSX:KOR) announced its new Preliminary Economic Assessment and resource update for its North Bullfrog project in Nevada, which includes all drill results through 2014 from the YellowJacket deposit. The PEA indicates the economic potential of the North Bullfrog project: Pre-Tax Total Cash Flow of $479M at $1,200 gold, IRR of 53%; a projected production of 149 k ounces gold per year for first 6 years; a cash cost per gold ounce of $635; and NPV (5% post-tax) of $246M at $1,200 gold, IRR of 38%.

Highlights of the Preliminary Economic Assessment:

- Pre-Tax Total Cash Flow: $479M at $1,200 gold, IRR of 53%

- NPV(5% post-tax): $246M at $1,200 gold, IRR of 38%

- Projected average annual production: 149 k ounces gold per year for first 6 years dropping to 68.5 k ounces gold per year for the remaining 4 years

- Project silver production of 2.49 M ounces LOM

- Cash Cost per gold ounce: $635

- Project Total Capital Cost per gold ounce: $206

- Initial Capex: $175M (life of mine sustaining Capital $83M)

- Strip ratio of 0.6-1 (waste to ore)

- Gold recoveries of 87% mill and 74% heap leach

- $900 gold WhittleTM pit used for base case production for PEA analysis

- Mill resource grade increase of +100% to 2.1g/t gold

- YellowJacket/mill resource confidence increased significantly with 91% in Measured & Indicated category up from <20% in 2014 resource

As quoted in the press release:

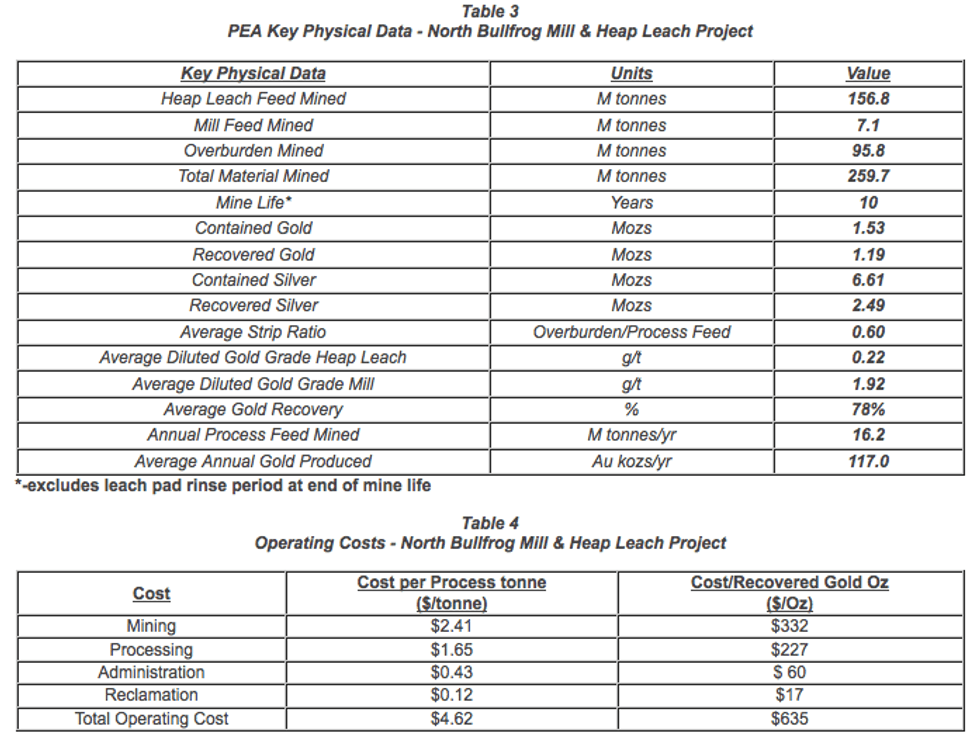

The PEA assumes development of a conventional drill and blast, surface mine using haul trucks and front end loaders, milling of higher grade mineralization with gravity-cyanide leaching, of the YellowJacket mineral resource, and heap leach processing of low grade mineralized material from the Sierra Blanca, Jolly Jane, and Mayflower mineral resources . Mineralized material from the YellowJacket vein and stockwork mineral resource would be delivered to a processing plant incorporating a gravity concentration circuit with intense cyanide leaching of the gravity concentrate followed by cyanide leaching of the gravity tail product. Tail materials would be stored in a conventional, lined tailing storage facility (TSF). Lower grade disseminated mineralization would be processed by heap leaching of run of mine (ROM) material. Ultra-high intensity blasting would be performed to minimize particle size for enhanced heap leach recoveries and would allow transport and stacking on a heap leach pad using a feeder/conveyor/stacker system. Gold and Silver in leachate solutions would be recovered from carbon from both process plants and a doré would be produced in a refinery located in the Mill. Sensitivity of the projected financial performance of the North Bullfrog project is listed around the Base Case assumption of a constant gold price of US $1,200 per ounce in Table 2.

The PEA uses gold and silver recoveries for a gravity-cyanide leach mill that are estimated from two sets of metallurgical composite samples developed from PQ core materials generated in YellowJacket drilling programs during 2013 and 2014. Gravity concentrate samples were developed using a KnelsonTM concentrator. The KnelsonTM feed was ground to P80 -0.21mm (-65 mesh). The produced gravity concentrate was then re-ground to P80 -0.044mm (-325 mesh), and subjected to intense cyanide leaching. The leached concentrate was then re-combined with the gravity tail product and ground to P80 -0.074mm (-200 mesh) before the final cyanide leach to maximize gold and silver recovery. Average recoveries of 86.8% for gold and 71.4% for silver were assumed for the mill process plant.

Heap leach metallurgical recovery estimates are based on column leach testing data for composite samples constructed from Mayflower, Jolly Jane, and Sierra Blanca 2012 PQ core drilling. A total of 23 column leach tests have been run at McClelland Laboratories at a particle size of 80% passing -19 mm (-3/4 inch) for the four resource areas. The process recovery assumptions reflect consideration of particle size resulting from ultra-high intensity blasting with a particle size of P80 -84mm (-3.3 inch), similar to a primary crushing product, scaling for the effects of vertical lift heights of > 10m (30 ft) and a leach time of 1000 days. The leach pad production model predicts an average gold recovery of 74%, and an average silver recovery of 6% of the fire assay grade.

A summary of the PEA results for the base case gold price assumption of US $1,200 is listed in Table 3. Working capital and initial fills, which are recovered at the end of year 1 and at the end of the project respectively, were estimated to be US $16.4 M. Operating costs included in the PEA were based on mining, processing, administration and reclamation, and are listed in Table 4, where they are normalized to process tonnage and recovered gold ounces. Total LOM cash operating costs are projected to be US $635 / produced Au oz and LOM capital cost (adjusted for recovery of pre-strip mining, working capital recovery and initial fills recovery) was estimated to be an additional US $206 / produced Au oz.

The Company cautions that the PEA is preliminary in nature, and is based on technical and economic assumptions which will be further evaluated in more advanced studies. The PEA is based on the North Bullfrog resource model (as at June 16, 2015) which consists of material in the measured, indicated and inferred classifications. Inferred mineral resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. The current basis of project information is not sufficient to convert the mineral resources to mineral reserves, and mineral resources that are not mineral reserves do not have demonstrated economic viability. Accordingly, there can be no certainty that the results estimated in this PEA will be realized. The PEA results are only intended as an initial, first-pass review of the potential project economics based on preliminary information.

Corvus Gold CEO, Jeff Pontius, said:

The results from this initial analysis of the North Bullfrog deposits have clearly illustrated the economic potential of this new and emerging Nevada Gold District. The unique mix of a high-grade vein/stockwork deposit surrounded by oxide heap leach deposit has resulted in a potentially exceptional, low strip, open pit, mining project in one of the best jurisdictions in the world. By using a conservative US$900 gold price driven WhittleTM pit to define the PEA base case pit design the project demonstrates potential to perform well in the current gold price environment. The existing project infrastructure and advanced permitting work linked with simple oxide processing offers the opportunity for a low Capex, high margin operation with near term production potential. Utilizing the new high-grade YellowJacket deposit as our proof of concept, we have begun a District wide exploration and development program to identify other large vein systems as well as follow-up resource expansion drilling of the YellowJacket deposit, both of which could add significant potential to the North Bullfrog project and Corvus as a whole.

Click here to read the Corvus Gold Inc. (TSX:KOR) press release