CRU Group: Tin Prices to See Slight Recovery in 2020 Despite Coronavirus

Tin prices saw a recovery at the end of 2019, but the coronavirus outbreak has now had an impact, said Lynn Lupori of CRU Group.

Tin prices are still on track to see a slight recovery this year despite the short-term impact the COVID-19 coronavirus outbreak could have on the market, according to Lynn Lupori, head of consulting at CRU Group.

Speaking with the Investing News Network at this year’s Prospectors & Developers Association of Canada convention, Lupori said the tin market has not performed as expected so far this year.

“It is pretty easy to say no, and that is related to the coronavirus,” she said. “Something like that can’t be predicted by anyone.”

According to the World Health Organization, the novel virus has infected more than 110,000 people around the world, with the death toll standing at more than 4,200. Recovery cases are above 65,000.

Despite seeing a rebound at the end of 2019, given the COVID-19 outbreak, tin prices have been impacted directly this year, Lupori said.

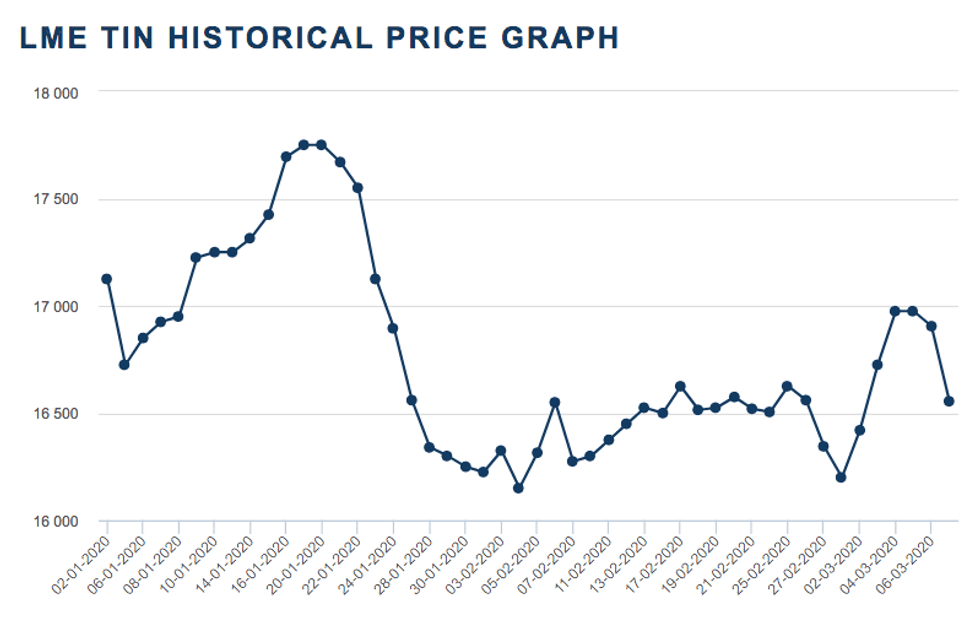

Tin prices on the London Metal Exchange (LME) started the year trading at US$17,125 per metric ton, and moved in an upward trend until January 20, when the coronavirus outbreak took over news headlines.

Prices for the industrial metal fell to US$16,150 on February 4 — their lowest since the start of the year.

Chart via London Metal Exchange.

“Short term our price outlook has changed slightly,” Lupori said. “But we still expect to see a slow recovery in prices.”

At the start of March, tin prices began to increase again on hopes of further stimulus measures from central banks and governments around the world. As of Monday (March 9), tin prices on the LME were trading at US$16,555.

Looking over to supply, the International Tin Association said global refined production fell by 6.6 percent to 334,400 metric tons in 2019 due to lower run rates in China. But in 2020, what impact the virus could have on tin supply is still to be seen.

“We saw some supply disruptions, but some of the smelters have come back online following the Spring Festival in China,” Lupori said.

She added that CRU expects demand to experience more of a hit than supply.

“A lot of that is going to be predicated on what the Chinese government does in terms of a stimulus. Is it going to be consumer based? Is it going to be infrastructure based?” she said, adding that another key factor will be what COVID-19 does to consumers outside of the Asian region.

Tin is used in solder, as well as tinplate, chemicals, brass and bronze and other niche areas. Last year, most demand for tin came from the semiconductor sector, where the metal is used as a soldering agent.

“It is going to be critical to see what path is taken by other economies and if there’s going to be further slowdowns in infrastructure spending and developments, in particular in the US and Europe.”

Further slowdowns in shipping and operations, both on the supply and demand side, could push things further southward, according to the expert. The availability of shipping containers is problematic as they haven’t been leaving China because of shutdowns at ports.

“It’s not only about getting the workers back to work, but it’s the movement of materials that is going to take a bit longer recovery,” she said. “But if we see, with the warmer temperatures, hopefully a downturn in COVID-19 outbreaks, then we are going to start to see (a tin) recovery happen.”

Lupori said that even though China plays a big role in the tin space, it is important for investors to understand the dynamics of the rest of the world. The 5G network and how it will impact semiconductor demand is one of the factors to keep an eye out for.

“Investors have to look at tin not only from a China-specific perspective, but also the demand side outside of that, as well as the supply of ore going into China for refinement,” she said.

When investors are looking at projects to invest in, they should remember that tin doesn’t react as other metals trading on the LME.

“But as with any other mined material or metal, (it) is about the lower-cost producers and the long-term viability of the assets,” she said.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.