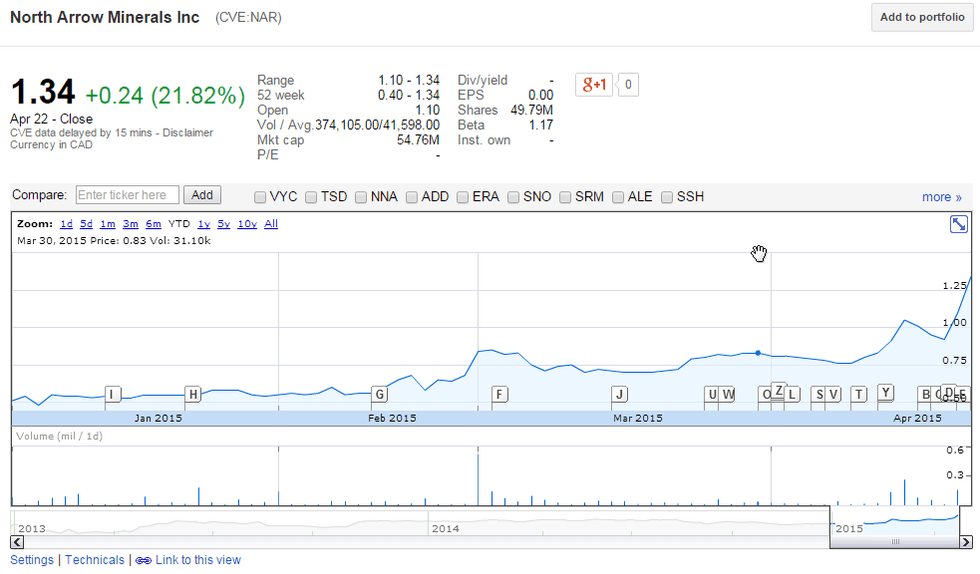

North Arrow Up Over 40 Percent on Yellow Diamond News

The company’s share price has risen 41.05 percent since Monday alone.

Junior miners have undeniably been having a tough time the last couple of years, but there are definitely bright spots to be found for investors willing to spend the time looking.

One company that’s faring well even during today’s difficult price environment is Canada’s North Arrow Minerals (TSXV:NAR), which is focused on identifying and exploring Canadian diamond projects. At close of day Wednesday, the company’s share price was up an impressive 162.75 percent year-to-date, and it’s risen 41.05 percent since Monday alone.

It’s not hard to see what’s driven the company’s upward movement. North Arrow has released a steady stream of news since 2015 began, with its most notable accomplishments being the discovery of three new kimberlites at its Pikoo project in Saskatchewan and the announcement that yellow diamonds from the Q1-4 kimberlite, located at its Qilalugaq project in Nunavut, are Type Ib diamonds.

That second piece of information is what’s pushed North Arrow’s share price higher this week. The company released the news Tuesday, stating that Apex Geoscience conducted Fourier Transform Infrared (FTIR) analyses of 41 representative yellow diamonds from the Q1-4 kimberlite and found that they range in color from “very pale yellow through intense yellow.” All but one contain unaggregated nitrogen, which is a characteristic of Type 1b diamonds.

For those not involved in the diamond space, it might seem odd that investors are so excited about North Arrow’s colored diamonds — after all, the majority of diamonds on the market are colorless.

However, colored diamonds, which make up just 2 percent of all diamonds, are experiencing a rise in popularity, and regularly fetch higher prices than their colorless peers. Indeed, a Forbes article published earlier this year states that from 2006 to 2014 colored diamonds experienced an average total appreciation of 154.7 percent, while colorless diamonds appreciated just 62.4 percent.

Furthermore, as North Arrow explains in Tuesday’s release, Type Ib diamonds in particular are ”exceptionally rare” and make up less than 0.1 percent of diamonds. Elaborating, Ken Armstrong, North Arrow’s president and CEO, said, “[i]n fact, less than 1% of over 24,000 fancy yellow diamonds investigated by the Gemological Institute of America as part of a 2005 study were classified as Type Ib diamonds, indicating that Type Ib diamonds are rare, even among natural fancy yellow diamonds. This rarity highlights the significance of today’s result: all but one of the analyzed Q1-4 yellow diamonds contain un-aggregated nitrogen and yellow diamonds make up over 21%, by carat weight, of the diamonds recovered so far from the Q1-4 bulk sample.”

All that is good news for North Arrow, which plans to complete final processing and diamond sorting for the Q1-4 bulk sample late this month, releasing a formal valuation for the resulting diamond parcel not long after. Collecting and processing the bulk sample is part of what North Arrow has to do to earn an 80-percent interest in Qilalugaq from Stornoway Diamond (TSX:SWY).

Investors will certainly be watching for those catalysts, and may also want to watch the company’s activity at Pikoo moving forward. Armstrong said recently that the next step there will be further expansion drilling.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: North Arrow Minerals is a client of the Investing News Network. This article is not paid-for content.

Related reading:

North Arrow Minerals: Bulk Sample Processing Approaching Completion