Alto Ventures Arranges Financing And Plans Till Sampling On Its Pikoo Area Claims

Alto Ventures Ltd. (TSXV:ATV) announced a non-brokered private placement of up to $400,000 through the issuance of a combination of flow through units and non-flow through units at a price of $0.04 per each FT Unit and NFT Unit.

Alto Ventures Ltd. (TSXV:ATV) announced a non-brokered private placement of up to $400,000 through the issuance of a combination of flow through units and non-flow through units at a price of $0.04 per each FT Unit and NFT Unit.

As quoted in the press release:

Each FT Unit will be comprised of one flow through common share and one-half of one share purchase warrant (a “FT Warrant”). Each whole FT Warrant is exercisable to purchase one flow through common share of the Company at a price of $0.08 per share for a period of two years from the date of closing of the financing. Each NFT Unit will be comprised of one common share and one share purchase warrant (a “NFT Warrant”). Each NFT Warrant is exercisable to purchase one common share of the Company at a price of $0.08 per share for a period of two years from the date of closing of the financing.

The private placement is subject to TSX Venture Exchange approval and all securities are subject to a four month hold period. Finder’s fees will be payable in connection with the private placement, all in accordance with the policies of the TSX Venture Exchange. The Offering will be conducted under available exemptions from the prospectus requirements of applicable securities legislation and participation in the private placement will be available to existing shareholders in qualifying jurisdictions in Canada in accordance with the provisions of Multilateral CSA Notice 45‐313 and BC Instrument 45‐354 (the “Existing Shareholder Exemption”). The Company has set September 23, 2015 as the record date for the purpose of determining shareholders entitled to participate in the private placement in reliance on the Existing Shareholder Exemption. Qualifying shareholders who wish to participate in the private placement should contact the Company at the contact information set forth below. If the private placement is over subscribed for, units will be allocated pro‐rata amongst all subscribers.

Proceeds from this financing will be used for continuing exploration on Alto’s GEFA diamond project adjacent to North Arrow’s Pikoo diamond discovery in northwestern Saskatchewan as follows:

Till Sample Collection – $165,000

Till Sample Processing & Analysis – $70,000

Consulting & Interpretation – $15,000

Ground Geophysics – $50,000

Working Capital – $100.000

TOTAL – $400,000

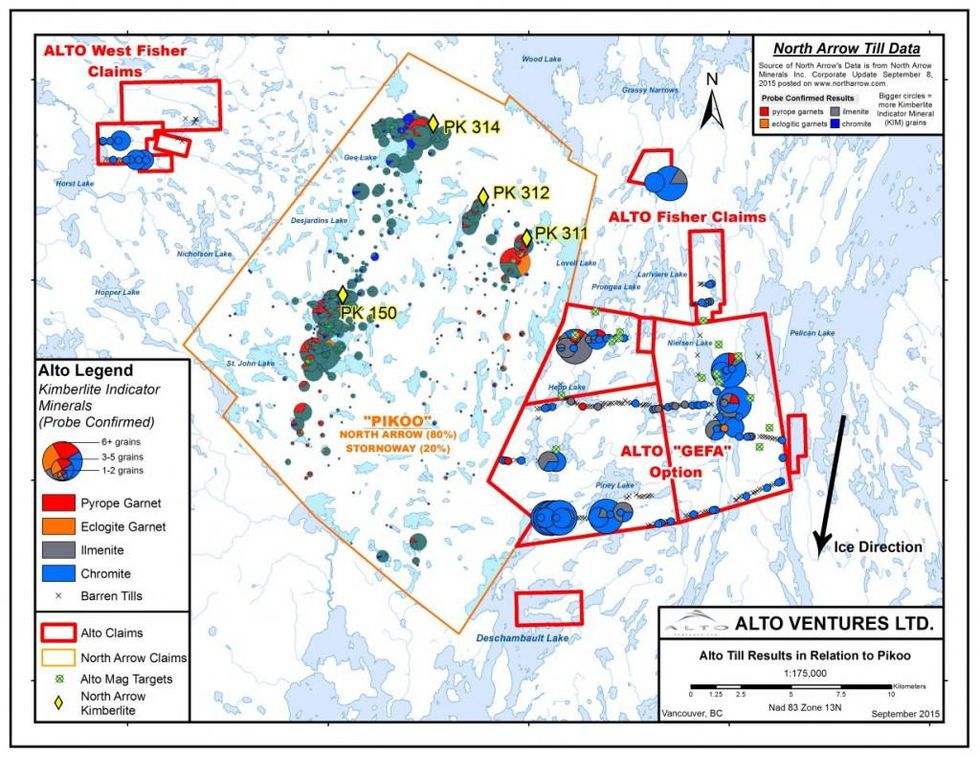

The till sampling program is scheduled to start in early October. Previous work by Alto Ventures has identified at least three kimberlite dispersion trains from its limited till sampling program in 2014 (see Alto Ventures news release dated February 23, 2015). A high resolution airborne magnetic survey in 2015 identified 16 priority targets that require follow-up till sampling to prioritize these targets. The objectives of this program are to advance some of the targets to the drill stage.

The GEFA claims lie strategically adjacent to and east of the Pikoo diamond property held by North Arrow Minerals. To date, drilling by North Arrow discovered three diamond bearing kimberlites and diamond count results for the fourth, PK314 (see map) are pending.

Till sample processing will be completed by C.F. Minerals Research Ltd. of Kelowna, B.C. C.F. Minerals is a heavy mineral processing laboratory founded by Mr. Charles Fipke and specializes in diamond, gold, platinum and base metals.