Ur-Energy Announces Second 2015 Mineral Increase Announced for Lost Creek; Target Price Increased

Ur-Energy (TSX:URE) announced a new mineral resource increase for the Lost Creek property located in Sweetwater County, Wyoming.

Ur-Energy (TSX:URE) announced a new mineral resource increase for the Lost Creek property located in Sweetwater County, Wyoming.

As quoted in the press release:

EVENT

Ur-Energy announced a new mineral resource increase for the Lost Creek property located in Sweetwater County, Wyoming.

BOTTOM LINE

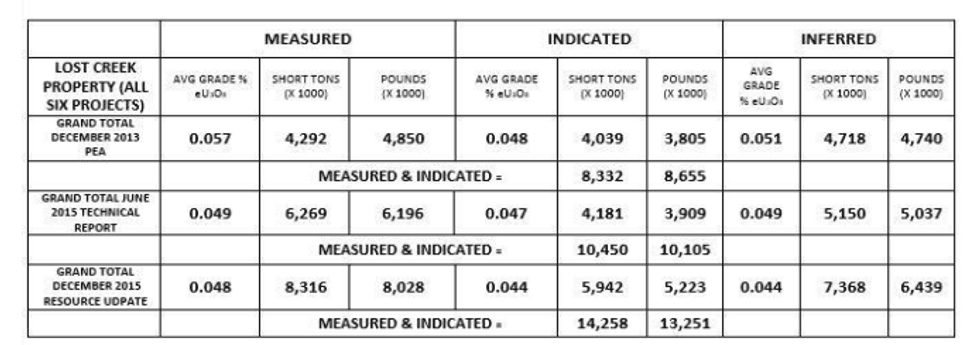

Compared to the previous resource update in June, yesterday’s announcement has the measured resource increasing by 30% to total 8.028M lbs, the indicated resource increasing by 33% to total 5.223M lbs, and the inferred resource increasing 28% to now total 6.439M lbs. The resource increase is a result of new wellfield development drilling in Mine Unit 2 (“MU2”) and from the second phase of the 2015 Lost Creek drilling program. Additionally, similar to the June resource increase, recall that the Lost Creek resources were revised using a 0.20 grade-thickness (“GT”) cut-off. The incorporation of this new, lower GT cut-off is the result of better-than-expected uranium recoveries from mining operations since initial production in 2H2013. We are maintaining our Buy recommendation and are increasing our target price to $2.35 per share from $2.15 per share.

FOCUS POINTS

- Sizeable resource increase at low cost – Together with the resource update reflected earlier this year in the June 17, 2015 Technical Report, the Lost Creek Property resources have seen combined 2015 net increases of 4.596M lbs in the Measured and Indicated resource categories, and 1.699M lbs in the Inferred resource category. The 2015 exploration cost totaled a modest $500,000.

- New production area in 2016 – Production from MU2 is expected in 2016 and will be pipelined to the Lost Creek facility.

SECOND 2015 RESOURCE INCREASE AT LOST CREEK

This is the second mineral resource update at Lost Creek over the past year. The previous increase was announced this past June. Compared to the previous June update, yesterday’s announcement has the measured resource increasing by 30% to total 8.028M lbs, the indicated resource increasing by 33% to total 5.223M lbs, and the inferred resource increasing 28% to now total 6.439M lbs. The resource increase is a result of new wellfield development drilling in Mine Unit 2 (“MU2”) and from the second phase of the 2015 Lost Creek drilling program. Additionally, similar to the June resource increase, recall that the Lost Creek resources were revised using a 0.20 grade-thickness (“GT”) cut-off. The incorporation of this new, lower GT cut-off is the result of better-thanexpected uranium recoveries from mining operations since initial production in 2H2013.

Exhibit 1: Combined Resource Estimate for 2015, Evolution since December 2013 PEA

The revised MU2 resource estimate is based on drilling results from 138 closespaced pattern wells, 20 monitor wells and 22 delineation drill holes. This resource re-estimation for MU2, based on increased drill hole density and the lower 0.20 GT cut-off, resulted in an increase of 682,000 pounds eU3O8 of Measured and Indicated resource and 185,000 pounds eU3O8 of Inferred resource.

The Phase 2 exploration program had a drill hole count of 59 (out of a total 150-hole exploration drilling program conducted in 2015 and located immediately south and east of MU1). The 59 drill holes totaled nearly 25,000 feet and added an additional 18,000 lbs eU3O8 of resources in the Measured and Indicated categories and 202,000 lbs eU3O8 of resources in the Inferred category. The combined increase in mineral resource as a result of the 150-hole program is 139,000 lbs eU3O8 of new Measured and Indicated uranium resources and 498,000 lbs eU3O8 of Inferred resources. The cost of this exploration program was approximately $500,000.

Using the new 0.20 GT cut-off, Ur-Energy geologists completed this reestimation, which involved the re-mapping of all mineralized trends within all host sand horizons for the Lost Creek, LC East, LC South, LC North and LC West Projects. As a result there was a net increase of 2.446M lbs eU3O8 in the Measured and Indicated categories, and 1.015M lbs eU3O8 in the Inferred category.

While lowering cut-off grades is a classic way to artificially increase resource sizes, we do not view Ur-Energy’s decision to lower its cut-off grade at MU2 with the same skepticism. This is because the Lost Creek asset has consistently outperformed estimates and has proven that the prior cut-off was too conservative. Together with the resource update reflected earlier this year in the June 17, 2015 Technical Report, the Lost Creek Property resources have seen combined 2015 net increases of 4.596M lbs in the Measured and Indicated resource categories, and 1.699M lbs in the Inferred resource category. These figures represent combined, net increases of 53% for Measured and Indicated categories of resource and 36% of Inferred resources.

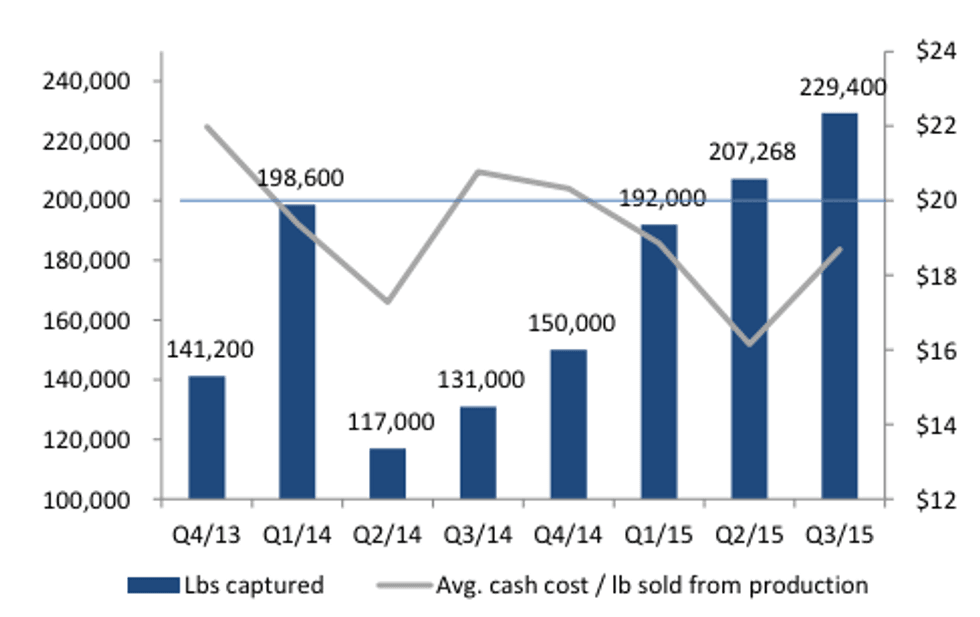

Ur-Energy has been operating the Lost Creek Mine since August 2013, to date, all production has come from MU1. Since initial production, nearly 1.4M lbs have been captured at the Lost Creek facility. Production from MU2 is expected in 2016 and will be pipelined to the Lost Creek facility. For 2015, Ur-Energy has managed to increase resources at a rate that is 8x its 2015 production.

Exhibit 2: Lost Creek Production & Cash Costs Since Initial Production

RECOMMENDATION

We maintain our BUY rating and are increasing our target price by 9% to C$2.35/share from $2.15/share. The increase is driven by the increase in the resource size at Lost Creek, which has effectively extended the life of mine. We have also assumed a wellfield capacity increase to 2M lbs per year beginning in 2020 as Lost Soldier and Shirley Basin are ramped into production. This would entail another permit by Ur-Energy, which is currently applying for an increase to 1.2M lbs for its wellfield. Our target is derived by applying a 1.0× multiple to the company-wide net asset value of $2.34 per share.