Forum Uranium – Well-Positioned for an Athabasca High-Grade Uranium Discovery

Forum Uranium Corp. (TSXV:FDC) is focused on making the next high-grade uranium discovery in Canada’s Athabasca Basin.

Forum Uranium Corp. (TSXV:FDC) is focused on making the next high-grade uranium discovery in Canada’s Athabasca Basin. The company holds a well-selected portfolio of near-surface uranium exploration properties which includes eight drill-ready projects that are wholly-owned or under joint venture with major uranium company partners. The company’s flagship property is the Fir Island Project, where a new large trend has been discovered.

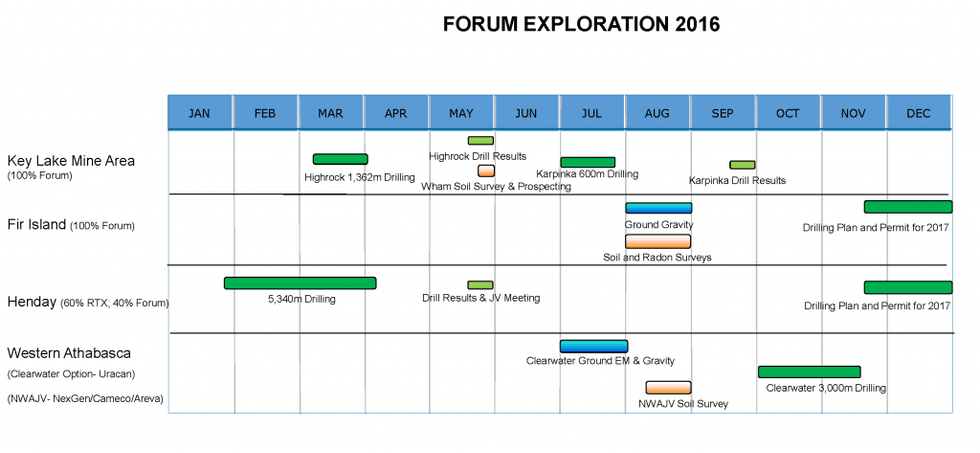

Forum has made significant exploration progress at several of its properties during the first half of 2016. At Henday, JV partner Rio Tinto identified a new zone of uranium mineralization and at Highrock, Forum has confirmed the potential for a strong EM conductor.

The Investing News Network recently spoke with Forum CEO & President Rick Mazur to discuss these developments as well as upcoming exploration work across its portfolio.

Investing News Network: So, Rick, you’ve had a busy first half of 2016 in terms of exploration, both at your Key Lake projects and your other Athabasca properties. Would you please share the latest results from your work at Highrock.

Rick Mazur: It has been a busy year to date, and I don’t think it’s going to slow down. At Highrock we just announced the results from eight holes that we drilled on the property over ten kilometers. They were very widely spaced holes, and we’ve identified two areas of interest for follow-up drilling. Elevated boron and uranium geochemistry was encountered in the northern part of the property and in the southern part two holes hit strong boron and uranium as well. And there’s a three kilometer-long trend that we didn’t even drill test that needs further work on beyond that southernmost hole. So, a little bit more gravity and then some really good drill targets.

INN: Let’s turn to your Karpinka property, it’s another Key Lake area project. Do you have any upcoming plans for this project?

RM: We do, actually. It has similar targets as at Highrock. The project is road accessible so we waited to do this one in the summertime. We’ll put five to six holes into that target this July.

INN: Looking at your impressive portfolio of exploration stage uranium properties, would you be able to give us some insight as to how you select your properties, and tell us more about your latest acquisition in the Key Lake area?

RM: Our business model from day one since we’ve formed Forum in 2004 has been to search for near-surface uranium exploration targets that are amenable to open pit mining, or a ramp or a shallow shaft. With regards to our latest acquisition, the Wham property, our Chief Geologist, Dr. Boen Tan had some intimate experience working with that project back in the 1980’s. We’ve been keeping our eyes on those two small claims that Areva didn’t already have and we did a nice deal with the prospectors.

So our game plan is to stake claims in the Athabasca or purchase them from private investors like we did the Wham property. And that’s been a successful strategy for us, even with our Henday property which is now joint ventured to Rio Tinto.

INN: That leads us to our next question. You recently shared some drill work results from you partner, Rio Tinto, on the Henday JV project. Please tell us more about the latest discovery and what’s next for this project.

RM: As I mentioned, we bought that from a private group and it’s now a 60/40 joint venture with Rio Tinto as operator, 60 percent owned by Rio Tinto. They did a 15-hole drill program this year on three target areas, all widely spaced over brand new parts of the property. The results were tremendous for a first pass, highly successful. Three target areas require some drill follow-up. On one of the target areas, Hollow Lake, we intersected uranium mineralization over 15 meters within a 20-meter alteration zone in the basement rocks. And the alteration extends well up into the sandstone which suggests that it’s a very strong mineralizing system.

As far as a plan for the future, with Rio Tinto being a large corporation, this project is in competition for funds with other exploration around the world, but they are very keen to move forward with this project. Hopefully we’ll get some funds to do some further resistivity surveys this summer and another big drill campaign in the winter of 2017.

INN: Your Fir Island property lies on the same trend as Cameco’s Centennial project. It looks like you’ve got some ground gravity and soil surveys planned for this summer. Would you tell us more about your goals here and what investors can look forward to?

RM: In the winter of 2015 we completed a 10-hole drill program on a new target area, never been drilled before. And we got some exceptional results. My VP of Exploration, Ken Wheatley, that’s one of his favorite targets after what we hit on that drill campaign. Very strong chemistry, alteration and elevated uranium. We think we’re close to something big there.

The plan this year will be a gravity survey over a 10-kilometer trend that we’ve identified on this property. We think we’ve identified what’s controlling this mineralization. I’ll be surprised if we don’t come up with a myriad of targets from that work, and we just want to get a good sense as to the regional potential of this property for a drill campaign that we’d like to mount in 2017.

INN: Another one of your partners, Uracan Resources, is about to embark on an exploration program at your Clearwater project. Would you tell us more about the goals of the program?

RM: Although most of our projects out east are 100-percent owned projects, Uracan has an opportunity to earn a 51 percent interest in Clearwater. We’ve already drilled nine holes, and Uracan drilled two holes as part of that option agreement. The plan this year is a summer gravity and electromagnetic survey on the property to identify further extensions along the Patterson Lake Corridor that hosts Fission’s Triple R deposit and NexGen’s deposits. Uracan has indicated that they will engage in the work program that we’ve presented to them as operators of the project. A 10 to 12-hole drill program will follow this coming fall. I think we’re going to try and get in there a bit early.

INN: Thank you. Do you have any plans for your Northwest Athabasca JV with NexGen, Cameco and Areva?

RM: That project has been very successful and inside three drill campaigns, four out of five targets that we’ve drilled there have identified uranium. It’s a very prolific area with very shallow targets. We have 19 other targets on the property that we’ve identified— we have so many targets we have to whittle them down somehow; a good problem to have. Every one of these targets in which we’ve hit uranium had very strong boron anomalies, so we’re going to do a small soil program for boron and we’re going to do an orientation survey to see if we can narrow down some of these targets on the property.

INN: And lastly, what’s your outlook on the uranium market for medium to long term and how well do you feel Forum is positioned?

RM: Long term, we wouldn’t be in this business if we didn’t think it was the right business to be in. Medium term, I think on the supply side what we’re seeing is marginal operations are shutting down. There’s no new production coming on stream with the prices as they are right now. So the supply side is going to decline. On the demand side, there’s still 440 reactors in the world with another 61 under construction. Six to eight reactors are coming online every year for the next few years. There’s going to be a pinch point here for sure and I think it’s going to happen within the next two years, and I think the market’s going to recognize that well in advance of when it actually happens.

CEO interviews are part of investor education campaigns for clients advertising on the Investing News Network. Important news is contextualized by CEOs, and the resulting interviews are disseminated to the Investing News Network audience because they have value to market watchers.

The Investing News Network interviews a CEO for an understanding of their perspective on the company, the investment potential of the company and market news related to the company. The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.