Sienna Resources Inc. Acquires the "Clayton Valley Deep Basin Lithium Brine Project" in Nevada

Sienna Resources (TSXV:SIE) announced that Sienna has acquired the “Clayton Valley Deep Basin Lithium Brine Project”.

Sienna Resources (TSXV:SIE) announced that Sienna has acquired the “Clayton Valley Deep Basin Lithium Brine Project”.

As quoted in the press release:

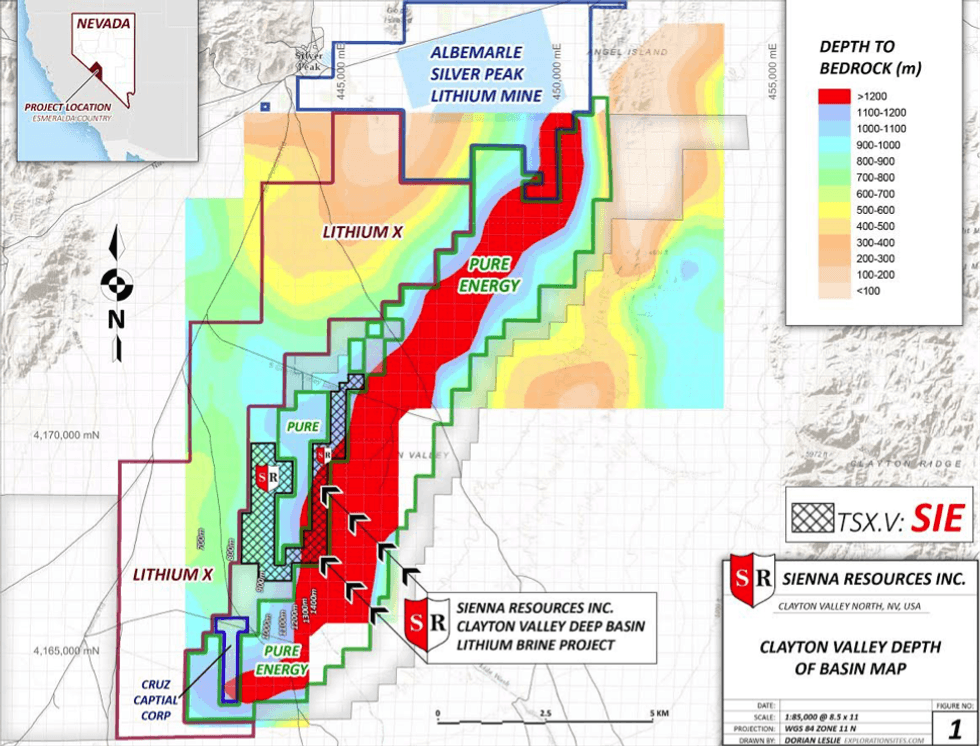

This project is located directly between and bordering Pure Energy Minerals Limited (PE—TSX.v) and Lithium X Energy Corp (LIX—TSX.v). The “Clayton Valley Deep Basin Lithium Brine Project” is located in parts of the deepest sections (refer to the map) of the only lithium brine basin with a producing operation in North America (Albemarle’s (ALB-NYSE) Silver Peak Mine). Pure Energy Minerals, which owns the Clayton Valley South project, has recently released an inferred resource of 816,000 tons of lithium carbonate equivalent on the Clayton Valley South project. According to the Pure Energy Minerals Limited website, “Geophysics shows that the same brine-bearing formations encountered during drilling (Pure) appear to extend to much greater depths within the basin.” Recently Pure Energy Minerals Limited signed a supply agreement with Tesla Motors Inc (TSLA-Nasdaq) to potentially supply lithium hydroxide from its Clayton Valley Lithium Brine Deposit.

Sienna Resources President, Jason Gigliotti, stated:

We are pleased to be one of the few companies that have property within the only known lithium brine basin with production in North America. Saline brines are higher density than fresh or brackish water and therefore tend to sink. Based on this, management is optimistic regarding this project as we are located in the deeper sections of this basin. Sienna also currently has one of the smaller market caps of the public companies in the Clayton Valley. The lithium space has shown signs of explosive growth recently and shows little to no signs of slowing down. Lithium is one of the few sectors of the market that appeals to both the traditional resource investor and millennials, as Tesla has primarily created a global knowledge for lithium, therefore being a true crossover element. Management plans to commence operations on this new project shortly.

We forecast the lithium market to grow by 81% to 347kt lithium carbonate equivalent (LCE) by 2020, and by 259% to 687kt LCE by 2025, representing a CAGR of 14% across all demand sectors. We anticipate Li-ion battery-based electric vehicles (passenger vehicles & electric buses) to be a key driver of demand over the next decade, accounting for 38% of all lithium demand by 2025 (from ~6% in 2015). Similarly, we also anticipate significant demand for lithium from the grid storage sector, which we forecast will account for 13.6% of all demand by 2025.

Connect with Sienna Resources (TSXV:SIE) to receive an Investor Presentation.