Lithium Australia Announce Exploration Target and Drill Schedule for Ravensthorpe

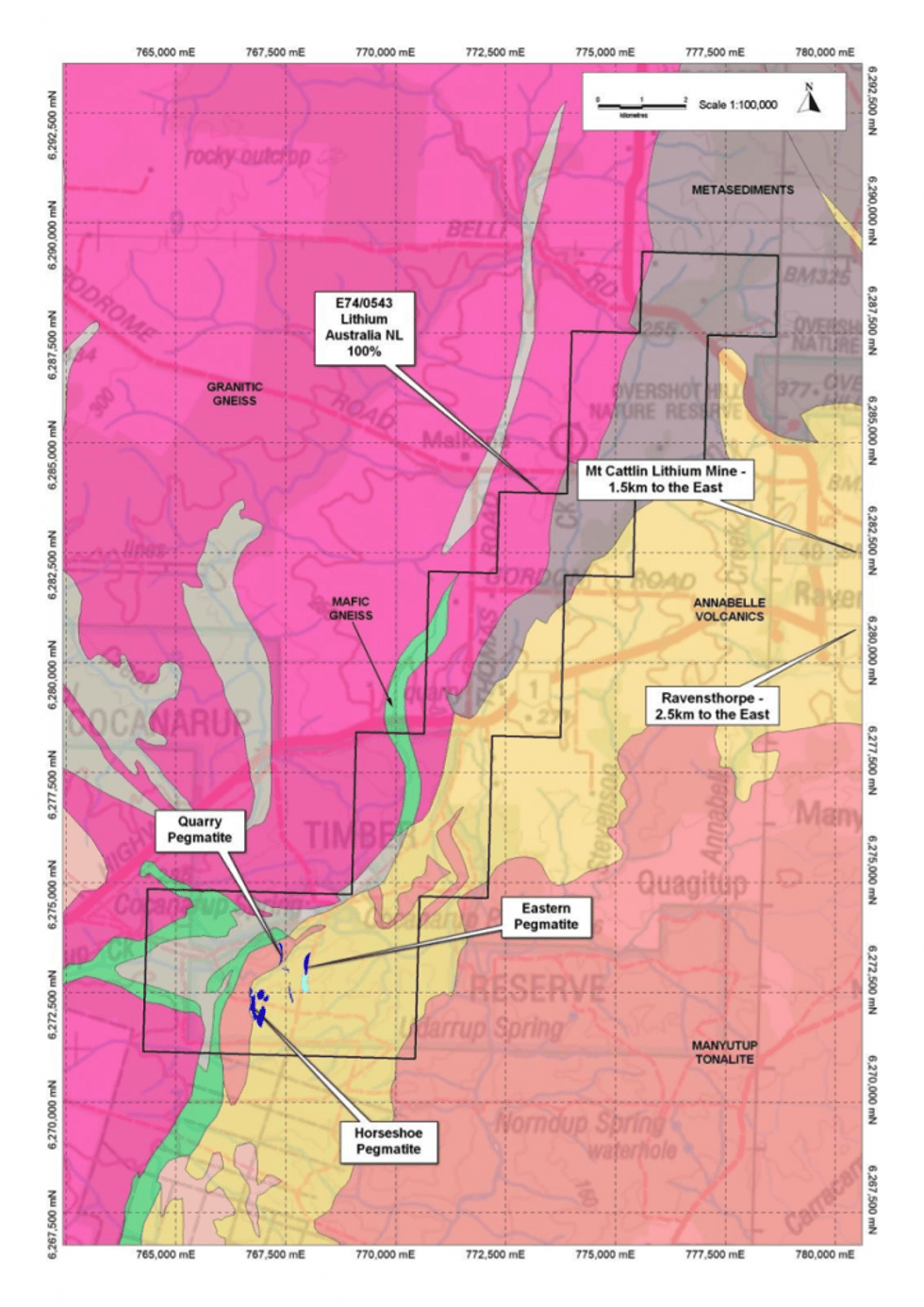

Lithium Australia NL (ASX:LIT) announced that recent fieldwork has identified an Exploration Target*1 of 525,00t to 1,281,000t and grade range of 0.8% – 1.2%) at the southern end of the Company’s 100%-owned Ravensthorpe lithium project, west of Esperance in southern Western Australia.

Lithium Australia NL (ASX:LIT) announced that recent fieldwork has identified an Exploration Target*1 of 525,00t to 1,281,000t and grade range of 0.8% – 1.2%) at the southern end of the Company’s 100%-owned Ravensthorpe lithium project, west of Esperance in southern Western Australia.

As quoted in the press release:

HIGHLIGHTS:

- Lithium Australia defines two key areas for first drilling on southern portion of its lithium prospective Ravensthorpe tenements, west of Esperance in Western Australia

- LIT defines an exploration target* of lithium mineralisation at a minimum grade of 1% Li₂O (with a size range from 525,00t to 1,281,000t and grade range of 0.8% – 1.2%)

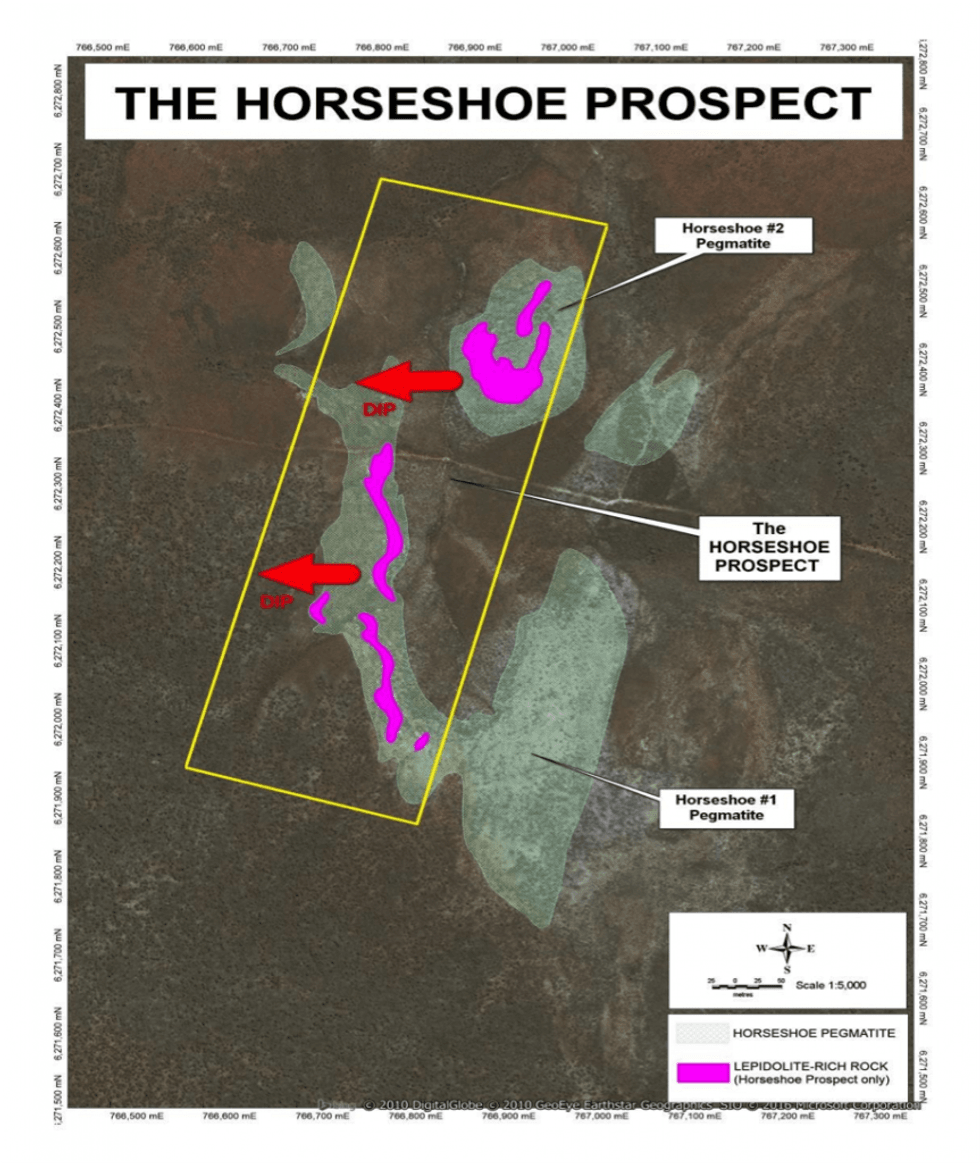

- Main focus is the Horseshoe #1 and Horseshoe #2 pegmatites (the primary source rock for lithium)

- Maiden drill program of up to 35 drill-holes scheduled once approvals confirmed

- Horseshoe is just kilometres from Galaxy-General Mining’s commissioning Mt Cattlin lithium mine

PLANNED DRILLING

A maiden drilling program of up to 35 holes has been scheduled for Horseshoe and is expected to commence by October once work permits have been approved.

Recent field work has confirmed the significance of the size of the Horseshoe prospect, its numerous lepidolite outcrops (lithium hosting micas), and its shallow dip with minimal overburden overlying the zone of lithium mineralisation.

The focus of the maiden drilling will be an area 650 metres long (Figure 2) containing the northern part of the large 950 metres long and 25 metres thick Horseshoe #1 pegmatite and the adjacent 250 metres long, 25-35 metres thick Horseshoe #2 pegmatite.Figure 2: Plan-view of LIT’s Horseshoe Prospect. Note that the areas of lepidolite-rich rock depicted are only those of the Horseshoe Prospect, as they are the ones to be tested by drilling.

Lithium Australia Managing Director, Adrian Griffin, stated:

It is indeed significant that so much un-touched lithium mineralization is sitting on the surface, within kilometres of the Galaxy-General Mining lithium operations. The more we look, the more of these less-common lithium minerals we find, and what has been the constraint to adding them to inventory? It has been the cost of processing. The Sileach™ process puts an end to the energy intensive process of roasting to recover lithium from silicates. Lithium Australia can used its 100% owned Sileach™ process to recover lithium from all lithium silicates, including spodumene.

Lithium Australia plans to use the Sileach™ process to unlock stranded lithium deposits on a global basis. Sileach™ is the start of a processing revolution that will lower the cost curve for the production of lithium chemicals from spodumene, and open the door for the less conventional mica deposits. We see the cost of hard rock lithium chemical production rivalling that of the low-cost the brine producers and we have the technology to make that happen. The Horseshoe Pegmatite is a great example and I look forward to the forthcoming exploration campaign.

Connect with Lithium Australia NL (ASX:LIT) to receive an Investor Presentation.