Mason Graphite Releases Feasibility Study for Lac Gueret

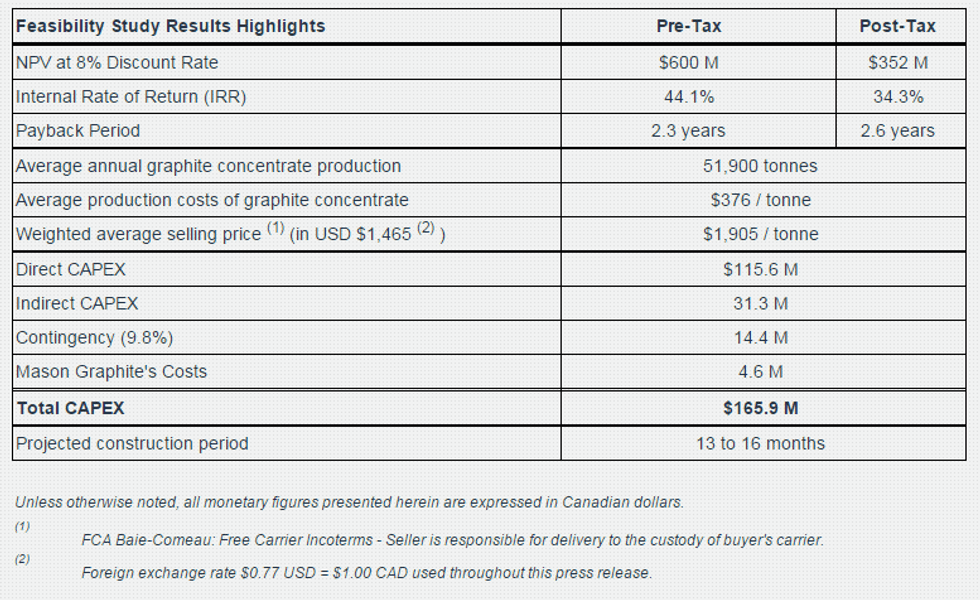

Mason Graphite Inc. (TSXV:LLG,OTCQX:MGPHF) released a feasibility study for its Quebec-based Lac Gueret graphite project. It points to a NPV of $352 million at an 8-percent discount, an IRR of 34.3 percent and a payback period of 2.6 years, all after tax.

Mason Graphite Inc. (TSXV:LLG,OTCQX:MGPHF) released a feasibility study for its Quebec-based Lac Gueret graphite project. It points to a NPV of $352 million at an 8-percent discount, an IRR of 34.3 percent and a payback period of 2.6 years, all after tax.

As of 11:56 a.m. EST, the company’s share price was up 9.76 percent, trading at $0.45.

Further feasibility study highlights are as follows:

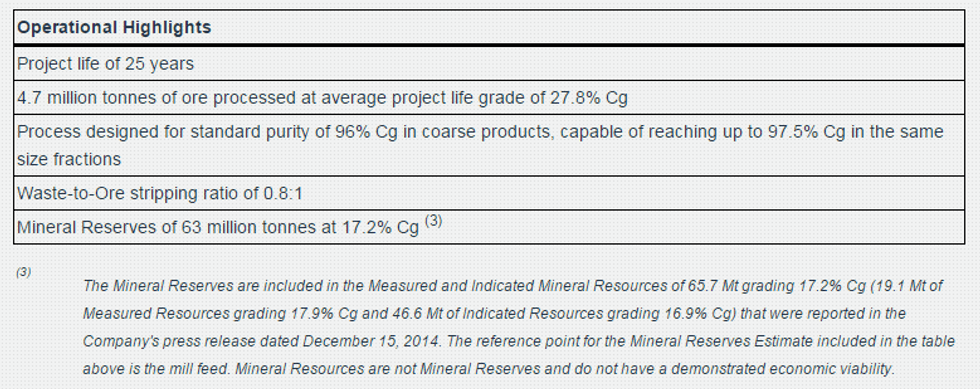

Operational highlights for Lac Gueret can be viewed below:

Benoit Gascon, president and CEO of Mason, commented:

We are thrilled about the excellent results of the Feasibility Study, which represent an important milestone as the Company moves towards becoming a leader in the sector. In the two years since issuing our PEA results, our team has been deeply involved in every aspect of this study, working with all the partners from 25 different firms. These results give us, in a very detailed way, what is needed to successfully build and operate the project. All components have been derived using measured and calculated, not factored, values. Based on our extensive experience in graphite production, we are confident that they are realistic and achievable.

Click here to read the full Mason Graphite Inc. (TSXV:LLG,OTCQX:MGPHF) press release.