Nevada Copper Feasibility Study for Pumpkin Hollow: 15.5% IRR After-tax, 4.9 Year Payback

Nevada Copper Corp. (TSX:NCU) released its National Instrument 43-101 Technical Report Integrated Feasibility Study for its Pumpkin Hollow Copper Project near Yerington, Nevada. The Study indicates a mine life of 23 years; significant LOM metal production of 4.5 billion pounds of copper, 512,000 ounces of gold and 15.6 million ounces of silver in a quality copper concentrate; and an initial capital cost estimated at $1.07 billion.

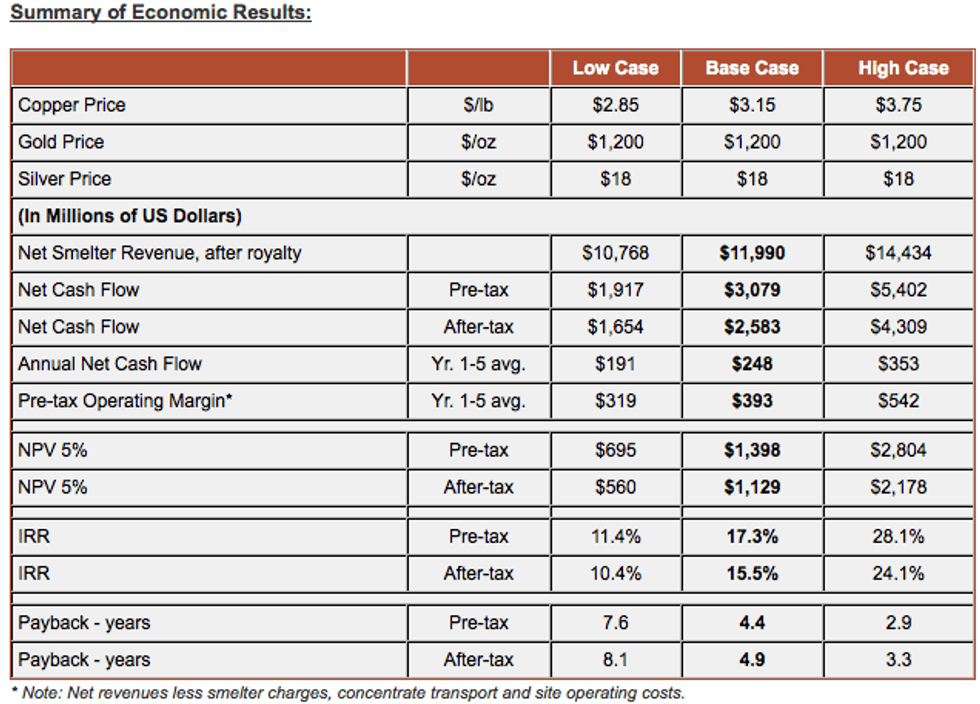

Highlights of the Integrated Feasibility Study (All dollar amounts are stated in United States currency):

- Long mine life of 23 years with low-risk profile located in an ideal mining jurisdiction close to existing infrastructure, an increase of 5 years from the first published integrated feasibility study, with production ramp-up targeted for 2018;

- Assuming the Base Case of US$3.15 copper, US$1,200 gold and US$18 silver, the Integrated Project generates Life-of-Mine (“LOM”) after-tax net cash flow of US$2.6 billion, NPV@5% of US$1.1 billion, an after-tax IRR of 15.5% with 4.9 year payback;

- Significant LOM metal production of 4.5 billion pounds (2.05 million tonnes) of copper, 512,000 ounces of gold and 15.6 million ounces of silver in a quality copper concentrate. Average annual copper production of 275 million pounds in years 1 to 5;

- The project development consists of a 63,500 tons/day open pit mine and 6,500 tons/day underground mine, feeding a single 70,000 tons/day concentrator, generating substantial annual cash flow over LOM;

Proven and Probable Mineral Reserves, including open pit and underground mineable, are 572 million tons of ore grading 0.47% copper equivalent1, containing 5.05 billion pounds of copper, 761,000 ounces of gold and 27.6 million ounces of silver;- Initial capital costs are estimated to be $1.07 billion including contingencies, excluding working capital of $34 million. Sustaining LOM capital is $0.64 billion;

- Low LOM site operating costs of $11.59 per ton of ore-milled (Year 1 to 5 – C1 Production Costs at $1.49/lb. payable copper);

- The IFS includes drilling data to 2011 for the underground deposits and 2013 for the open pit deposits. Further upside and optimization potential exists from current planned drilling in 2015 which is not included in the current IFS;

- The IFS confirms the technical and financial viability of constructing and operating a 70,000 tons/day copper mining and processing operation at Pumpkin Hollow comprising a single large concentrator with mill feed from both open pit and underground operation.

Nevada Copper President and CEO, Giulio Bonifacio, said:

The updated Integrated Feasibility Study reported today encompasses a project that has over the last number of years been de-risked significantly with: permits for the larger operation expected shortly by way of the passage of the land bill by the United States Congress, substantial value added engineering and optimization, a fully commissioned head frame, hoist and, a 24 foot diameter concrete lined production sized shaft which has been sunk to the 1,900 foot primary production level.

We are also very pleased that, while incorporating significant engineering and design changes since 2012, the Pumpkin Hollow project maintains positive economics at forecast copper prices, with further upside potential based on results from our current drilling campaign and the open extent of both the open pit and underground deposits.

Our base case feasibility results provides cumulative after-tax net cash flow of $2.6 billion demonstrating that the Pumpkin Hollow project provides investors with a low-risk copper mine with an initial mine life of 23 years with further upside. With the closing of the land transfer conveyance and receipt of modified state permits expected in the next few months, Nevada Copper will be very well positioned as a fully permitted large copper project located in an ideal mining jurisdiction close to existing infrastructure.

With the Integrated Feasibility Study results in hand, and permits expected shortly, we will move to assess project financing alternatives and advance discussions currently underway. We will continue to assess our financing options with respect to both the Integrated Project as well as the fully-permitted Stage 1 underground operation and will determine the optimal development strategy upon receipt the final permits for the Integrated Project, which are expected in Q3 2015.

As quoted in the press release:

Project Upside

Project upside and opportunities include the following:Resource expansion

Drilling in 2012 and more recently in 2015 has demonstrated the potential for material extensions to the known mineral inventories at Pumpkin Hollow, particularly the North open pit deposit. Updating the mineral resource inventory to reflect this drilling, along with updated mining plans, is expected to expand the mineral resources at the project.North Pit Expansion

Recent drilling in the connector zone between the North and South deposits continues to produce positive results and is expected to produce future mine designs where the North and South pits will continue to merge. A merged pit configuration can be expected to have a positive effect on the strip ratio, as well as improvements in pit scheduling, overburden placement and equipment utilization.Underground Resource Expansion

Drilling has commenced from underground drill stations. This drilling will better define the higher grade areas targeted for first production and will test the boundaries of the underground resources in the East deposit. The JK34 zone which is located between the East and E2 deposits will be drilled later when the ramp between the deposits is completed.Metallurgy

Metallurgical test work and optimization is continuing with a view to increasing copper recoveries particularly in the years of higher copper grades in the mill feed. Initial test results reflect increased recovery levels and will be followed up.Iron

Work has been initiated to assess the metallurgy and marketability of the Pumpkin Hollow iron magnetite resources under a Memorandum of Understanding with a major international steel producer. The benefits of existing infrastructure and power costs further support the possible future benefit of processing our copper tailings to produce a byproduct iron magnetite revenue stream.Background

The IFS builds upon the results of three previous feasibility studies, beginning with an integrated feasibility study published in January 2012 that considered open pit and underground deposits feeding a single 67,500 tons/day copper concentrator.In 2012, the Company determined that a standalone 6,500 tons/day underground mine could be permitted under State regulations on private lands within a shorter timeline. As a result the Company commissioned a second feasibility study to support a stand-alone underground operation (“Stage 1″) with results published in November 2012. All State permits were received for the underground operation in September 2013.

A third feasibility study evaluated the open pit operation as a separate standalone 70,000 tons/day open pit mine and concentrator (“Stage 2″) with results published in October 2013.

In late 2014 the Yerington land bill (“Land Bill”) was passed by the United States Congress and signed into law by President Obama. The passage of the Land Bill represented a very significant milestone for the Company as it accelerated the permitting timeline for a 70,000 tons/day open pit and underground operation with all permits and land transfer targeted for completion in Q3-2015. As a result the Company commissioned and updated its integrated feasibility study to include the information from additional open pit drilling, optimized resource modelling and engineering work completed between 2011 and 2015. New capital and operating cost estimates were also developed to reflect current market conditions resulting from the recent slowdown in the mining sector.

Click here to read the Nevada Copper Corp. (TSX:NCU) press release

Click here to see the Nevada Copper Corp. (TSX:NCU) profile.