The inferred resource tonnage for Baobab’s Gadde Bissik area is now 10.9 percent higher compared to the previous estimate, released in October 2017.

Avenira (ASX:AEV) has increased the longevity of its Baobab phosphate project in Senegal with the release of an updated inferred mineral resource estimate for the Gadde Bissik area.

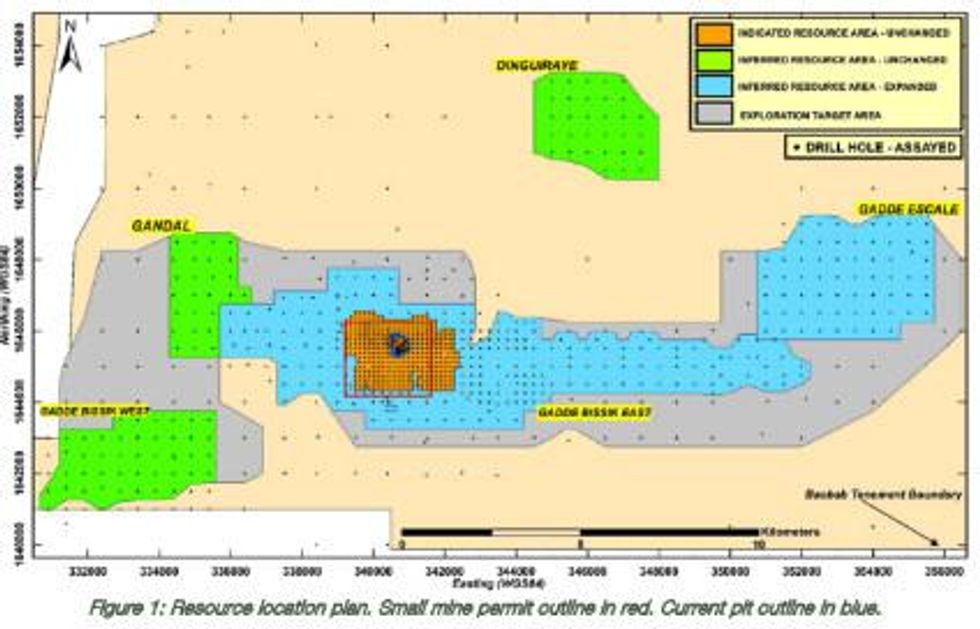

The inferred resource tonnage for Gadde Bissik is 10.9 percent higher compared to the previous estimate, released in October 2017; the inferred resource area is also now continuous over 20 kilometers. Gadde Bissik’s indicated mineral resource estimate remains the same, at 34.9 million tonnes grading 20.7 percent P2O5 at a 15-percent cut off.

Gadde Bissik’s new inferred mineral resource estimate incorporates a 22-hole drill campaign, and is now estimated at 173 million tonnes grading 18 percent P2O5 at a 15-percent cut off.

Avenira says the inferred mineral resource estimate update and a planned resource report are key components of a feasibility study for an expansion and upgrade project at Gadde Bissik. The feasibility study has just begun, according to the company.

At a 10-percent P2O5 cut off, the indicated resource tonnage and inferred resource tonnage for Gadde Bissik are estimated at 42 million tonnes grading 19.4 percent P2O5 and 320 million tonnes grading 16 percent P2O5, respectively.

“This updated resource model showing a continuous Inferred Resource area over 20 km is yet another strong confirmation of the vast scale of Baobab’s Gadde Bissik resource, and is most welcome as the Company is actively pursuing engineering studies for the Gadde Bissik expansion and upgrade investment project,” said Avenira Managing Director Louis Calvarin.

The Baobab project tenement covers about 1,163 square kilometers, and was recently granted to Avenira for an additional three years. The company obtained a small mine permit in May 2015 for the ground covering the thickest and highest-grade mineralization in the Gadde Bissik area, and it has since become the focus of exploration.

Avenira has also carried out drill campaigns further to the east of the property with the goal of increasing the inferred resources at Gadde Bissik East and Gadde Escale.

The company completed its first phosphate shipment from Baobab in March 2017. Later that year, it established a strategic plan for Baobab that is focused on expanding and upgrading the existing beneficiation plant at Gadde Bissik to bring it to “a sustainable operational level.”

The global phosphate fertilizers market was valued at $51.6 billion in 2016, and is expected to expand at a CAGR of 5.1 percent from 2017 to 2025, according to a recent report from Grandview Research. However, new supply entering the market from projects in Saudi Arabia and Morocco is expected to put pressure on prices.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Shaw, hold no direct investment interest in any company mentioned in this article.