Lotus Ventures Inc (CSE:J) (“the Company”) held a strategy session in October to review and report on the direction of the company for 2018 and 2019. The strategy is to grow the highest quality strains at one of the lowest production costs/grams in the industry.

Lotus Ventures Inc (CSE:J) (“the Company”) held a strategy session in October to review and report on the direction of the company for 2018 and 2019. The strategy is to grow the highest quality strains at one of the lowest production costs/grams in the industry. The facility and its planned expansion are built to Good Manufacturing Practices (“GMP”) type specifications. The company will produce at quality levels that exceed the minimum Good Production Practices (“GPP”) set forth in the Cannabis Act and its regulations. To access export markets, generally GMP certification is required. The company plans on obtaining its GMP certification in 2019.

The foundation of the strategy and the company’s financial model is based on the 10-year streaming agreement in place with the Company’s strategic partner, Auxly Cannabis Group Inc. (“Auxly”), a vertically integrated international cannabis operator. The macro economic impact of this agreement is the company has agreed to sell 50% of the production from the facility and its expansion in the Township of Spallumcheen, for a period of 10 years. The first three years of the streaming agreement pay a fixed price of $2.25 gram. The revenues generated from the streaming agreement will be enough to notionally cover close to 100% of the operating costs during that time. Auxly has a right to purchase, at discounted market rates, from time to time the 50% of the non-allocated production.

In addition to this expansion, the company immediately intends to expand its short-term future production capacity through partnership arrangements across the country, with minimal additional direct financial investment. The first one has been announced with 4th Generation Duwyn Farms Inc in Ontario.

What is the Market Telling Us?

The size of the global cannabis markets is approaching $200 billion in the next seven years (BMO Capital Markets, Oct 31st Report and Arcview Research). Our own survey of wholesale prices, since Oct 17th, indicates that wholesale prices range from a band of $5/gram to high of $10/gram (GMP Equity Research October 29th). The derivative products, such as beverages and edibles are less than one year away, along with an expected growth in wellness and natural health products. Supply does not equal demand currently and may not for several years, with the expansion of the global and domestic markets.

Lotus Ventures Inc’s investment thesis is that the company’s funded capacity comes partially on line in 2019 and more fully on line by 2020. After 2020, the company’s growth plan will include the expanded derivative cannabis markets and greater use of the partnership model, exemplified by the 4th Generation Duwyn Farms Inc deal.

Construction Schedule

The company is completing its first special purpose-built cannabis production plant. The facility is being built to GMP specifications, which the company plans on being GMP certified. It is 22,500 sq. ft, with 9,120 sq. ft of growing capacity. The facility is designed to produce 2,000,000 grams of cannabis annually. The budget was $8.6 million. The budget was adjusted upwards by $800,000 to include infrastructure for an immediate expansion. Some design changes, to improve quality and production flows bring the estimated full cost of the first facility to $9,800,000. Financing was provided by the company’s strategic partner, Auxly and a series of private equity placements; all completed and announced.

The next step in the path to obtaining a cultivation licence and approval for sale of the cannabis being produced is submission of the evidence package for review and approval by Health Canada. This package will be submitted in the next few weeks. The company is working with David Hyde and Associates and Cannabis Consulting Inc on the final stage. Upon approval of the evidence package, cultivation of 2 clone crops will commence and final testing and approval by Health Canada tends to follow – within a 5- month window (anticipated May 2019) with approval for sales and revenue generation anticipated in June 2019.

Expanded Capacity and Construction Plans

Lotus is progressing with its 30,000 sq. ft. expansion adjoining to its initial purpose-built prototype facility. There will be no additional real estate to purchase or lease and the offices have been put in the first facility. The company’s planning enables flexibility in the amount of growing space and production capacity which it can phase depending on capital finance decisions. The amount of grow space will be in the range of 17,000 sq. ft. Using conventional industry production metrics, the capacity of the expansion is estimated to be approximately 4,500,000 grams annually, error range +/- 5%. Production capacity is estimated using the industry standard of 1 gram of production per watt of lighting. Depending on use of two tiers or three tiers of lighting, this production can be increased beyond 4,500,000 grams annually.

Site Preparation for construction of this expansion has already commenced, the building permit application has been submitted and completion of construction is anticipated in 2019. Depending on the scale and configuration of the fit out, the budget for this is estimated to be in the range of $14,000,000 + budget.

Auxly, through its streaming agreement with the company, provides additional funding in the amount of $9,000,000 based on a mutually agreed construction budget, for the expansion plans. Final design decisions will happen after Lotus meets with Auxly and reviews the various scale and configuration options.

The company intends to fund the balance of construction costs through a combination of internally generated cash from being in production with its first facility in 2019; Auxly, non-dilutive debt sources; and/or convertible debentures/equity.

Learning Curve and Scalability

The increase in production capacity, from the expansion, comes about from several factors. The company adjusted in the first facility to include HVAC improvements, and lighting technology improvements with the expansion being twinned to the first facility. The blended full annual production capacity for the full year 2020 shall be in the order of 6,500,000 grams. The alternate plans, not yet accepted by the company, could get this blended production to as much as 8,000,000 grams annually, for an additional construction cost of $6,000,000 on the expansion. At this time, the company is committed to the expansion model described.

The company has access to the right personnel and has a sophisticated organization chart with SPIC, RPIC, QAP, Master Grower, Production Manager (ARPIC) all identified and in place. Other necessary positions, like IT, have been outsourced or are under active recruitment.

The company is aiming for revenues from the premium quality dried flower segment to start in 2019 and 2020. The company will commence production using cloned genetics to get faster to market followed with seeds of the best strains its growers in BC have experience with. The genetics to be selected are confidential but will be chosen with quality, sales and yields in mind. A rigorous growing process with special designed HVAC, one system per grow room with meticulous canopy care managing all the variables to minimize crop damage and negate poor-quality results. The company will regularly post pictures and updates of the facility on its website as it nears completion.

Operating Costs

The emphasis on GMP type quality processes, building, HVAC, lighting and growing knowledge allow the company to look forward to low operating costs. The market producers, which have production cash costs that are in excess of $1.50/gram, will not be able to compete with the company’s quality of product and cost of production. The company has costing models, which it believes will yield a cash cost of under $1.20/gram of its annual production. In part, BC hydro provides an advantage. In part, the design of the facility and its expansion provides lower operating costs. In part, its location and access to highly qualified employees reduces the need to bid for talent.

The economic impact of Auxly’s streaming agreement has provided the company with most of the capital required to build the facility and its expansion, while delivering a better than break-even model if the company only produced at 50% of its annual expected production capacities out to 2020. The company estimates that its working capital and operating costs, on the 2 million-gram first facility, will be in the $1.7 million range when fully operational, on an annual basis.

Financial Model

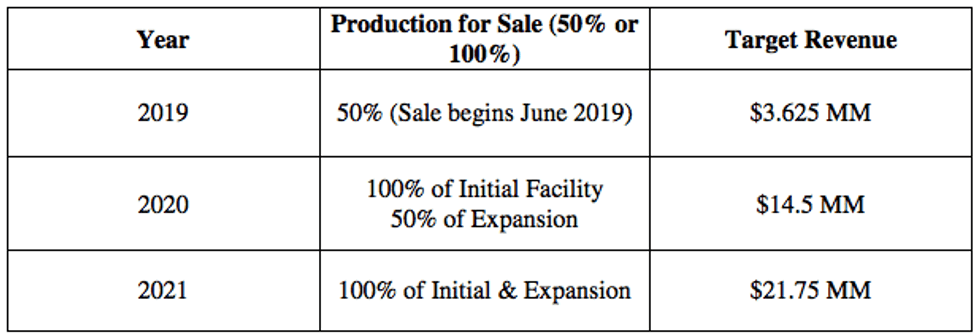

In its first year of production, with its 2,000,000 grams of annual production, it is estimated that the company can be achieving revenues commencing June 2019. This is, of course, predicated on Health Canada being responsive in a timely manner with the cultivation and sales licenses.

The announced streaming agreement with our strategic partner, Auxly, in simple terms, takes 50% of the annual capacity, 1,000,000 grams for a fixed price of $2.25 per gram, for the first three years, thereafter at a discount to wholesale prices. The other 50% can be sold at or close to market wholesale prices, which currently vary from $5.00/gram to $10.00/gram across Canada. Blending in the $2.25/gram for 50% of the production with the low end of the wholesale market (for the unallocated 50%) delivers 2019 revenues in a range of $3,000,000 to $3,500,000. The 2020 outlook jumps, due to a full year of production – from the first facility and a full year from the additional expansion. The company looked at two scenarios for 2020. One is based on having the expansion on line for the full 2020 fiscal and calendar year, which would be in excess of $20 million and then the reduced it to three quarters of the year being on line and up to speed.

It should be noted these are scenarios are based on, market tested and accepted assumptions, used by many other public producers and cannabis sector equity analysts with forward looking assumptions -which may or may not be accurate. The company has adopted conservative assumption and estimates.

The financial model, which is not a forecast, uses a conservative fully funded production capacity of 6 million grams annually (6.5 million is the estimate) when on line and assumes the lowest current market wholesale prices for Lotus premium quality production.

The company remains leveraged to wholesale and retail prices for quality cannabis and adding even more high-quality production capacity. It should be noted that the company has committed only the first facility and the first expansion of that facility, to Auxly’s streaming agreement. The company maintains a strong relationship with Auxly. The company also has rights to sell its non-allocated production to Auxly at wholesale market prices as defined in the agreements it has signed.

This financial model excludes other avenues and channels for distribution and growth which could potentially result in higher revenues and profitability. These other avenues are not reflected in the investment thesis for the company.

Exploring other Avenues and Channels for Growth

As previously announced, the Company has entered into an Agreement to license its intellectual property including its proprietary facility design, the first of a planned national expansion. The licensee will be a newly formed company owned by Lotus and 4th Gen Duwyn Farms Inc. (“DFI”) in Southwestern Ontario, headed by Shawn Duwyn, its President. The Duwyn family has been in the business of growing tobacco for four generations since the mid 1920’s.

Under the Agreement, Lotus will provide DFI access to its IP including building design, standard operating procedures, training and license application support in return for DFI selling 100% of the production from the facility (2,000,000 grams) to Lotus for a period of 15 years at a discount to wholesale pricing.

Final arrangements are underway to submit a licensing application to Health Canada for approval for cannabis production and construction of the facility is currently anticipated to commence in 2019.

Risks to the Financial Model and Investment Thesis

There are some material risks to the investment thesis, for Lotus Ventures, Inc. including:

- The spot, forward and long-term prices for wholesale could drop lower than a breakeven level, considered to be lower than $1.25/gram wholesale for quality product.

- The illegal market could grow its market share and reduce viability of the legal market.

- Future regulations could adversely impact revenues and cash flows of producers.

- Access to capital financing sources are dependent on general market conditions and sector performances

- Health Canada could act in an untimely manner with respect to the last stages of approval for the company and delay our first revenues beyond the anticipated date in mid-2019.

The company believes that these risks and others, including acts of god and force majeure events are, on a balance of probabilities are remote or that actions have been taken to mitigate the risks. Importantly, most, but not all of these risks are market or systemic risks and are not unique to the company.

ON BEHALF OF THE BOARD

Lotus Ventures Inc.

“Dale McClanaghan”

Dale McClanaghan,

President and CEO

For further information:

Dale McClanaghan: dalemcclanaghan@gmail.com (604) 644-9844 or

Daniel McRobert, Communications danielmcrobertt@gmail.com (604) 842-4625

Forward-Looking Information

This news release may contain certain “forward-looking information” within the meaning of applicable Canadian securities law. Forward-looking information is frequently characterized by words such as “plan”, “continue”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “may”, “will”, “potential”, “proposed”, and other similar words, or information that certain events or conditions “may” or “will” occur. This information is only a prediction. Various assumptions were used in drawing the conclusions or making the projection contained in the forward-looking information throughout this news release. The Company is under no obligation, and expressly disclaims any intention or obligation, to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required by applicable law.

The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this release.

Click here to connect with Lotus Ventures Inc (CSE:J) for an Investor Presentation.

Source: cloud.stockwatch.com