Red Light Holland Provides Initial FAQ in connection with Transaction with Creso Pharma

Red Light Holland Corp. is pleased to provide the following initial FAQ to assist shareholders in connection with its previously announced transaction with Creso Pharma Limited.

Red Light Holland Corp. (CSE: TRIP) (FSE: 4YX) (OTC Pink: TRUFF) (“Red Light Holland”) is pleased to provide the following initial FAQ to assist shareholders in connection with its previously announced transaction with Creso Pharma Limited (ASX: CPH) (FSE: 1X8) (OTCQB: COPHF) (“Creso Pharma”).

The HighBrid LabTM

What is an Exchange Ratio?

When two companies combine in an all-share transaction (i.e. where one company acquires another by issuing shares as consideration), a ratio is set to determine how many shares of the acquirer are provided for each share of the target.

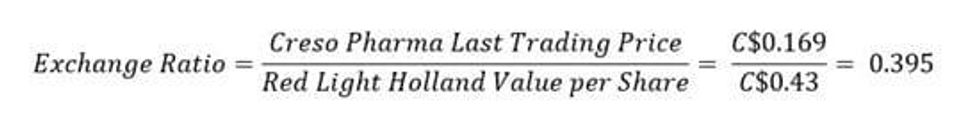

How was the 0.395 Exchange Ratio Determined?

Prior to announcing the transaction, Creso Pharma valued Red Light Holland at C$148 million, representing approximately C$0.43 per Red Light Holland share. Given that the closing price of the Red Light Holland shares on the CSE was C$0.34 immediately prior to the announcement of the transaction, Creso Pharma valued Red Light Holland at C$30 million more than its actual market capitalization at such time (C$118 million market capitalization based on the closing market price of C$0.34 vs. C$148 million market capitalization offered by Creso Pharma, again representing approximately C$0.43 per Red Light Holland share.)

The day prior to the announcement of the transaction, the closing price of the Creso Pharma shares on the ASX was A$0.18, representing approximately C$0.169. As such, an exchange ratio was determined on this basis. As Red Light Holland is to be the surviving entity in order to maintain the CSE listing for the combined company, the exchange ratio was calculated on the basis of a number of Red Light Holland shares per share of Creso Pharma:

If Creso Pharma had not valued Red Light Holland at a premium, and the exchange ratio was based solely on the market price, the exchange ratio would have been 0.496. This would have meant more Red Light Holland shares being issued for each share of Creso Pharma, as opposed to the agreed “each Creso Pharma share will be replaced by 0.395 of a Red Light Holland share” that the deal was based on.

What does the Exchange Ratio Mean for Shareholders?

Upon closing the transaction, each Creso Pharma share will be replaced by 0.395 of a Red Light Holland share. For example, someone who owns 1,000 shares of Creso Pharma will receive 395 Red Light Holland shares in exchange for those Creso Pharma shares. Another example of this ratio would mean that if a Creso Pharma shareholder owns 100,000 shares they will receive 39,500 shares of Red Light Holland in exchange for those Creso Pharma shares, upon closing of the transaction.

Anyone who currently holds shares of Red Light Holland will have no change in their holdings. There will be no changes to Red Light Holland options or warrants either.

Is a Share Consolidation or Reverse Split Part of the Transaction?

No, there is no share consolidation or reverse split required as part of the transaction.

When will the Transaction Close?

The transaction is expected to close at the beginning of the fourth quarter of 2021. Until the closing date, both companies will continue to operate and trade independently.

How Many New Red Light Holland Shares will be Issued?

Based on Creso Pharma’s current capital structure, it is expected that up to 467 million Red Light Holland shares will be issued in connection with the transaction.

“Red Light Holland prides itself on continuously working hard to expand our business with the intention of increasing shareholder value. Creso Pharma believed we were a very strong company and rewarded our aggressive approach in the psychedelic sector, by agreeing to pay us a significant premium to our share price and market cap, as explained above,” said CEO & Director of Red Light Holland, Todd Shapiro. “We also pride ourselves on having transparency with our valued shareholders and we appreciate this opportunity to answer the many questions we’ve been receiving. Thank you for your enquiring minds. And thank you for your support. We look forward to future growth in Psychedelics and beyond!”

For additional information on Red Light Holland:

Todd Shapiro

Chief Executive Officer & Director

Tel: 647-204-7129

Email: todd@redlighttruffles.com

Website: https://redlighttruffles.com/

About Red Light Holland

Red Light Holland is an Ontario-based corporation engaged in the production, growth and sale (through existing Smart Shops operators and an advanced e-commerce platform) of a premium brand of magic truffles to the legal market within the Netherlands, in accordance with the highest standards, in compliance with all applicable laws.

Forward-looking statements

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation and Australian law. Often, but not always, forward-looking statements and information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “estimates”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Red Light Holland or its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained in this news release. Examples of such information include statements with respect to the live stream. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information, including the ability of the parties to receive, in a timely manner and on satisfactory terms, the necessary regulatory, court and shareholder approvals for completion of the proposed transaction between Red Light Holland and Creso Pharma; the ability of the parties to satisfy, in a timely manner, the other conditions to the completion of the transaction; the prompt and effective integration of the businesses and the ability to achieve the anticipated benefits contemplated by the transaction; risks related to the value of the shares of Red Light Holland to be issued pursuant to the transaction; the diversion of management time on transaction-related issues; expectations regarding future investment, growth and expansion of the operations of the businesses; regulatory and licensing risks; changes in general economic, business and political conditions, including changes in the financial and stock markets; risks related to infectious diseases, including the impacts of the COVID-19 pandemic; legal and regulatory risks inherent in the cannabis and magic psychedelics industries, including the global regulatory landscape and enforcement related to cannabis and psychedelics, political risks and risks relating to regulatory change; risks relating to anti-money laundering laws; compliance with extensive government regulation and the interpretation of various laws regulations and policies; public opinion and perception of the cannabis and psychedelics industries; and such other risks contained in the public filings of Red Light Holland filed with Canadian securities regulators and available under Red Light Holland’s profile on SEDAR at www.sedar.com, including Red Light Holland’s annual information form for the year ended March 31, 2020.

In respect of the forward-looking information concerning the anticipated benefits and completion of the transaction and the anticipated timing for completion of the transaction, Red Light Holland has provided such information in reliance on certain assumptions that they believe are reasonable at this time. Although Red Light Holland believe that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information and no assurance can be given that such events will occur in the disclosed time frames or at all. Should one or more of the foregoing risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although Red Light Holland has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The forward-looking information included in this news release are made as of the date of this news release and Red Light Holland does not undertake any obligation to publicly update such forward-looking information to reflect new information, subsequent events or otherwise unless required by applicable securities laws.

Click here to connect with Red Light Holland Corp. (CSE:TRIP) for an Investor Presentation.