Naturally Splendid Reports Third Quarter Results for 2018

Naturally Splendid Enterprises Ltd. (“Naturally Splendid”, “NSE” or “the Company”) (FRANKFURT:50N) (TSXV:NSP) (OTC:NSPDF) announces its financial results for the nine months ended September 30, 2018.

Naturally Splendid Enterprises Ltd. (“Naturally Splendid”, “NSE” or “the Company”) (FRANKFURT:50N) (TSXV:NSP) (OTC:NSPDF) announces its financial results for the nine months ended September 30, 2018. All amounts are in Canadian dollars and are prepared in accordance with International Financial Reporting Standards.

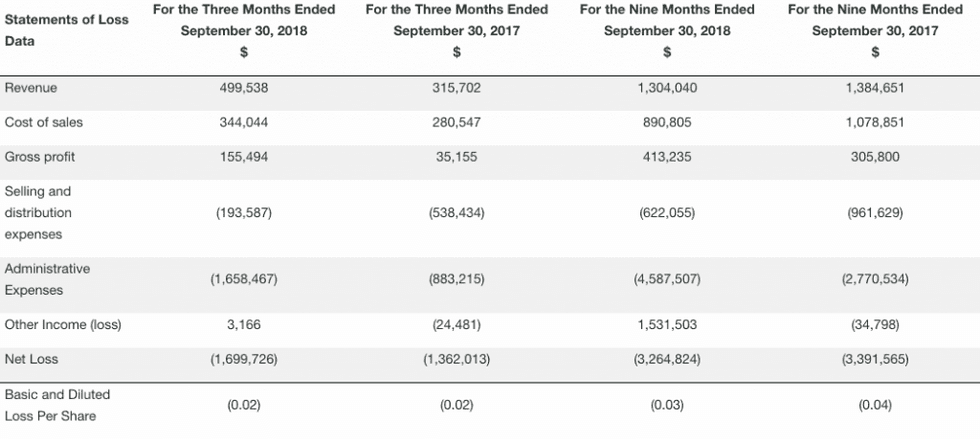

Naturally Splendid recorded a net loss of $3,264,824 during the nine months ended September 30, 2018, compared to a loss of $3,391,565 during the nine months ended September 30, 2017. The decrease in net loss was due to the sale of POS BPC Manufacturing Corp. which provided for a gain on sale of $1,535,096, an increase in Gross Profit Margins, a reduction Selling and distribution costs of $339,574 and an increase in Administrative expenses of $1,816,973 mainly due to the addition of the Prosnack business which were not included in the expenses in the comparative period as the acquisition occurred on October 18, 2017and an increase in share-based compensation of $777,786.

Naturally Splendid recorded sales of $1,304,040 during the nine months ended September 30, 2018, compared to $1,384,651 in for the nine months ended September 30, 2017. This revenue decrease was mainly due to the collapse of sales of bulk hemp seed to South Korea where the Company had recorded $Nil bulk sales in the current quarter compared to $245,400 in the nine months of 2017. The additional sales generated from the acquisition of the Prosnack business was not enough to counter the loss bulk sales. Retail sales were off during the first nine months whereas online sales remained consistent.

Cost of Sales during the nine months ended September 30, 2018 was $890,805, compared to $1,078,851 in the nine months ended September 30, 2017. The Company significantly changed its sales mix in 2018 with a reduction of exporting bulk seed sales, which, have been generally sold at a lower gross margin percentage.

Gross profits during the nine months ended September 30, 2018 was $413,235 (31.7% of sales) compared to $270,645 (22.1%) in the nine months ended September 30, 2017 due to higher margins on its retail and online sales whereas in the comparative quarter, the lower margins on bulk seed sales caused the overall margins to decrease. In 2018, the Company is focused on rebuilding its markets and products and new commercial opportunities, both domestically and in new international markets and acquired Prosnack Natural Foods Inc. (“Prosnack”) on October 18, 2017 and the addition of Absorbent Concepts Inc. (“ACI”) which closed on July 16, 2018.

CEO Mr. Douglas Mason states,” We have accomplished a number of strategic objectives in the third quarter, improving efficiencies and increasing margins being a major focus for any growing company, we see our strategy beginning to reflect in this latest quarter. We anticipate recently announced sales and manufacturing contracts to bolster revenues moving forward.

We continue to follow the licensing process for our Dealer’s License, which has now been changed to a Processors License under the revised Cannabis Act, and have added more expertise with the addition of Kevin Flanagan as Lead Food Scientist and Advisory Board member. Kevin’s many years of experience will be invaluable as we embark on more national and international food company sales and seek lager manufacturing commitments.

Shipments to our Australian distributor continued in the period and we anticipate orders from this region becoming more consistent, and increasing in volume. Private Label and co-packing is also gaining traction, as many clients have begun signaling the demand for increased production.”

About Naturally Splendid Enterprises Ltd.

Naturally Splendid is a biotechnology and consumer products company that is developing, producing, commercializing, and licensing an entirely new generation of plant-derived, bioactive ingredients, nutrient dense foods, and related products. Naturally Splendid is building an expanding portfolio of patents (issued and pending) and proprietary intellectual property focused on the commercial uses of industrial hemp cannabinoid compounds in a broad spectrum of applications.

For more information e-mail info@naturallysplendid.com or call Investor Relations at 604-673-9573

On Behalf of the Board of Directors

Mr. Douglas Mason

CEO, Director

Contact Information

Naturally Splendid Enterprises Ltd.

(NSP – TSX Venture; NSPDF – OTCQB; 50N Frankfurt)

#108-19100 Airport Way

Pitt Meadows, BC, V3Y 0E2

Office: (604) 465-0548

Fax: (604) 465-1128

E-mail: info@naturallysplendid.com

Website: www.naturallysplendid.com

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management’s current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Naturally Splendid cautions that all forward looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Naturally Splendid’s control including, Naturally Splendid’s ability to compete with large food and beverage companies; sales of any potential products developed will be profitable; sales of shelled hemp seed will continue at existing rates or increase; the ability to complete the sales of all bulk hemp seed purchase orders; and the risk that any of the potential applications, including its application to become a Licensed Dealer, may not receive all required regulatory or legal approval. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Naturally Splendid undertakes no obligation to publicly update or revise forward-looking information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Click here to connect with Naturally Splendid (TSXV:NSP) for an Investor Presentation.

Source: www.thenewswire.com