Harvest Buys Fellow MSO for US$850 Million in All-share Deal

Multi-state operator Harvest Health & Recreation has announced the multimillion-dollar acquisition of private company Verano Holdings.

Public multi-state operator (MSO) Harvest Health & Recreation (CSE:HARV,OTCQX:HRVSF) will expand to 11 states with over 100 retail stores thanks to the acquisition of a private MSO.

On Monday (March 11), Harvest confirmed its US$850 million purchase of Verano Holdings through an all stock deal based on a share price of C$8.79.

The resulting corporation, if the deal is completed, will carry over 150 branded items for sale and hold 123 retail dispensaries in its portfolio, therefore allowing the company to operate in 16 total states

During a conference call with analysts and investors, the management of Harvest revealed beyond the number of states the company operates what is more significant to them is the “depth of reach within those states.”

When asked about upcoming markets that interest the company with this acquisition, the leaders of Harvest indicated New Jersey, Illinois and Nevada are some top markets to operate in.

Thanks to the purchase, Harvest gained entry to Illinois, New Jersey, Michigan, Oklahoma and Puerto Rico.

The management team of Harvest expects to see New Jersey and Illinois go ahead and open recreational sales in the next 12 months, adding more value to its purchase than previously anticipated due to key licenses in these states.

The acquisition will offer an overlap in the portfolio of licenses and presence in legal states.

“[The acquisition] supplements our operations and licenses in California, Nevada, Massachusetts, Ohio, Maryland and Arkansas,” Steve White, CEO of Harvest, said during the call.

Harvest was asked about the challenges of integrating the Florida assets from Verano due to policy rules on the ownership of multiple licenses by one party. White revealed Verano’s Florida interests were not being acquired as part of the whole transaction.

“We will do whatever we can to monetize it in the most strategic matter,” the executive said.

As part of the arrangement, investors of Veranos will obtain “a combination of Harvest subordinate voting shares and Harvest multiple voting shares as mutually agreed between the parties.”

Harvest expects the acquisition to be completed in the first half of 2019.

“We have the unique opportunity to create truly national brands by deploying these products within the future combined footprint of states and dispensaries,” Steve White, CEO of Harvest, said in a press release.

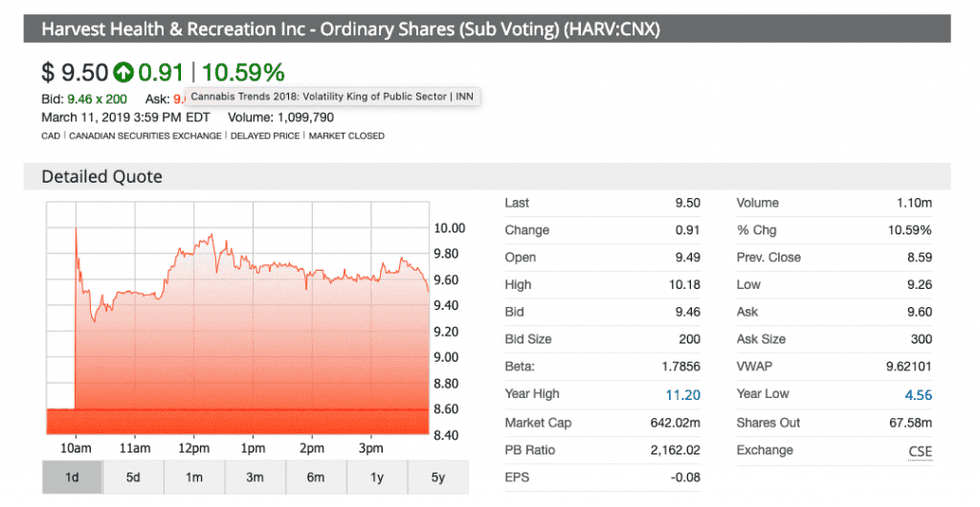

Shares of Harvest jumped during Monday’s trading session thanks to the announcement. The stock rose 10.59 percent to close the day at a price of C$9.50 per share.

Over a year-to-date period, shares of Harvest have increased in value by 21.16 percent, representing a C$1.50 gain.

“Within the next 18 months, Harvest plans to cultivate more than 720,000 [square feet] of indoor, outdoor and greenhouse cannabis,” an info document prepared by Canaccord Genuity (TSX:CF) as part of this year’s “Growth Investor Day.”

In February, Matt Bottomley, cannabis analyst for Canaccord, raised his price target on the MSO to C$16 and retained his “Speculative Buy” rating for the stock.

Similarly, Nawan Butt, portfolio manager with Purpose Investments, and Alan Brochstein, cannabis analyst with 420 Investor, signaled the stock as one of the ones to watch in the growing MSO space.

Harvest was highlighted as one of the “significant investment banking transactions” for the financial institution during its fiscal Q3 for 2019.

Harvest reached a listing on the Canadian Securities Exchange (CSE) in November, through a raise reported by Reuters to be worth C$303 million.

During the conference call, Harvest revealed talks with Verano picked up last summer were put on hold as the company needed to complete its reverse-takeover deal.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in contributed article. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.