Green Growth Brands Launches Seventh Sense eCommerce Website

Green Growth Brands Inc. (CSE:GGB OTCQB: GGBXF)(GGB or the Company) is pleased to announce the launch of ShopSeventhSense.com.

Green Growth Brands Inc. (CSE:GGB OTCQB: GGBXF)(GGB or the Company) is pleased to announce the launch of ShopSeventhSense.com. The eCommerce site will allow consumers access to hemp-derived cannabidiol (CBD) personal care and beauty products under the Seventh Sense Botanical Therapy brand.

Seventh Sense (CNW Group/Green Growth Brands)

“We have the most comprehensive assortment of CBD-infused personal care and beauty products of anyone in the CBD industry,” said Peter Horvath, CEO of GGB. “Sales through our digital channel are a huge component of our strategy. Our digital presence is harmonious with our bricks and mortar strategy. The site expands our reach and will drive subsequent purchases for our customers who have shopped at our Seventh Sense shops or our assortment at DSW.”

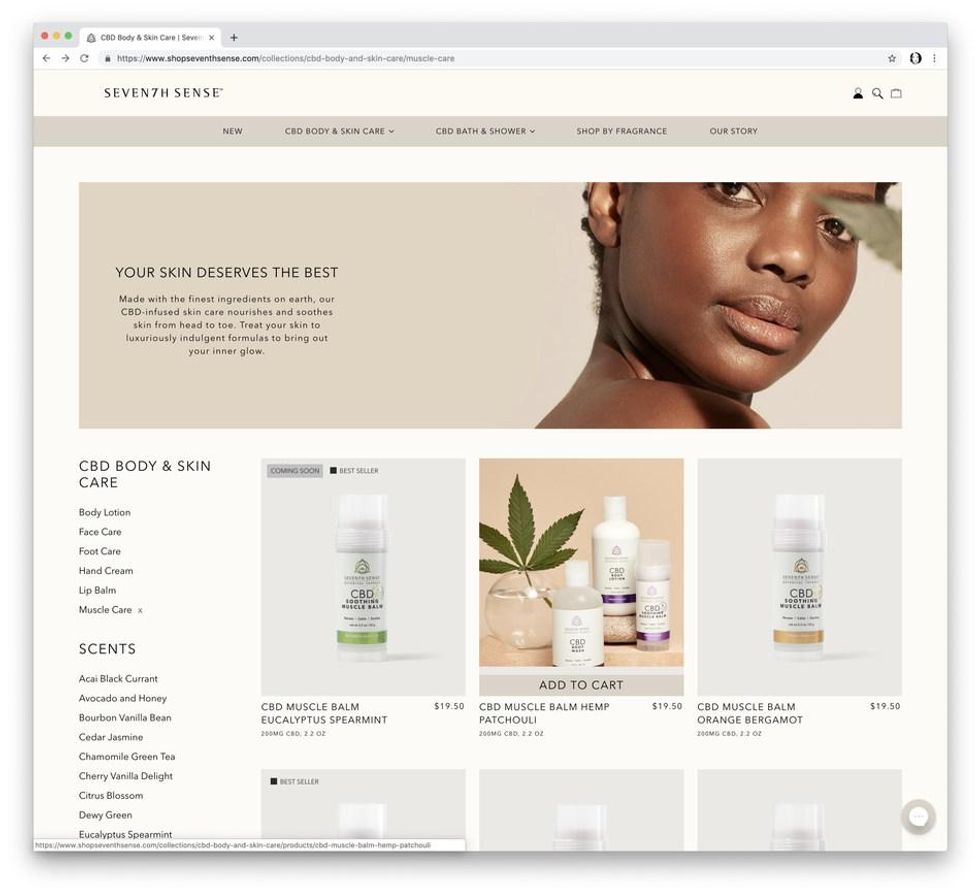

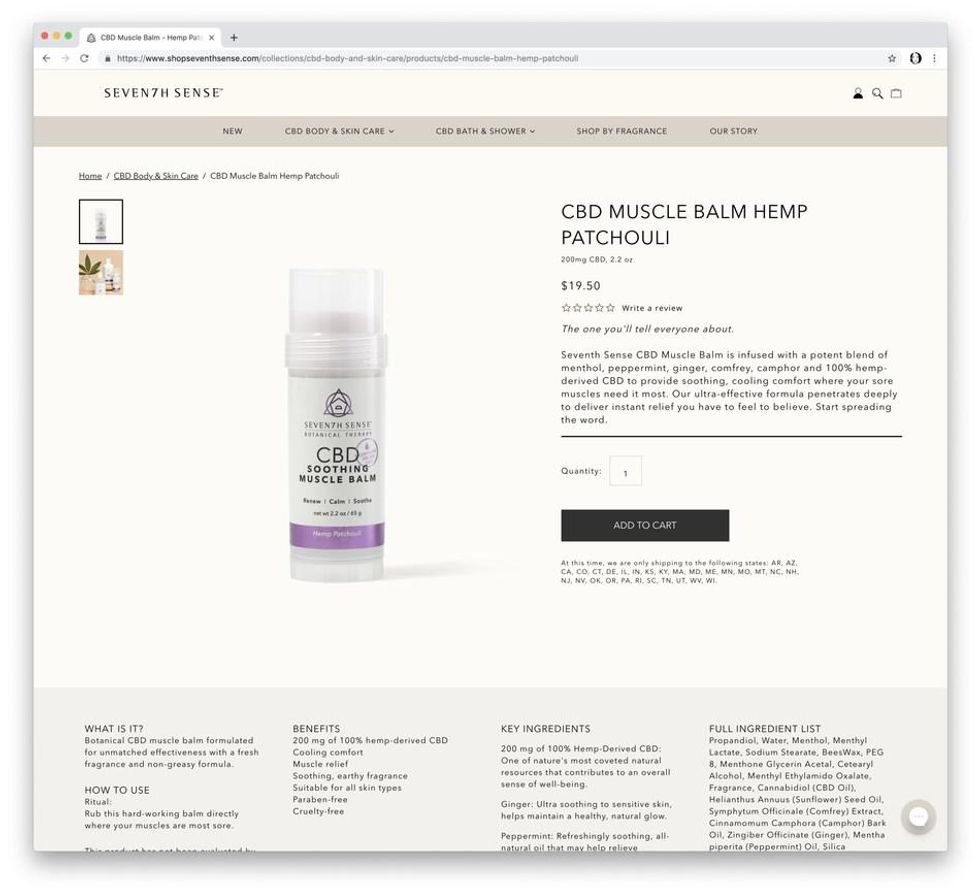

Seventh Sense Botanical Therapy products include CBD-infused body lotion, muscle balm, body wash, bath salts, sugar scrub, bath bomb, lip balm, and face oil. Fragrances available currently include eucalyptus spearmint, hemp patchouli, chamomile green tea, citrus blossom, cedar jasmine, orange bergamot and dewy green. ShopSeventhSense.com will ultimately offer over 300 SKUs of Seventh Sense high quality personal care and beauty products. Price points currently range from USD$7.50 to USD$39.50.

“We created Seventh Sense Botanical Therapy products because when we looked for these types of products in the marketplace, there simply weren’t any,” added Horvath. “We wanted to create world-class products that were made with high-quality, hemp-derived CBD. We are proud to share them with our customers, and now we are making it easier for them to enhance their everyday self-care routine with our new online offering.”

Seventh Sense Botanical Therapy is made only with legally sourced industrial hemp, not marijuana, so it’s legally available for purchase without a prescription or medical marijuana card.

Green Growth Brands is currently able to ship to customers in the following states: Arkansas, Arizona, California, Colorado, Connecticut, Delaware, Illinois, Indiana, Kansas, Kentucky, Massachusetts, Maryland, Maine, Minnesota, Missouri, Montana, North Carolina, New Hampshire, New Jersey, Nevada, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Utah, West Virginia and Wisconsin. This list will grow as CBD is becoming more common throughout the United States.

About Green Growth Brands

Green Growth Brands expects to dominate the cannabis and CBD market with a portfolio of emotion-driven brands that people love. Led by Peter Horvath, the GGB team is full of retail and consumer packaged goods experts with decades of experience building successful brands. Join the movement at GreenGrowthBrands.com.

Cautionary Statements:

Certain information in this news release constitutes forward-looking statements under applicable securities law. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often identified by terms such as “may”, “should”, “anticipate”, “expect”, “intend”, “forecast” and similar expressions. Forward-looking statements necessarily involve known and unknown risks, including, without limitation, risks associated with general economic conditions; adverse industry events; marketing costs; loss of markets; future legislative and regulatory developments involving medical and recreational marijuana; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; the marijuana industry in the United States, income tax and regulatory matters; the ability of the Company to implement its business strategies; competition; currency and interest rate fluctuations and other risks, including those factors described under the heading “Risks Factors” in the Company’s Annual Information Form dated November 26, 2018 which is available on the Company’s issuer profile on SEDAR.

Readers are cautioned that the foregoing list is not exhaustive. Readers are further cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. The forward-looking statements contained in this release is made as of the date hereof and the Company is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

This announcement does not constitute an offer, invitation or recommendation to subscribe for or purchase any securities and neither this announcement nor anything contained in it shall form the basis of any contract or commitment. In particular, this announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States, or in any other jurisdiction in which such an offer would be illegal.

The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or under the securities laws of any state or other jurisdiction of the United States and may not be offered or sold, directly or indirectly, within the United States, unless the securities have been registered under the Securities Act or an exemption from the registration requirements of the Securities Act is available.

For further information: For investor relations inquiries, please contact: Julia Fulton, Investor & Public Relations, (614) 505-9880, jfulton@greengrowthbrands.com or Eric Wright, 416-640-2963, ewright@greengrowthbrands.com or Peter Horvath, (614) 508-4222; For media enquiries or interviews, please contact: Wynn Theriault, Thirty Dash Communications, 416-710-3370, wynn@thirtydash.ca

Related Links

https://www.greengrowthbrands.com/

Source: www.newswire.ca