Acreage Holdings Reports Second Quarter 2019 Results

Acreage Holdings, Inc. (CSE:ACRG.U) (OTCQX:ACRGF) (FSE:0VZ) reported financial results for the quarter ended June 30th, 2019.

Acreage Holdings, Inc. (“Acreage”) (CSE:ACRG.U) (OTCQX:ACRGF) (FSE:0VZ) reported financial results for the quarter ended June 30th, 2019.

SECOND QUARTER FINANCIAL HIGHLIGHTS

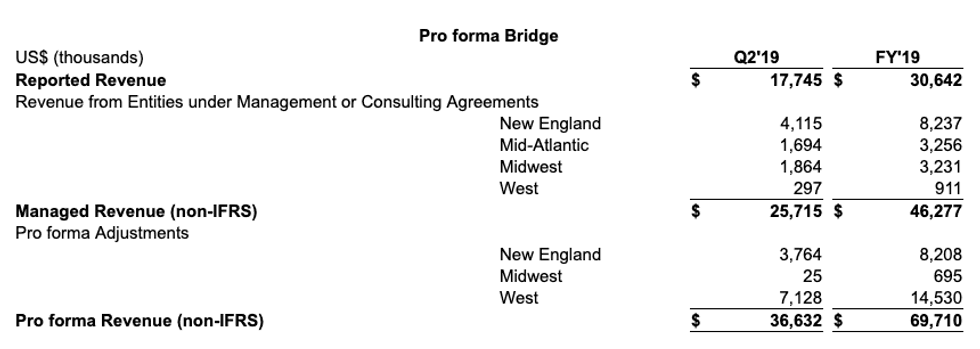

- Reported second quarter revenue of $17.7 million, a 501% increase compared to the same period in 2018

- Pro forma revenue* for the second quarter was $36.6 million

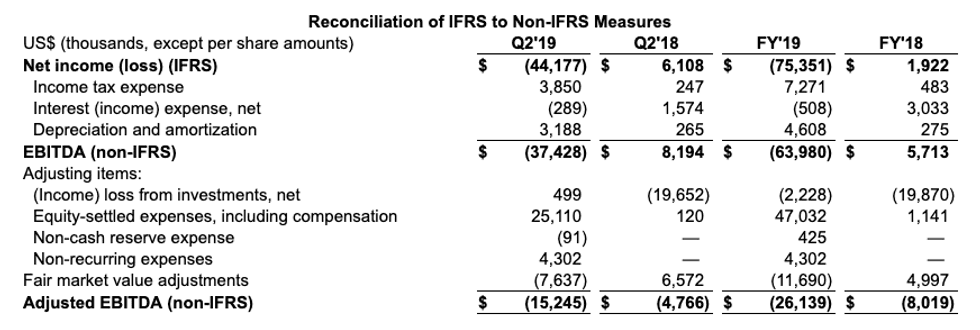

- Reported a net loss attributable to Acreage of $33.9 million

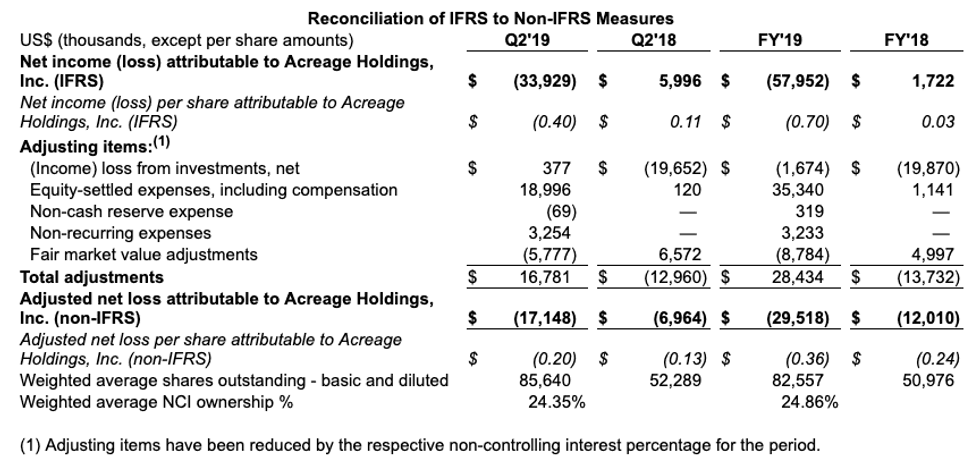

- Adjusted net loss* attributable to Acreage was $17.1 million

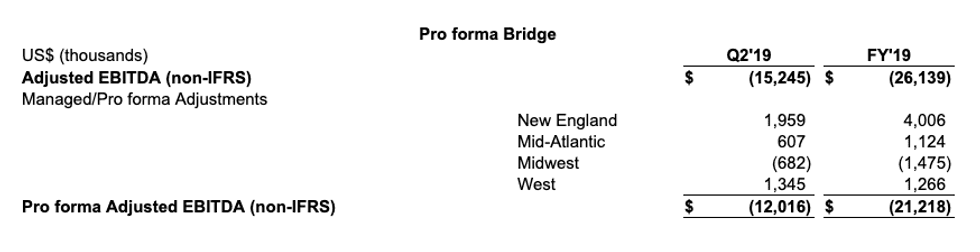

- Pro forma adjusted EBITDA* was a loss of $12.0 million

*Pro forma revenue, adjusted net loss and pro forma adjusted EBITDA are Non-IFRS measures. Please see discussion and reconciliation of Non-IFRS measures below.

“During the second quarter, we received overwhelming support from our shareholders and a final court order to proceed with our historic arrangement with Canopy Growth. The arrangement unlocks significant potential and will help further position Acreage as the leading cannabis operator in the United States. I am excited to share our strategy leveraging Canopy Growth’s brands, technology, and IP, which will give us a significant advantage over our competition,” said Kevin Murphy, Chairman and Chief Executive Officer of Acreage.

ACREAGE – CANOPY ARRANGEMENT UPDATE

The following are key highlights of management’s strategy leveraging Canopy Growth’s technologies, systems, IP, brands, and know-how. As management continues to explore the vast wealth of opportunities, Acreage anticipates adding to the strategy.

- Dispensaries:

- In addition to the Botanist, we will begin leveraging Tweed and Tokyo Smoke dispensaries across the U.S.

- Products:

- Continue with national launch of internally developed house of brands – The Botanist, Live Resin Project, Natural Wonder

- Expand brand portfolio utilizing Canopy Growth developed Tweed products in 2020

- Launch Spectrum Therapeutics medical cannabis brand in 2020

- Processing/Cultivation:

- Evaluate all facilities in design, pre-construction, and construction phases to leverage Canopy Growth systems, technologies, IP, and processes at our option

- Commercialize Canopy Growth and ebbu developed IP for both in-house and co-packed brands via Form Factory, unlocking speed to market with innovative products and likely yielding cost savings

- Technology/Other:

- Evaluating whether to voluntarily adopt Canopy Growth IT systems and architecture for potential synergies

- Evaluating entering into additional agreements with Canopy Growth to use other administrative, back office functions, and strategic vendor relationships

“We remain deeply committed to the arrangement to acquire Acreage Holdings,” remarked Mark Zekulin, Chief Executive Officer of Canopy Growth. “We support their revised path forward and are very much looking forward to being able to share that vision – once federally permissible – to continue building the relationship and our combined footprints within the United States.”

Constellation Brands, the largest shareholder of Canopy Growth Corporation, expressed its support of the Canopy-Acreage agreement and the independent paths each is taking to fulfill their respective visions for cannabis not only in the United States, but globally as well.

“With the combined strengths Constellation Brands, Canopy Growth and Acreage Holdings bring to the table, no team is better positioned to win in the U.S. market when cannabis becomes federally permissible,” said Bill Newlands, President and CEO, Constellation Brands. “Acreage’s operational and retail assets together with Canopy’s IP, brands and product development capabilities, all supported by an unmatched balance sheet, will result in a powerful alliance with excellent prospects for the future upon federal legalization in the U.S.”

EARNINGS CALL DETAILS

Acreage will host a conference call with management on Wednesday, August 14th at 8:30 AM Eastern Daylight Time. The call will be webcast and can be accessed at investors.acreageholdings.com. To listen to the live call, please go to the website at least 15 minutes early to register, download and install any necessary audio software.

ABOUT ACREAGE HOLDINGS, INC.

Headquartered in New York City, Acreage is one of the largest vertically integrated, multi-state operators of cannabis licenses and assets in the U.S., according to publicly available information. Acreage owns licenses to operate or has management or consulting services or other agreements in place with license holders to assist in operations in 20 states (including pending acquisitions) with a population of approximately 180 million Americans, and an estimated 2022 total addressable market of $16.7 billion in legal cannabis sales, according to Arcview Market Research. Acreage is dedicated to building and scaling operations to create a seamless, consumer-focused branded cannabis experience. Acreage’s national retail store brand, The Botanist, debuted in 2018.

On June 27, 2019 Acreage implemented an arrangement under section 288 of the Business Corporations Act (British Columbia) (the “Arrangement”) with Canopy Growth Corporation (“Canopy Growth”). Pursuant to the Arrangement, the Acreage articles were amended to provide Canopy Growth with an option to acquire all of the issued and outstanding shares in the capital of Acreage, with a requirement to do so, upon a change in federal laws in the United States to permit the general cultivation, distribution and possession of marijuana (as defined in the relevant legislation) or to remove the regulation of such activities from the federal laws of the United States (the “Triggering Event”), subject to the satisfaction of the conditions set out in the arrangement agreement entered into between Acreage and Canopy Growth on April 18, 2019, as amended on May 15, 2019 (the “Arrangement Agreement”). Acreage will continue to operate as a stand-alone entity and to conduct its business independently, subject to compliance with certain covenants contained in the Arrangement Agreement. Upon the occurrence or waiver of the Triggering Event, Canopy Growth will exercise the option and, subject to the satisfaction or waiver of certain conditions to closing set out in the Arrangement Agreement, acquire (the “Acquisition”) each of the Subordinate Voting Shares (following the automatic conversion of the Class B proportionate voting shares and Class C multiple voting shares of Acreage into Subordinate Voting Shares) in exchange for the payment of 0.5818 of a common share of Canopy Growth per Subordinate Voting Share (subject to adjustment in accordance with the terms of the Arrangement Agreement). If the Acquisition is completed, Canopy Growth will acquire all of the Acreage Shares, Acreage will become a wholly owned subsidiary of Canopy Growth and Canopy Growth will continue the operations of Canopy Growth and Acreage on a combined basis. For more information about the Arrangement and the Acquisition please see the respective information circulars of each of Acreage and Canopy Growth dated May 17, 2019, which are available on Canopy Growth’s and Acreage’s respective profiles on SEDAR at www.sedar.com. For additional information regarding Canopy Growth, please see Canopy Growth’s profile on SEDAR at www.sedar.com.

*NON-IFRS MEASURES, RECONCILIATION AND DISCUSSION

This release contains tables that reconcile our results of operations reported in accordance with International Financial Reporting Measures (“IFRS”) to adjusted result that exclude the impact of certain items identified as affecting comparability (non-IFRS). We use EBITDA, adjusted EBITDA, adjusted net loss attributable to Acreage, managed results of operations, and pro forma results of operations among other measures, to evaluate our actual operating performance and for planning and forecasting future periods. We believe the adjusted results presented provide relevant and useful information for investors because they clarify our actual operating performance, make it easier to compare our results with those of other companies and allow investors to review performance in the same way as our management. Since these measures are not calculated in accordance with IFRS, they should not be considered in isolation of, or as a substitute for, our reported results as indicators of our performance, and they may not be comparable to similarly named measures from other companies. The tables below reconcile our results of operations in accordance with IFRS to the adjusted results mentioned above:

Managed results of operations are IFRS reported results plus the results of all entities for which we have a management contract in place, and pending acquisitions, but do not consolidate due to a lack of control.

Pro forma results of operations are managed results, plus the pre-acquisition results for all acquired entities from the beginning of the applicable period presented through the date prior to the acquisition date.

FORWARD LOOKING STATEMENTS

This news release and each of the documents referred to herein contains “forward-looking information” within the meaning of applicable Canadian and United States securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information, including, for greater certainty, statements regarding the proposed transaction with Canopy Growth, including the anticipated benefits and likelihood of completion thereof.

Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budgets”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. There can be no assurance that such forward-looking information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such forward-looking information. This forward-looking information reflects Acreage’s current beliefs and is based on information currently available to Acreage and on assumptions Acreage believes are reasonable. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Acreage to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the ability of the parties to receive, in a timely manner and on satisfactory terms, the necessary regulatory approvals; the available funds of Acreage and the anticipated use of such funds; the availability of financing opportunities; the ability of Acreage and Canopy Growth to satisfy, in a timely manner, the conditions to the completion of the Acquisition; the likelihood of completion of the Acquisition; other expectations and assumptions concerning the transactions contemplated between Acreage and Canopy Growth; legal and regulatory risks inherent in the cannabis industry; risks associated with economic conditions, dependence on management and currency risk; risks relating to U.S. regulatory landscape and enforcement related to cannabis, including political risks; risks relating to anti-money laundering laws and regulation; other governmental and environmental regulation; public opinion and perception of the cannabis industry; risks related to contracts with third-party service providers; risks related to the enforceability of contracts; reliance on the expertise and judgment of senior management of Acreage; risks related to proprietary intellectual property and potential infringement by third parties; the concentrated voting control of Acreage’s founder and the unpredictability caused by Acreage’s capital structure; risks relating to the management of growth; increasing competition in the industry; risks inherent in an agricultural business; risks relating to energy costs; risks associated to cannabis products manufactured for human consumption including potential product recalls; reliance on key inputs, suppliers and skilled labor; cybersecurity risks; ability and constraints on marketing products; fraudulent activity by employees, contractors and consultants; tax and insurance related risks; risks related to the economy generally; risk of litigation; conflicts of interest; risks relating to certain remedies being limited and the difficulty of enforcement of judgments and effect service outside of Canada; risks related to future acquisitions or dispositions; sales by existing shareholders; and limited research and data relating to cannabis. A description of additional assumptions used to develop such forward-looking information and a description of additional risk factors that may cause actual results to differ materially from forward-looking information can be found in Acreage’s disclosure documents, including the Circular and Acreage’s Annual Information Form for the year ended December 31, 2018 filed on April 29, 2019, on the SEDAR website at www.sedar.com. Although Acreage has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Readers are cautioned that the foregoing list of factors is not exhaustive. Readers are further cautioned not to place undue reliance on forward-looking information as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Forward-looking information contained in this news release is expressly qualified by this cautionary statement. The forward-looking information contained in this news release represents the expectations of Acreage as of the date of this news release and, accordingly, is subject to change after such date. However, Acreage expressly disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities law.

Neither the Canadian Securities Exchange nor its Regulation Service Provider has reviewed and does not accept responsibility for the adequacy or accuracy of the content of this news release.

Source: www.globenewswire.com