Crypto Market Update: Crypto Market Bill Markup Rescheduled

A markup for the Senate's version of the crypto market structure bill has reportedly been rescheduled, likely due to widespread winter storm conditions.

Here's a quick recap of the crypto landscape for Monday (January 26) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

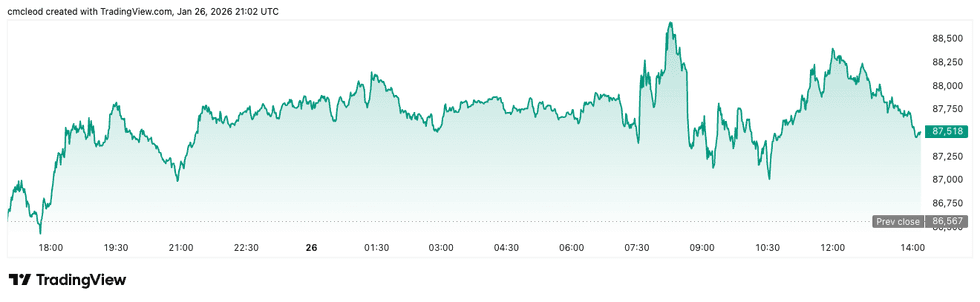

Bitcoin (BTC) was priced at US$87,515.29, up by 1.2 percent over 24 hours.

Bitcoin price performance, January 26, 2026.

Chart via TradingView.

Crypto executives foresee a fragile market ahead of this week's US Federal Reserve meeting, citing tightening liquidity, political uncertainty over Fed leadership and weak spot demand.

"Bitcoin’s fragile market structure below key support levels has left it vulnerable to volatility shocks, as seen in the market dump during Sunday evening’s low-liquidity environment when the digital asset market shed more than US$100 billion in value within a couple of hours," said Ray Youssef, CEO of crypto app NoOnes.

"The wave of sales that followed the local rise in Bitcoin and other cryptocurrencies last week contributed to the price decline. Market participants, not expecting a return of the bull cycle anytime soon, rushed to take profits after the brief Bitcoin surge," he added in an email to the Investing News Network.

Farzam Ehsani, co-founder and CEO of crypto exchange VALR, also shared his outlook.

"The crypto market is likely to remain in its current reactive, volatility-driven phase until inflation data prints provide easing signals and the overall macro backdrop allows for a market rally," he said.

"I expect BTC to trade near US$85,000 to US$90,000 this week unless a black swan event or a surprise outcome from this week's macro events drives further volatility. If BTC breaks below US$85,000, capital will likely continue to exit the digital asset market indiscriminately, making a decline towards US$80,000 and a steeper altcoin downturn plausible."

Ether (ETH) was priced at US$2,899.05, up by 3.4 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.89, up by 4 percent over 24 hours.

- Solana (SOL) was trading at US$123.50, up by 4.7 percent over 24 hours.

Today's crypto news to know

Markup hearing rescheduled

Multiple news outlets reported on Monday that a spokesperson for Senator John Boozman (R-AR) said that the Senate Agriculture Committee will reschedule a markup for its version of a crypto market structure bill, called the Digital Commodity Intermediaries Act, from Tuesday (January 27) to Thursday (January 29).

The winter storm that canceled flights and caused transportation issues across a large part of the country over the weekend was cited as a likely reason for the change.

The bill will attempt to establish clear rules for the Commodity Futures Trading Commission (CFTC) over digital assets.

Additionally, the CFTC and US Securities and Exchange Commission issued a statement on Monday to reschedule a joint event on crypto oversight harmonization to Thursday.

Strategy slows down Bitcoin buying spree

Despite the market slide, Strategy (NASDAQ:MSTR) has continued adding to its Bitcoin stash, spending about US$267 million last week to acquire roughly 2,900 BTC. The purchase marks a clear slowdown from the company's prior buying spree, when it spent more than US$3 billion across two weeks. Strategy now holds more than 712,000 BTC, making it the largest corporate holder of the asset by a wide margin.

The latest buy was funded mainly through common stock issuance, alongside additional sales of its STRC preferred shares, which carry an 11 percent annualized cash dividend. Executive Chair Michael Saylor has pitched STRC as a yield-focused alternative to cash, with proceeds ultimately flowing back into Bitcoin.

GameStop’s Bitcoin transfer raises exit questions

Speculation swirled after GameStop (NYSE:GME) transferred its entire Bitcoin holding — about 4,710 BTC — to Coinbase Prime, a platform often used for institutional trading and custody.

The transfer, flagged by CryptoQuant, sparked talk that the retailer may be preparing to unwind its Bitcoin treasury experiment. Based on current prices, a full sale could lock in an estimated US$75 million to US$85 million loss, given that GameStop reportedly accumulated the coins near market highs earlier this year.

Currently, the company has not confirmed any sale nor addressed the speculation.

Valour announces UK retail launch

Valour announced it has received permission from UK regulators to sell its yield-bearing Bitcoin and Ether crypto products to everyday retail investors on the London Stock Exchange, effective immediately.

Both funds are yield-bearing, meaning they participate in "staking." This allows the funds to earn extra rewards from the underlying crypto networks, which are then added to the value of the investment.

Previously, these products were only available to professional investors in the UK. Now, anyone with a standard UK brokerage account can buy them like a regular stock.

VanEck launches Avalanche ETF

VanEck said it has launched a new exchange-traded fund (ETF) tracking the price of Avalanche (AVAX) in the US. It will trade on the Nasdaq under the ticker symbol VAVX.

It is the first US ETF to offer exposure to both the price of the AVAX token and the rewards earned from staking on the Avalanche network. According to the announcement, VanEck is waiving the management fee for the first US$500 million invested or until February 28, 2026. After that, the fee will be 0.2 percent per year.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.